Battling for Batteries: Li-ion Policy and Supply Chain Dynamics in the U.S. and China

Three decades of U.S.–China battery policy show China’s playbook-built dominance while U.S. efforts fluctuated. We map out this timeline and implications and lessons for the future of U.S. Li-ion, and potentially other clean tech industries.

At A Glance

Key Challenge

With U.S. climate policy rolling back, and minerals security ascendant and China dominant, the challenge is building competitive Li-ion supply chains amid rising trade, tech, and geopolitical rivalry.

Policy Insight

In this landscape, strategic policymaking—well-timed investments across supply chains—will decide who leads the next wave of battery and next-generation clean energy technology.

Introduction

As the world’s two largest economies, the United States and China are leading actors in the global renewable energy transition (Hou et al. 2020), and their competition has intensified across trade, technology, and geopolitics. These areas are closely linked to the lithium-ion battery industry, which powers electric vehicles, grid storage systems, and much of the clean energy economy. Control over battery supply chains increasingly shapes national security, industrial competitiveness, and global influence.

Both countries have adopted green industrial policies to navigate this strategic landscape as a form of industrial planning; these policies address market failures related to decarbonization and resource security (Allan and Nahm 2025; WEF 2024). Often driven by national priorities rather than global cooperation, these policies have contributed to growing fragmentation in the global energy transition (Aiginger and Rodrik 2020; Allan and Nahm 2025).

Under the new Trump administration, climate-related policies have been discontinued and reversed; however, the administration has maintained efforts to support critical minerals under the umbrella of strategic assets and national security. This has allowed green industrial policies to continue, but with a greater focus on defense and material security.

This report provides a comparative analysis of U.S. and Chinese lithium-ion battery policies over the past several decades. These policies shape the lithium-ion battery supply chain, impacting everything from critical mineral sourcing to the development and deployment of the batteries themselves. By tracing this policy evolution, we can draw lessons for how to move forward—not only to strengthen current battery supply chains, but also to guide the development of future clean energy technologies. This is especially important in the U.S. context, where government support for climate policy has eroded, but interest in mineral security remains strong.

Background

Although the lithium-ion battery industry began with researchers from the U.S., Japan, and South Korea, Chinese companies such as BYD and CATL dominate the global battery industry today. Stanley Whittingham’s Exxon-era TiS₂/Li design in the 1970s proved the concept, John B. Goodenough’s 1980 LiCoO₂ cathode unlocked higher voltage, and Akira Yoshino’s 1985 carbon-anode cell made it safe enough for Sony to commercialize in 1991 (Nobel Prize 2019).

The first commercial lithium-ion battery was released in 1991 (Liu 2019; Reddy et al. 2020). Through the 1990s and 2000s, manufacturing clustered in Japan and then Korea (Sony/Panasonic, LG Chem, Samsung SDI), along with scientific research on battery development in the U.S. (Xie and Lu 2020). From the late 2000s, China fused industrial policy with scale: the 2009 “Ten Cities, Thousand Vehicles” pilots and subsequent NEV subsidies, plus Made in China 2025, nurtured firms like BYD and CATL and built a full mid-stream (anodes/cathodes) and cell base that today dominates global markets (Chu 2021).

A symbolic inflection for U.S.–China dynamics came in 2013, when China’s Wanxiang acquired federally backed A123 Systems out of bankruptcy, highlighting U.S. struggles to scale domestic production even after ARRA’s $2.4B battery grants (Renewable Energy World 2013). Since then, China has taken a decisive global lead in the lithium-ion battery and EV industry.

A recent study assessing lithium-ion battery supply chains in the U.S. and China determined that, as of 2025, the U.S. was predominantly medium-to-high-risk, and China was predominantly low-risk across the supply chain (Craig-Scheckman and Moore 2025). One example of China’s success in the lithium-ion supply chain is its high levels of exports of major lithium-ion components and lithium-ion batteries themselves (see Figure 1).

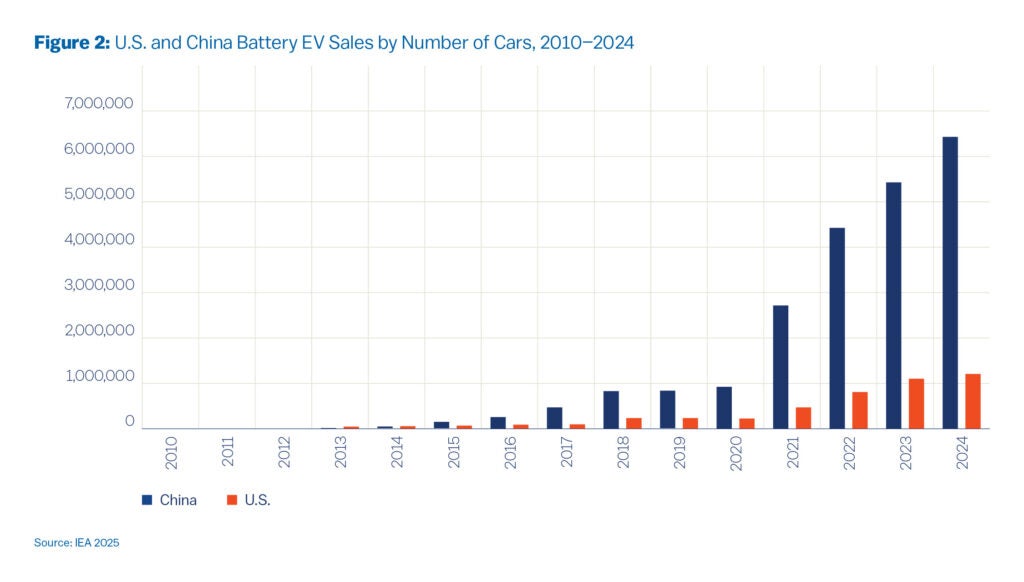

China’s dominance in battery manufacturing has resulted in strong electric vehicle production as well, and it now produces far more vehicles than the U.S. (see Figure 2). While U.S. sales have grown over the past decade, initial 2025 numbers indicate that EV sales in the U.S. have already slowed, despite global market growth (Rivers 2025).

Lithium-ion batteries are essential for reducing global carbon emissions, especially in the transportation sector (Peiseler et al. 2024; Sacchi et al. 2022). The transportation sector accounts for 15% of global emissions (Climate Watch 2024). Lithium-ion batteries, and electric vehicles themselves, require “critical” minerals like lithium, cobalt, nickel, copper, graphite, and rare earth elements (REE).

The definition of critical minerals varies depending on the context, as different stakeholders and institutions may categorize them based on economic importance, supply risk, or strategic necessity (Frenzel et al. 2017; Zepf 2020). According to the United States government, a critical material is defined as “any non-fuel mineral, element, substance, or material that the Secretary of Energy determines: (i) has a high risk of supply chain disruption; and (ii) serves an essential function in one or more energy technologies, including technologies that produce, transmit, store, and conserve energy,” (DOE 2025).

On the other hand, Chinese policies and policymakers refer to these minerals as “strategic” instead of critical. In 2016, China released a strategic minerals list as part of its National Mineral Resources Plan (2016–2020), the most recent publicly available national-level framework for managing mineral exploration, development, utilization, and protection. This list emphasizes the role of these minerals in economic growth, national defense, and strategic industries.

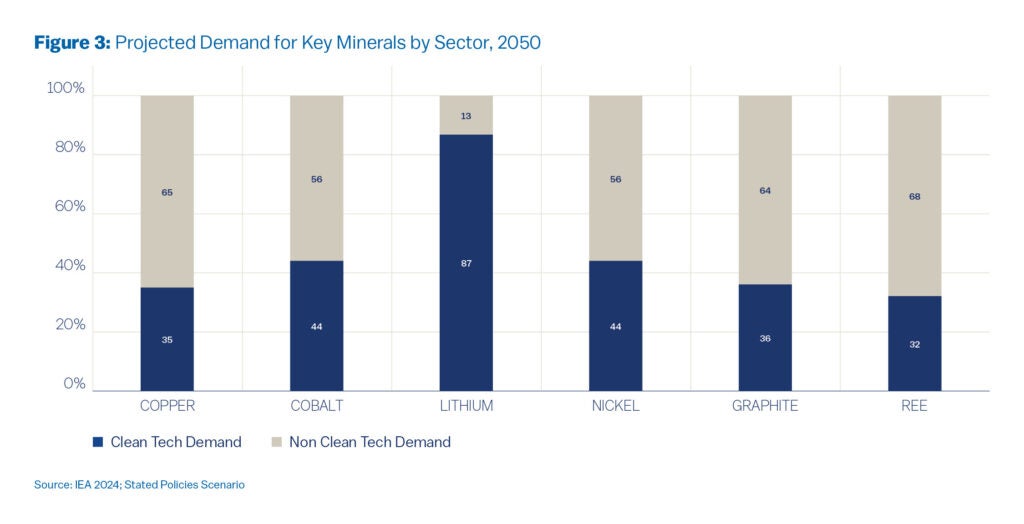

These minerals are essential for many renewable energy technologies, as well as a wide variety of essential electronics like semiconductors, used to generate artificial intelligence, and numerous military technologies (e.g., missiles, unmanned aerial vehicles, communications equipment). However, even the IEA’s most conservative projections show that renewable technology will drive demand for these minerals by 2050 (see Figure 3) (IEA 2024).

Mapping the Policy Timeline

Government policies are not the sole determinant of a nation’s success in an industry, but as green industrial policies continue to emerge, it is essential to understand their role. Using a combination of the IEA Policy Tracker Database and data from U.S. and Chinese government websites, we have identified 50 Chinese policies and 85 American policies relating to the lithium-ion battery supply chain since the 1970s.

These policies were selected using the IEA Policy Tracker, along with government documents from the U.S. and China. The selection criteria for a “lithium-ion battery policy” were if the policy impacted materials along the supply chain, from the mining of minerals used for the batteries, the manufacturing of components, as well as the production, use, and discarding of the battery itself.

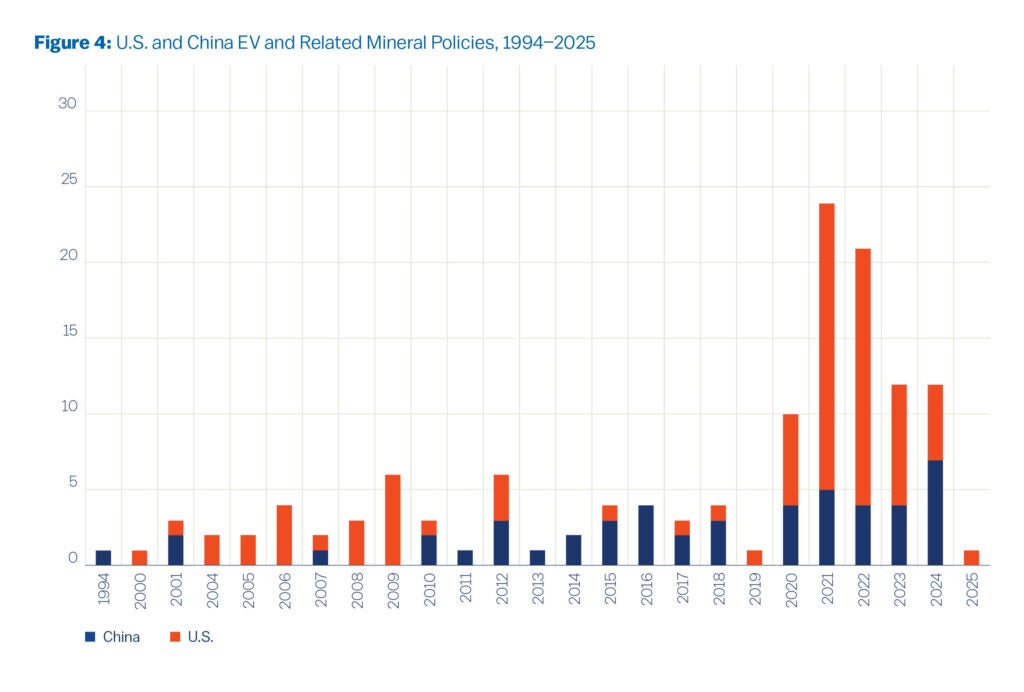

Figure 4 provides a snapshot of policy implementation from 1994 to 2025. This snapshot demonstrates a high-level overview of the policy narrative. China’s policy activity starts earlier and ramps steadily from the late 2000s, reflecting a long-running, programmatic push across the battery value chain. While U.S. policies were strong in the early 2000s, China pulled ahead in the 2010s and maintained consistency.

The U.S. attempted a frenzy of policies in the 2020s, many of which have since been reversed or altered; the full impact of these policies remains to be seen. However, the frequency and quantity of policy implementation do not tell the full story. The following sections outline three distinct policy periods: 2000 to 2010, 2010 to 2020, and 2020 to 2025.

2000 to 2010. This decade marked a high point in U.S.-China relations, with China engaging in global institutions (i.e., acceding to the World Trade Organization, joining the UN, and the World Bank). Climate change also began gaining international recognition, though it was not yet a central policy focus for either country. By the early 2000s, lithium-ion battery technology was emerging, though still in its early commercial stages.

During this period, the U.S. implemented 15 lithium-ion battery–related policies, while China implemented just 3. U.S. efforts centered on trade liberalization, with 8 free trade agreements (e.g., with Jordan, Chile, and Australia) that eliminated tariffs on raw and processed battery materials. The 2000 African Growth and Opportunity Act further expanded duty-free access for battery-related products. Key domestic initiatives included the 2007 Energy Storage Technology Advancement Act, the 2006 and 2008 clean vehicle tax credits, and two federal programs focused on fuel cell buses and smart grid development. In China, the 10th Five-Year Plan (2001) marked an early shift toward renewable energy, prioritizing wind, solar, and battery development. China also negotiated FTAs with Chile and Pakistan, reducing tariffs on critical battery components and minerals like nickel and lithium—early steps in building its industrial base for energy technologies.

2010 to 2020. This period saw a major acceleration in global EV adoption and a shift in geopolitical dynamics. In China, Xi Jinping became president in 2012, while in the U.S., the decade was shaped by the Obama and Trump administrations. The U.S.–China trade war began in 2017, embedding clean energy and battery policy within a broader context of economic rivalry. Between 2010 and 2020, China implemented 20 battery-related policies, compared to 8 in the U.S. China’s approach was systematic; it combined national plans (e.g., the 12th Five-Year Special Plan), fiscal incentives for New Energy Vehicles, and trade instruments like FTAs with Peru, Costa Rica, Switzerland, and Korea.

Tariff adjustments were used both to protect domestic manufacturers and stimulate innovation, while environmental controls, such as the 2018 import ban on battery waste, supported broader sustainability goals. While China’s EV policies supported the nation’s leadership in clean energy development, it is important to note that a major driver of China’s EV push is energy security (Ezell 2024). In the U.S., policy efforts were more reactive and fragmented. Measures like the 2015 NETL rare earth recovery initiative and the 2019 Strategic and Critical Minerals Stockpiling Act demonstrated growing interest in domestic supply chains.

In 2018, the U.S. implemented a 10% tariff on $200 billion of Chinese goods (List 3), which was later increased to 25% on May 10, 2019. This list included a broader range of products, such as certain types of batteries and components used in EV manufacturing. In 2019, the U.S. imposed a 15% tariff on approximately $112 billion of Chinese imports (List 4A). This list encompassed consumer electronics and products more directly related to lithium-ion batteries and EVs.

2020 to 2025. Tensions between the U.S. and China deepened during the 2020–2025 period. The Biden administration launched landmark green industrial policies, including the Infrastructure Investment and Jobs Act and the Inflation Reduction Act, to stimulate the clean energy economy and compete directly with China in battery manufacturing and critical minerals.

For the first time, the U.S. outpaced China in policy volume, with 50 lithium-ion battery–related policies, compared to 24 from China. U.S. policies included a mix of executive orders, tax credits, workforce programs, and global agreements, such as the Canada–U.S. Critical Minerals Plan and the 2023 U.S.–Japan Supply Chain Agreement.

This period also saw a sharp rise in tariffs: in 2024, the Biden administration imposed a 100% tariff on Chinese EVs, and the 2025 Trump administration followed with a 54% cumulative tariff on Chinese imports, signaling a deepening use of industrial policy as economic statecraft (Chung 2025; The White House 2024).

Major U.S. policies like the Defense Production Act and CHIPS Act supported domestic mineral production and processing, while executive orders targeted supply chain vulnerabilities and boosted federal demand for clean energy technologies. Since the start of the second Trump administration in January 2025, U.S. policies around lithium-ion batteries have been in flux—while renewable energy momentum in the market remains, the administration has shifted its focus away from renewable energy. One of President Trump’s first executive orders, the 2025 Unleashing American Energy order, reversed many Biden-era climate directives; additionally, under the One Big Beautiful Bill Act, many previously implemented tax incentives and credits are under review or in the process of being removed (The White House 2025a).

However, the administration has maintained a focus on critical minerals as strategic assets. The 2025 Unleashing American Energy executive order states that “It is the policy of the United States… to establish our position as the leading producer and processor of non-fuel minerals, including rare earth minerals, which will create jobs and prosperity at home, strengthen supply chains for the United States and its allies, and reduce the global influence of malign and adversarial states,” (The White House 2025a).

Despite having significant negative implications for the future of renewable energy development, the document maintains that critical minerals, especially rare earth elements, remain a priority for the United States. For example, in March 2025, the White House released a document outlining “Immediate Measures to Increase American Mineral Production” (The White House 2025b). The DOE also conducted a Request for Information to create an updated 2026 Critical Mineral framework. Trump’s Liberation Day tariffs exempted many minerals but still put pressure on lithium-ion battery supply chains.

Meanwhile, China maintained a coordinated strategy through their Five-Year Plans, national tax incentives, and strategic trade agreements, such as the China–Serbia free trade agreement. Policy tools included EV subsidies, recycling standards, rare earth management regulations, and targeted tariff exemptions. Additionally, the rollout of the Trump administration tariffs led to China implementing export controls on key minerals such as rare earth elements (REEs). In retaliation to U.S. tariffs, China introduced a 34% tariff on U.S. imports and imposed export controls on rare earths, reflecting a tit-for-tat escalation in mineral-related trade tools.

While REEs are not key components of lithium-ion batteries themselves, they are essential for permanent magnets used in EVs and other renewable energy technologies like wind turbines. China is home to 70% of REE processing (Huld 2025). In June 2025, the two countries reached a deal in which China agreed to resume REE shipments to the U.S., and the U.S. agreed to ease tariffs and export controls (Hawkins and Rushe 2025). Despite a pause in escalation, the future of U.S.–China mineral regulations remain uncertain.

Implications

This policy assessment reveals a strategic landscape shaped by evolving priorities, competing agendas, and shifting global dynamics. The results offer valuable guidance for navigating current uncertainties within the lithium-ion battery industry and critical mineral mining, as well as for emerging and next-generation renewable energy technologies.

First, it’s important to contextualize recent U.S. policy shifts. After observing the effectiveness of China’s industrial policies during the 2010s, the U.S. began adopting similar approaches, with increasing frequency in the 2020s. These efforts have increasingly fueled protectionist behavior, a trend that has accelerated under the Trump administration. While lithium-ion battery policies are not the sole drivers of this shift, they are emblematic of the broader move toward economic nationalism.

The recent tariff battle between the U.S. and China is linked to provisions around critical minerals, indicating that, within the broader context of U.S.–China relations, minerals and batteries are a tool being utilized by both sides to gain leverage. Given current trajectories, critical minerals and technologies like lithium-ion batteries are likely to remain at the heart of U.S.–China tensions well into the foreseeable future.

If countries are using resources and technologies as leverage, it would serve the U.S. to support domestic efforts around creating robust mineral supply chains (mining, processing, and manufacturing into technologies). Protectionist, resource nationalism policies like tariffs and export controls need to be combined with investment in the domestic industry. That includes investing in research, workforce development, and infrastructure. Otherwise, these policies will just make lithium-ion battery manufacturing more expensive and stifle production efforts.

Second, lithium-ion battery policies cannot be disentangled from defense and national security priorities. Many policies targeting lithium-ion batteries also have direct implications for military technologies, and vice versa. As a result, the push for EVs and clean energy is only one piece of the puzzle. Especially under the new U.S. Trump administration, strategic competition and security concerns are playing an equally important role in shaping the future of battery policy.

As highlighted earlier in this report, in China, national security concerns have always played a role in lithium-ion battery policy. These intersections between national security, resource management, and emerging technologies explain why minerals continue to hold such high policy importance, not just as inputs for clean energy, but as tools of economic statecraft in an era of intensifying geopolitical rivalry. While continued policy relevance will have some positive outcomes for mineral-based renewable energy technologies, reduced focus on decarbonization will slow climate change mitigation progress in the U.S.

A third takeaway is the importance of strategic policymaking and implementation timing; these factors have played a decisive role in shaping global leadership in the lithium-ion battery industry. China aligned state support with the global commercialization phase of battery technologies, positioning itself early in the value chain, from raw materials to manufacturing. This first-mover advantage, reinforced by coordinated industrial policy, helped China dominate the market before competitors could respond. At the same time, China’s efforts also supported global lithium-ion battery adoption by lowering costs.

However, the current U.S. context is defined by decreasing acceptance of reliance on Chinese materials. While the U.S. may have initially benefited from Chinese lithium-ion battery innovation, recent U.S. legislation is forcing companies to restructure supply chains away from China, creating supply chain and innovation challenges. In contrast, U.S. policy momentum has picked up only recently, largely in reaction to China’s success. While current efforts are robust, they face structural lag: developing a domestic supply chain, scaling production, training a workforce, and commercializing next-gen technologies all require long lead times and sustained investment.

Additionally, changes from direct lithium-ion battery and EV incentives to policies focused more on mineral development will impact previously obtained momentum. It is not too late to apply lessons learned to emerging technologies. Despite policy uncertainty, clean energy investments are still growing (Abrahams and Majkut 2025). With the right policy tools, the U.S. could position itself at the forefront of future key sectors—whether advanced batteries, hydrogen, or AI-enabled clean energy optimization.

Madeline Craig-Scheckman

Ph.D. Candidate, Northeastern UniversityMadeline Craig-Scheckman is Ph.D. candidate at Northeastern University. Her research focuses on geopolitics and critical minerals in the Indo-Pacific. She is a non-resident fellow at the Jain Family Institute, an associate researcher with the Second Cold War Observatory.

Scott Moore

Director of China Programs and Strategic InitiativesScott Moore is a faculty fellow at the Kleinman Center for Energy Policy and the Director of China Programs and Strategic Initiatives. He is also a practice professor of political science.

Abrahams, Leslie, and Joseph Majkut. 2025. “U.S. Clean Tech Exports Are the Key to Long-Term U.S. Economic Growth.” CSIS. https://www.csis.org/analysis/us-clean-tech-exports-are-key-long-term-us-economic-growth

Aiginger, K. and D. Rodrik. “Rebirth of Industrial Policy and an Agenda for the Twenty-First Century.” Journal of Industry, Competion and Trade 20, 189–207 (2020). https://doi.org/10.1007/s10842-019-00322-3

Allan BB and J. Nahm. “Strategies of Green Industrial Policy: How States Position Firms in Global Supply Chains.” American Political Science Review. 2025;119(1):420-434. doi:10.1017/S0003055424000364

Climate Watch. 2024. “Electricity and Heat” [dataset]. Climate Watch, “Greenhouse gas emissions by sector” [original data]. – With major processing by Our World in Data. https://ourworldindata.org/grapher/ghg-emissions-by-sector?overlay=sources

Christensen, T. J. 2015. The China Challenge: Shaping the Choices of a Rising Power. W. W. Norton & Company.

Chu, Yudan. 2021. “How China Promotes New Energy Vehicles. The International Council on Clean Transportation.” OECD. https://www.itf-oecd.org/sites/default/files/docs/china-promotes-new-energy-vehicles-historically-future.pdf

Chung, Andrew. 2025. “U.S. Supreme Court to Decide Legality of Trump’s Tariffs.” Reuters. https://www.reuters.com/legal/government/us-supreme-court-decide-legality-trumps-tariffs-2025-09-09/

Ezell, Stephen. 2004. “How Innovative Is China in the Electric Vehicle and Battery Industries?” Information Technology and Innovation Foundation. https://itif.org/publications/2024/07/29/how-innovative-is-china-in-the-electric-vehicle-and-battery-industries/

Federal Register. 2023. “Notice of Final Determination on 2023 DOE Critical Materials List.” Federal Register, 88(151). https://www.federalregister.gov/documents/2023/08/04/2023-16611/notice-of-final-determination-on-2023-doe-critical-materials-list

Frenzel, M., J. Kullik, M.A. Reuter, and J. Gutzmer. 2017. “Raw Material ‘Criticality’—Sense or Nonsense?” Journal of Physics D: Applied Physics, 50(12), 123002. https://doi.org/10.1088/1361-6463/aa5b64

Hawkins, Amy, and Dominic Rushe. 2025. “U.S. Reaches Deal with China to Speed upRare-Earth Shipments, White House Says.” The Guardian. https://www.theguardian.com/business/2025/jun/27/us-china-rare-earth-shipments-deal

Hou, J., Q. Li, J. Wang, and X. Liu. 2020. “The Global Competitiveness of China’s New Energy Vehicle Industry: A Policy and Market-Based Perspective.” Energy Policy, 137, 111171. https://doi.org/10.1016/j.enpol.2019.111171

Huld, Arendse. 2025. “Rare Earth Elements: Understanding China’s Dominance in Global Supply Chains.” China Briefing. https://www.china-briefing.com/news/chinas-rare-earth-elements-dominance-in-global-supply-chains/

International Energy Agency (IEA). 2024. Critical Minerals Dataset, IEA, Paris https://www.iea.org/data-and-statistics/data-product/critical-minerals-dataset, Licence: CC BY 4.0

International Energy Agency (IEA). 2025. Critical Mineral Database. https://www.iea.org/account/login

Liu, Z. 2019. “The History of the Lithium-Ion Battery.” ThermoFisher Scientific. https://www.thermofisher.com/blog/materials/the-history-of-the-lithium-ion-battery/

Lobosco, K. 2024. “Biden Finalizes Increases to Some of Trump’s China Tariffs.” CNN. September 13. https://www.cnn.com/2024/09/13/politics/china-tariffs-biden-trump/index.html

Nahm, J. 2021. Collaborative Advantage: Forging Green Industries in the New Global Economy. Oxford University Press.

Nobel Prize. 2019. “Nobel Prize in Chemistry 2019.” https://www.nobelprize.org/prizes/chemistry/2019/summary/

Observatory of Economic Complexity. 2025. “HS Products.” https://oec.world/en/product-landing/hs.

Peiseler, L., V. Schenker, K. Schatzmann, et al. “Carbon Footprint Distributions of Lithium-Ion Batteries and their Materials.” Nature Communications 15, 10301 (2024). https://doi.org/10.1038/s41467-024-54634-y

Procell, C., and D. Zhang. 2025. “Tariff Timeline: Tracking the Evolution of Donald Trump’s Trade War.” USA Today. March 28. https://www.usatoday.com/story/graphics/2025/03/28/trump-tariff-tracker-timeline/82367214007/

Reddy, M. V., A. Mauger, C.M. Julien, A. Paolella, and K. Zaghib. 2020. “Brief History of Early Lithium-Battery Development.”Materials, 13(8), 1884. https://doi.org/10.3390/ma13081884

Renewable Energy World. 2013. “Wanxiang wins U.S. Government Approval to Buy Battery Maker A123.” Renewable Energy World. January 30. https://www.renewableenergyworld.com/storage/wanxiang-wins-u-s-government-approval-to-buy-battery-maker-a123/

Rivers, Stephen. 2025. “The World Is Racing Toward EVs While America Barely Leaves the Driveway.” Car Scoops. https://www.carscoops.com/2025/08/electric-vehicle-sales-are-up-all-over-the-globe/

Sacchi, R., C. Bauer, B. Cox, and C. Mutel. 2022. “When, Where and How Can the Electrification of Passenger Cars Reduce Greenhouse Gas Emissions?”Renewable and Sustainable Energy Reviews, 162, 112475. https://doi.org/10.1016/j.rser.2022.112475

The White House. 2024. “President Biden Takes Action to Protect American Workers and Businesses from China’s Unfair Trade Practices.” https://bidenwhitehouse.archives.gov/briefing-room/statements-releases/2024/05/14/fact-sheet-president-biden-takes-action-to-protect-american-workers-and-businesses-from-chinas-unfair-trade-practices/

The White House. 2025a. “Unleashing American Energy.” https://www.whitehouse.gov/presidential-actions/2025/01/unleashing-american-energy/

The White House. 2025b. “Immediate Measures to Increase American Mineral Production.” https://www.whitehouse.gov/presidential-actions/2025/03/immediate-measures-to-increase-american-mineral-production/

United Nations. 2021. United Nations Sustainable Transport Conference 2021: Outcomes and Messages. https://www.un.org/en/conferences/transport2021

U.S. Department of Energy. 2023. Critical Materials Assessment 2023. Office of Policy. https://www.energy.gov/eere/ammto/articles/2023-doe-critical-materials-assessment

U.S. Department of Energy (DOE). 2025. “What Are Critical Materials and Critical Minerals?” https://www.energy.gov/cmm/what-are-critical-materials-and-critical-minerals

World Economic Forum. 2024. “Energy Transition and Geopolitics: Are Critical Minerals the New Oil?” https://www3.weforum.org/docs/WEF_Energy_Transition_and_Geopolitics_2024.pdf

Xie, J., and C. Lu. 2020. “A Retrospective on Lithium-Ion Batteries.” Nature Communications, 11, 2499. https://doi.org/10.1038/s41467-020-16259-9

Zepf, V. 2020. “Rare Earth Elements: What and Where they Are. In M. A. A. Elshazly and K. S. Batarseh (Eds.), Rare Earth Elements: The Global Supply Chain

Zhou and Manberger, 2024. “Critical Minerals and Great Power Competition: An Overview.” Stockholm International Peace Research Institute. https://www.sipri.org/publications/2024/research-reports/critical-minerals-and-great-power-competition-overview