To understand how climate change affects asset prices, we must first understand the types of risks that global warming creates. Then can we address those risks.

Climate change exposes firms to significant new risks. Rising sea levels and new natural disasters triggered by global warming disrupt firms’ production, either in a positive or negative way. Assets of firms that rely heavily on fossil fuels are exposed to the risk of losing most of their value if households, governments, and firms make bold moves toward sustainable energies.

Some commentators have warned about the danger of not taking into account this risk, as it could potentially create a “carbon bubble.”1 However, climate change creates new markets and new needs—such as clean energy—that will be a new source of growth. Climate risks also include new types of lawsuits, as the quest to make those responsible for climate change—for instance firms or public authorities—develops.

Understanding how these risks affect all asset prices is crucial, not only because they matter for financial stability, but also because financial markets play a key informational role in allocating resources in a market economy2 Therefore, in this policy note, we will ask the following questions: do financial investors take climate risk into account when making their portfolio decisions and how do they manage these risks? As a result, does a financial market provide incentives for climate change mitigation efforts on the part of firms?

We will first define the different risks that climate change creates. Then in a second step, we will discuss whether these risks are priced, and what could potentially limit the transmission of climate risk into prices. Finally, we will discuss different ways investors manage these risks, and show that public policies can be designed to aid individual investors in risk assessment and allocate capital toward projects and technology that are less CO2 intensive.

Which Risks Are We Talking About?

The first step in understanding how climate change affects asset prices is to understand the types of risks that global warming creates. Climate change causes several different risks. The first is regulatory or transition risk. Political initiatives that aim to reduce carbon emissions can make business models built around the exploitation of fossil fuels lose much of their economic value. If financial investors do not integrate this possibility, this can lead to a carbon bubble3 in the sense that fossil fuel-dependent firms may be overvalued.4 This risk is far from theoretical: the Paris agreement, signed in 2016 by 195 countries, commits these governments to limit the temperature increase to 1.5°C above pre-industrial levels. In efforts to comply with some aspects of this agreement, states are starting to implement environmentally friendly policies that affect current corporate cash flows.

The second is litigation risk. Firms that emit more CO2 than others are more exposed to class-action lawsuits and other legal attention, which will seek to make them responsible for climate change. As people pay to adapt to increased regulatory pressure or to mitigate the effects of global warming—for instance people living in coastal areas that are more exposed to changes in sea level—the incentive to demand compensation from the groups responsible for climate change will increase.

To date, more than 1,000 climate change lawsuits have been filed around the world. Examples include Kivalina v. ExxonMobil Corp., where people from a region in Alaska asked for compensation from major oil companies for extreme weather events that were seen as a consequence of climate change.5 Although these lawsuits have little chance of succeeding currently, they are entailing direct costs and reputational damages.

The last type of climate risk—physical risk—comes from changes in the frequency and geography of natural disasters, overall temperatures, and increases in sea levels. This includes costs generated by the subsequent political instability and conflicts that climate change may bring about. Former UN Secretary General Ban Ki-moon considers Sudan’s Darfur region as the first climate change conflict in the world, as alterations in rainfalls caused water shortfall. Using a statistical approach, Hsiang, Burke, and Miguel (2013) find strong evidence that abnormal rainfalls and temperatures systematically and significantly increase the risk of conflict and violence.

Notice that the aforementioned risks are not independent from one another. For instance, if the transition to sustainable economy is strong and happens quickly, then the effects of global warming can be reduced, which would attenuate the direct negative impacts of climate change. Said differently, if transition risk realizes then the physical risks of climate change are less strong. Similarly, if physical risk and / or transition risk realize in a quantitatively important manner, then there is greater likelihood of litigation risk. The more people and communities directly suffer from climate change, the higher the likelihood of more judicial actions against firms or governments considered responsible for global warming.

Are Risks Priced?

The best way to understand whether investors value climate risks is to first ask them. According to surveys, institutional investors deem climate risk important enough to have implications for their portfolio choices, but less important than financial, operating, governance, and social risks. Climate risks are not viewed as a risk that could materialize in the distant future, but as a risk that is taking place currently, especially transition risks (Krueger, Sautner, and Starks 2018).

However, surveys have limitations: they only apply to a small set of agents—namely institutional investors in the study who are available—and assume that people truthfully answer the questions.

Another extremely common methodology in finance is to use a revealed preference approach. If market participants deem an asset to be risky, then, all other things being equal, its payoffs should be higher to compensate for taking on this extra level of risk. As a result, if climate risk is integrated into asset prices, then we should observe a premium in asset prices.

Given the limitations, the challenge becomes how to find a measure of aggregate climate risks and their exposure at the firm level. A first approach is to use the quantity of fuel reserve firms have on hand and whether the firm is in a country that has implemented more climate-friendly policies. Following this approach, banks price transition risks in the cost of borrowing only after 2015 (Delis, de Greiff, and Ongena 2019).

For the average loan in the syndicate market, this represents an increase in the total cost of borrowing of $1.5 million for firms more likely to have their assets stranded. However, this method has a limitation: it gives us the comparative premium that banks ask to bear climate risks through their portfolio of loans instead of how climate risks affect firms’ total cash flows.

One way to handle this limitation is to look at asset prices. A stock is a claim on all the firms’ net cash flows; its price is the function of the firm future discounted expected cash flows. Therefore, under some specific assumptions, climate risk should be reflected in firms’ stock prices.

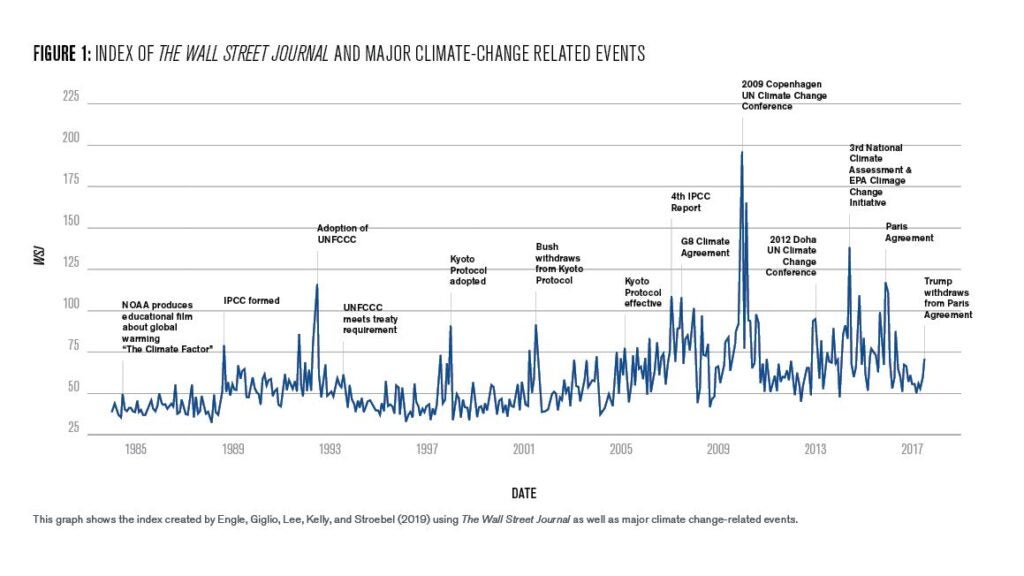

Robert Engle and his coauthors (2019) use a statistical approach to construct a variable that captures how climate risk affects stocks. Investors are more likely to rebalance their portfolio following climate change-related events reported by newspapers. Based on this insight, they construct two different indexes. The first relies on The Wall Street Journal, one of the most read newspapers among investors. They count the number of words related to climate change, as found in 55 climate change glossaries such as the NASA, IPCC, and the United Nations. As can be seen in the graph, this index peaks around major climate change-related events, such as the 2015 Paris agreement.

The second textual analysis relies on a broader sample of news and takes into account the tone of the article, whether it contains negative information or not. The next step is to take into account the fact that firms might be differently affected by the news. So to plausibly account for different exposures to variations of this index, the authors also create a measure of the firm’s level of energy efficiency. This approach has the direct benefit of using variables that the econometrician can observe and capturing exposure to regulatory risk, but has the drawback of being less efficient in capturing physical risk induced by climate change. Finally, they show that climate risk is taken into account in asset prices and one can construct portfolios using their indexes to hedge climate risk. 6

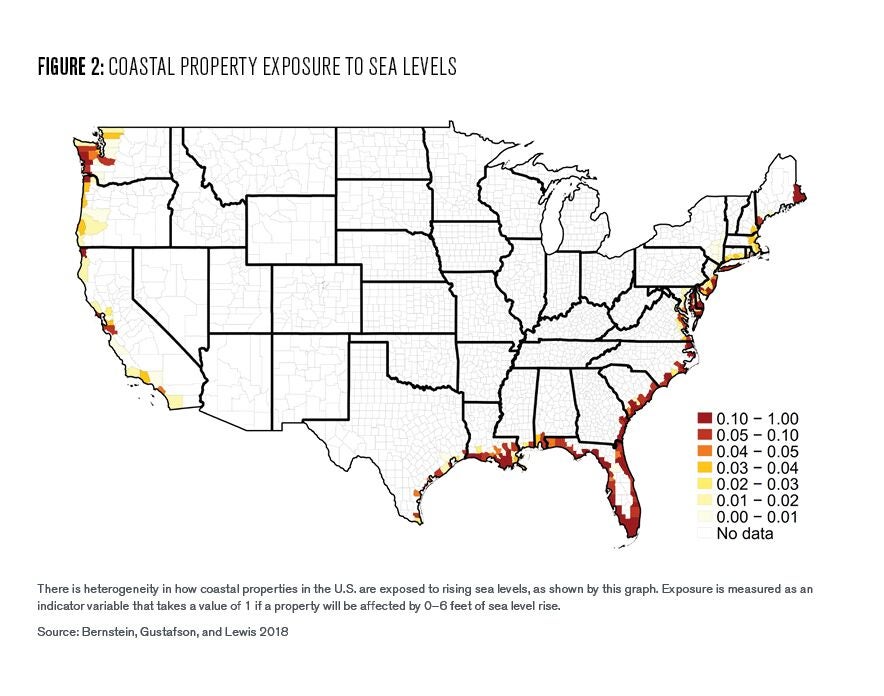

Both approaches provide only indirect evidence that exposure to the climate effects of global warming affect asset prices. The difficulty comes from distinguishing between these risks—namely physical from regulatory risk. Focusing on the housing market can alleviate this problem, as coastal houses have different exposures to rising sea levels coming from different ground elevations (see Figure 2).

Moreover, coastal houses are potentially directly exposed to the physical consequences of climate change, namely a rise in sea levels. Coastal houses exposed to projected rises in sea level trade at a discount of around 7% (Bernstein, Gustafson, and Lewis 2018). This result implies that although the rise of sea level induced by climate change will materialize in several decades, its impact on asset prices is already happening, at least in the real estate market.

Behavioral and Asymmetric Information Frictions

If assets more exposed to climate risks—broadly defined—seem to carry a premium, the way these risks translate into prices is subject to behavioral frictions.

First, financial investors are exposed to framing biases: experiencing extreme weather in local areas where investors live leads them to have more attention to global warming. For instance, when the local temperature is unusually high, people will attribute it to climate change, even if it is totally unrelated to climate change. This comes from the fact that permanent small changes from the trend—such as a 1 or 2 degree increase—are less noticeable than a large and non-permanent increase in local heat.

Attention from investors can be measured by their Google searches as well as their Bloomberg news searches and reading activities. One drawback of this approach is that the authors identify searches from the consumers of these platforms that could potentially be different than the investors, although highly correlated to it. This increased attention translates into an underperforming of carbon-intensive firms, as captured by the realized returns (Choi, Gao, and Jiang 2019). However, it is difficult so far to understand whether people are over or under reacting to climate change.

It could be that experiencing extreme weather is not just affecting attention, but also the beliefs that people hold about climate change. Investors’ personal opinions about global warming affect the way they price climate risks. If a person is personally skeptical about climate change, then he is less likely to consider the type of climate finance risk induced by changes in the Earth’s temperature or sea level. Coastal properties located in areas where people are more skeptical about climate change sell 7% higher in price paid than places where people have the opposite beliefs (Baldauf, Garlappi, and Yannelis 2019).

How to Deal with Risks

There are two ways of dealing with these risks, and the methods used affect the speed at which societies reduce their overall carbon emissions.

- Disinvestment. Investors can walk away from firms more exposed to climate risks. Some investors have made the commitment to decarbonize their portfolio through different initiatives. One of them is the Portfolio Decarbonization Coalition, where investors can submit their written commitment to withdraw capital from carbon-intensive projects within a specific time frame, and for a specific fraction of the assets they manage.

Disinvestment favors a “between transformation,” where firms that don’t pollute are implicitly subsidized and firms that pollute are implicitly taxed through a higher cost of capital. However, disinvestment reduces the possibility of a “within transformation,” where firms that pollute invest in technologies to reduce CO2 emissions because it increases the cost of capital for polluting firms that need to invest in carbon efficient technology.

Everything else equal, more financial constraints translate into less investment that favors the use of environmentally friendly technologies. It remains unclear which type of transformation—between and within—is the best to favor a transition into a green economy. It affects how the burden of climate change will be shared among firms and workers. - Engagement. Investors can act so that the firm pollutes less. This reduces their exposure to transition risk without the need to rebalance their portfolio. There are two ways investors can engage. The first is when investors directly influence firms’ management decisions. Discussion with management, as well as submission of shareholder proposals on climate-risk issues are the main way through which institutional investors affect firms’ outcomes (Krueger, Sautner, and Starks 2018).

Another way to engage in firms’ investment is to invest in green bonds. They constitute an asset class characterized by the Green Bond Principles set by a consortium of banks and institutional investors. The principles are designed to finance directly projects that are environmentally friendly and foster transparency on the bond utilization:

- The proceeds of the bond should be used to develop a project that is environmentally friendly. This means that the project’s goal is related to “pollution prevention and control, biodiversity conservation and climate change adaptation.”

- The issuer should also provide enough information on the project, such as whether it helps the firm to meet a particular environmental objective.

- There should be transparency regarding the unallocated net proceeds of the bonds. This information should be certified by a third-party.

- Finally, the issuer should provide annual reporting on the overall use of proceeds.

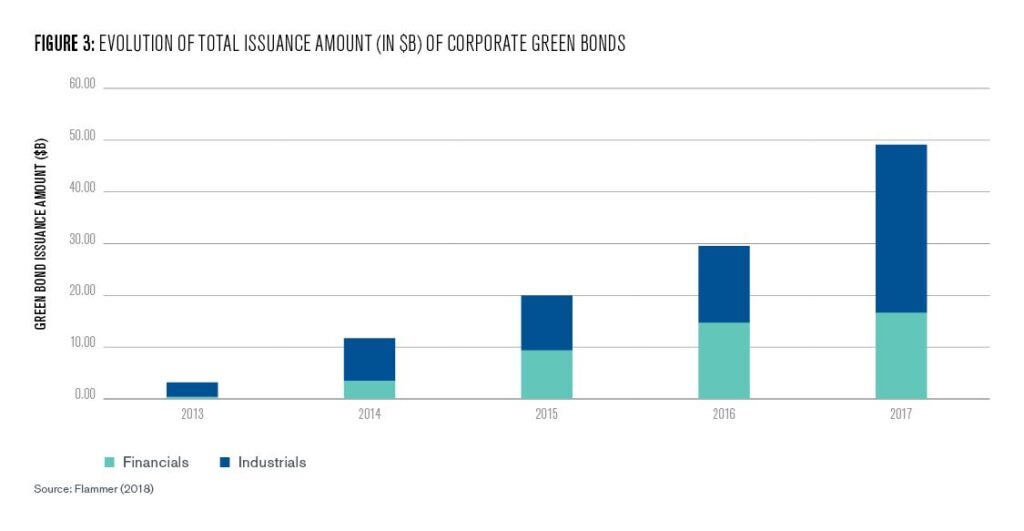

This market has rapidly developed. As shown in Figure 2, the total amount issued rose from $3.2 billion in 2013 to $49.1 billion in 2017. This is even more surprising given that no legal enforcement exists to control whether the funds raised through the bonds go to the projects that are to be financed. Also, green bonds carry significant lower yields—they have an after-tax yield at issue 6 basis points lower than an equivalent bond and have lower return (Baker, Bergstresser, Serafeim, Wurgler 2018).

The green bond market has developed despite having a unique certification mechanism. For instance, firms can apply for a green label from the Climate Bond Certification. This standard does not have a verification purpose on a rolling basis, and most bonds have multiple year horizons. Other certification mechanisms include Moody’s Green Bond Assessments and Standard & Poor’s Green Evaluations. The diversity of certifications can increase the overall welfare in the sense that it creates different shades of green bonds, which can then be matched to investors’ specific preferences more easily than having only one type of bond. However, it increases the cost for external investors to collect information on each certification mechanism.

Role of Government Policies

Policies to deal with climate risk suppose that households and investors have access to legally enforced data on firms’ carbon emissions, which is often not the case in practice. Disclosure standards concerning investment in CO2 reduction projects are not harmonized among countries and differ between firms. Moreover, certification mechanisms are paid by the issuers, an approach that creates a conflict of interest.

On one hand, they have an incentive to provide strict standards when evaluating whether a bond is eligible to receive the certification. On the other hand, however, being lenient in accepting green bonds increases their number of clients. Just the presence of a potential conflict of interest between the issuer and the certification organization is sometimes enough to undermine investors’ trust, even if in reality there is no conflict of interest. That is why harmonized and independent information enforced by a public authority is needed.

This does not mean that private certification should be suppressed. There is value in having competition between different ways of assessing firms’ commitment to environmentally friendly policies. These “shades of green” allow investors to benefit from a diverse range of assets that vary in intensity and commitment to environmentally friendly policies. However, simple, harmonized, and legally enforced information on CO2 policies should be provided.

This is needed to allocate funds from polluting firms to cleaner ones and to see whether shareholders’ engagement is translated into policies that reduce CO2. Similarly, understanding which portfolio-managing firms are investing in sustainable firms is key for households concerned with global warming to properly allocate their savings.

To reduce the incentive firms currently have to “green wash,” we should design policies aimed at increasing the quality and quantity of data on CO2 emissions, environmentally friendly projects as well as the carbon content of portfolios and the climate risk exposure of banks and institutional investors.

Aymeric Bellon

Doctoral StudentAymeric Bellon is a Ph.D. student of finance in the Wharton School at the University of Pennsylvania.

Baker, Malcolm, Daniel Bergstresser, George Serafeim, and Jeffrey Wurgler. 2018.

“Financing the Response to Climate Change: The Pricing and Ownership of U.S. Green Bonds.” No. w25194. National Bureau of Economic Research.

Baldauf, Markus, Lorenzo Garlappi, and Constantine Yannelis. 2019. “Does Climate Change Affect Real Estate Prices? Only If You Believe In It.” Review of Financial Studies, forthcoming.

Bernstein, Asaf, Matthew T. Gustafson, and Ryan Lewis. 2019. “Disaster on the Horizon: The Price Effect of Sea Level Rise.” Journal of Financial Economics.

Carbon Tracker Initiative. 2001. “Unburnable Carbon –Are the World’s Financial Markets Carrying a Carbon Bubble?” Technical report.

Choi, Darwin, Zhenyu Gao, and Wenxi Jiang. 2019. “Attention to Global Warming.” Available at SSRN 3180045.

Delis, Manthos D., Kathrin de Greiff, and Steven Ongena. 2019. “Being Stranded with Fossil Fuel Reserves? Climate Policy Risk and the Pricing of Bank Loans.” Swiss Finance Institute Research Paper 18-10.

Engle III, Robert F., Stefano Giglio, Bryan T. Kelly, Heebum Lee, and Johannes Stroebel. “Hedging Climate Change News.” No. w25734. National Bureau of Economic Research, 2019.

Flammer, Caroline. 2018. “Corporate Green Bonds.” Journal of Financial Economics, revise & resubmit.

Hsiang, Solomon M., Marshall Burke, and Edward Miguel. 2013. “Quantifying the Influence of Climate on Human Conflict.” Science 341, no. 6151.

International Energy Agency. 2008. IEA World Energy Outlook.

Krueger, Philipp, Zacharias Sautner, and Laura T. Starks. 2018. “The Importance of Climate Risks for Institutional Investors.”

Le Page, Michael. 2011. “Carbon Bubble Could Threaten Markets.” New Scientist.

OECD. 2017. “Investing in Climate, Investing in Growth.” OECD Publishing, Paris.

- This term captures the idea that fossil fuel reserves could lose all their economic value as the economy moves toward less intensive carbon technology. [↩]

- Firms receive price signals from investors and this helps them to make investments. This comes from the fact that public firms maximize shareholders’ value and minimize the cost of external funding. This information role is even more important than climate change and requires an enormous amount of investments. For instance, to reach the 2 degree Celsius cap—agreed upon in Paris at the 21st Conference of Parties (OECD, 2017)—will require a bit less than $7 trillion of investment per year. Estimates from the International Energy Agency (IEA 2008) suggest that $26 trillion of investment will be required on infrastructure from 2008 to 2030 to maintain energy demand. [↩]

- The term first appears in Le Page (2011) and Carbon Tracker Initiative (2011). [↩]

- In a rational economy without any mispricing, asset prices reflect all their future expected cash flows. Climate risk should therefore be reflected in prices. [↩]

- See https://www.whitecase.com/publications/insight/climate-change-litigation-new-class-action for more examples of juridical cases. [↩]

- Said differently, an investor can potentially purchase and sell stocks with returns that will be negatively correlated with climate risk realization: the investor will gain money when climate risk realizes, and will lose when climate risk has not realized. [↩]