Paying close attention to distributional impacts and political economy constraints is key to understanding why governments around the world keep falling short on carbon pricing—and what to do about it.

Pricing carbon.

It could be the most powerful tool in the climate policy arsenal. By putting a price on carbon pollution equal to the marginal societal damages caused by an additional ton of carbon dioxide (CO2)—referred to as the “social cost of carbon” (Nordhaus 2017)1 —policy makers can incentivize businesses and consumers to consider the economic cost of climate change in countless decisions. “Internalizing” the cost of carbon emissions in this way, by implementing either a carbon tax (Metcalf & Weisbach, 2009) or emissions cap and permit trading system (Stavins 2008), is widely regarded as the least expensive and most market friendly way to drive down greenhouse gas (GHG) emissions and confront the threat posed by climate change (Nordhaus 1994; Stavins 1997; Aldy & Stavins 2012; Stiglitz et al. 2018).

There’s only one catch: governments around the world consistently fall short in their efforts to price carbon.

As of 2018, 47 regional, national, and subnational jurisdictions worldwide have enacted some form of carbon price (World Bank 2018).2 That represents a robust increase in the number of carbon pricing policies, up from 32 in 2013 and 15 in 2008 (ibid.).

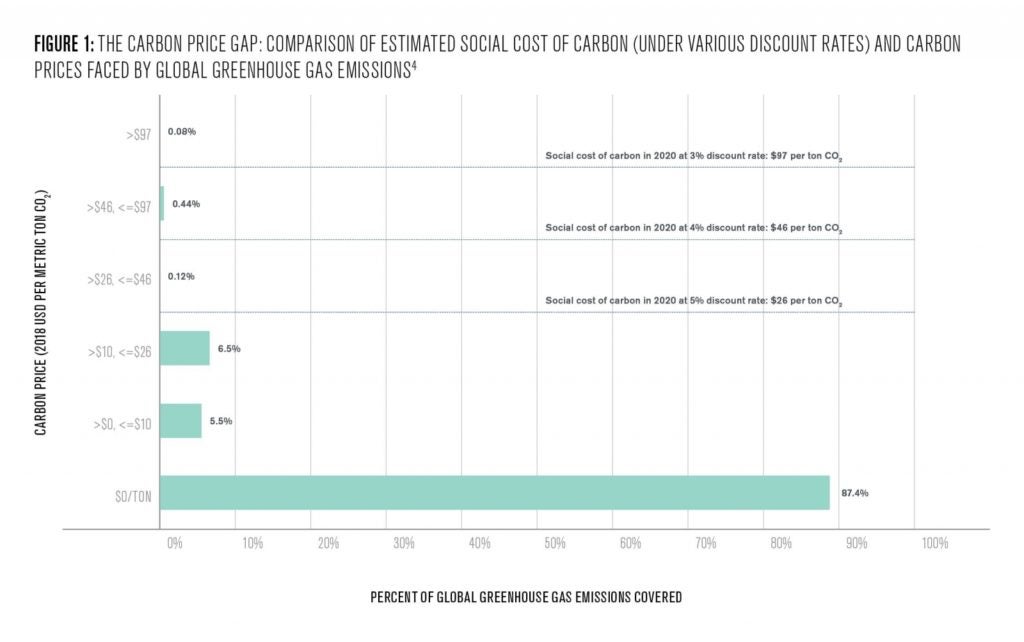

Despite this progress, 87% of global GHG emissions still face no carbon price at all.3 More striking still, less than one percent of global emissions are currently subject to a carbon price equal to even a low-end estimate of the social cost of carbon (see Fig. 1; World Bank 2018).

In other words, even where governments successfully enact carbon prices, they do not do the job that environmental economists envision: fully internalizing the costs of climate damages in market transactions. The result is a “carbon price gap” (OECD 2018), a substantial difference between the damages caused by a ton of CO2 emissions and the price paid by industry, business, and households for the emissions their activities cause.

–4

Why do governments fail to put an adequate price on carbon, and what can be done to accelerate the pace of progress towards a low-carbon energy system commensurate with the threat posed by a warming world?

This carbon price gap—and the potential solutions to overcome it—can be understood by considering the political economy of carbon pricing (Jenkins 2014; Jenkins & Karplus 2016; Biber et al. 2017; Carattini et al. 2018; Klenert et al. 2018). Any effort to transform the energy system will create economic and political winners and losers. Designing efficient and effective climate policy for the real world thus requires careful attention to how costs and benefits are distributed across stakeholders in ways that determine both the immediate political feasibility and the durability of various policy options over time. Attention to how clever policy choices can affect distributional outcomes and alter the political economy of climate policy may hold the key to accelerating the as-yet inadequate pace of carbon reductions.

Winners and Losers: The Distributional Impacts of Climate Policy

Pricing carbon may be the most efficient way to confront climate change, which means that it offers the lowest cost method of producing any given level of carbon reduction and generates the largest aggregate benefits of any policy option. However, it is not only the size of the pie that matters, but how it is divided. The so-called “distributional impacts” of carbon pricing policies will fundamentally shape what can and cannot be accomplished in the political realm.

Impacts on Industry. Near-term economic losses associated with transitioning towards a lower-carbon economy will be greatest for firms that exhibit high “asset specificity”5 —that is, firms that have invested significant resources in durable physical assets, human capital, or natural resource endowments that would lose considerable value under a carbon price. The costs of carbon pricing are thus concentrated in certain industries, including fossil fuel extraction, oil refiners, electric utilities with significant capital invested in coal or gas-fired power plants, energy-intensive industries, and some agricultural interests.

Additionally, depending on market conditions, firms will pass on some (maybe even most) of the costs of a carbon price to consumers in the form of higher prices for intermediate and final goods. However, by raising prices, firms can lose market share to domestic competitors with a lower carbon intensity and international competitors subject to laxer regulatory environments (Aldy & Pizer 2015; Fowlie et al. 2016). The availability of substitutes and the nature of demand for final output both affect the price sensitivity of demand for the output of firms subject to carbon. The greater this price sensitivity of demand, the more these firms stand to lose from carbon pricing.

Impacts on Households. Annual CO2 emissions associated with household consumption (including direct use of fuels and carbon emissions associated with goods and services) vary significantly across both geography and income (Boyce & Riddle 2010; Pizer et al. 2010; Rausch et al. 2011; Cronin et al. 2017). Households in states where electricity generation is more dependent on fossil fuels, that use more electricity for heating or air conditioning, that heat homes with oil rather than natural gas, or are more dependent on personal vehicles for transportation will tend to see their costs increase under a carbon price to a greater extent than other households.6 Taking into account differences in household size, consumption patterns, income, and carbon intensity of electricity supply, average household CO2 emissions from consumption and fuel use varies by nearly a factor of two across the 50 U.S. states and the District of Columbia.7 There is also considerable variation of household carbon intensity within income or expenditure deciles (Rausch et al. 2011; Cronin et al. 2017).

Additionally, while wealthier households produce more carbon emissions in absolute terms (due to greater overall consumption),8 carbon intensive spending as a share of income is significantly higher for poorer households (Boyce & Riddle 2007; Cronin et al. 2017). This fact has often meant that carbon pricing policies are viewed as “regressive” taxes that fall disproportionately on poorer households.

However, this apparent regressivity is diminished if lifetime income, or proxies such as annual consumption, are used to measure household financial status, rather than annual income.9 Cronin et al. (2017) find that the initial incidence of a carbon tax in the United States is roughly flat across consumption deciles and is actually mildly progressive after accounting for increases in government transfer payments that are indexed to changes in the cost of living, such as social security benefits or the supplemental nutrition assistance program. However, these adjustments in transfer payments may not have the same salience to households as the initial increase in energy costs.

Impacts on industries are also transmitted to households in several ways. Employees, as members of households, exhibit their own forms of asset specificity. A person trained for specialized work in a particular industry (coal mining, oil refining, etc.) has high human capital specificity. A family with their wealth tied up in the value of their home could lose everything if the sector supporting the local economy goes into decline. Concentrated impacts on industrial sectors thus beget concentrated impacts on certain households.

Benefits of Carbon Pricing. The economic benefits of a carbon pricing policy are also unevenly distributed. Certain regions have existing endowments that will gain considerable value under a carbon price, such as abundant solar or wind energy potential, existing hydropower or nuclear plants, or industrial agglomerations that supply low-carbon technologies.

Because CO2 emissions and air and water pollutants are frequently produced by the same sources, carbon pricing can also deliver considerable reductions in conventional pollution. The resulting health benefits are considerable (Thompson et al. 2014; Li et al. 2018) but are also concentrated in particular regions.

Climate change is itself already affecting extreme weather events in numerous ways, causing increasingly salient and localized damages that vary across the United States (U.S. Global Change Research Program 2018; Fan et al. 2018). However, the benefits of reducing carbon emissions at any particular location are shared broadly and unequally across the world and across generations. Rational choice would predict that extreme weather events would tend to motivate local investments in climate resilience and adaptation (with concentrated, local benefits) to a greater extent than increased climate mitigation efforts (with broad, diffuse benefits).

Benefits of Carbon Pricing Revenues. Finally, how governments choose to allocate revenues from a carbon tax or permits created under an emissions cap significantly affects the distributional outcomes from carbon pricing policies. The initial incidence of carbon pricing policies is regressive across income deciles and can be weakly progressive across consumption deciles (see discussion above). However, targeted transfers to low-income households, lump-sum transfers to all households, or offsetting cuts to certain taxes (e.g., payroll taxes) can transform carbon prices into moderately or strongly progressive policies.10

A Political Economy Perspective

The distributional impacts of climate policy—who wins and who loses—offer a powerful lens to understand and predict how different political constituencies are likely to react to a carbon pricing proposal. While economists often provide insight on distributional impacts of policies, it is the realm of political economy, and public choice theory11 in particular, that can help translate these impacts into insights on how politics can constrain efforts to price carbon—and what might be done to improve policy outcomes.

For example, public choice theory predicts that carbon-intensive firms (and communities) with high asset specificity will be most likely to oppose carbon pricing initiatives. In addition, economic sectors that are highly concentrated (e.g., with a few dominant firms) are most likely to overcome collective action challenges to mount effective opposition to legislative or regulatory proposals (Olson 1965). It comes as no surprise to political economists that oil producers and refiners, large electric utilities with carbon-intensive generating fleets, large energy-intensive manufacturers, and other such concentrated interests play an outsized role in opposing—or capturing—climate policy.

The theory of collective action also predicts that even if total benefits of climate policy are large (and exceed costs), the diffuse nature of these benefits (both spatially and temporally) makes it difficult to motivate potential beneficiaries to act. The costs of climate policy are concentrated on the regulated region and felt in the near-term, while the substantial benefits of climate mitigation are shared broadly (and unequally) across the planet and enjoyed for generations to come. Consistent with this theory, public support for climate policies is broad but shallow. Substantial majorities of registered voters in the United States express worry about climate change and support various policies to address the threat (Lieserowitz et al. 2018). But public opinion research also repeatedly reveals a limited willingness to pay for such policies (Johnson & Nemet 2008; Villar & Krosnick 2010; Kotchen et al. 2013, 2018; Carattini et al. 2018). As the cost to households rises, public support for climate policy steadily falls.

Finally, public choice theorists predict that policymakers will prefer policies that minimize direct, salient impacts on organized stakeholders, redistribute benefits in a manner that secures a politically-durable coalition, and spread costs broadly and indirectly (e.g., across the tax base or through the indirect costs of regulatory compliance).

A Path for Climate Progress?

While any policy sufficient to make meaningful progress on climate mitigation will face serious political obstacles, the central thesis of this essay is that attention to the distributional impacts and political economy of various policy choices can provide important insights about the likely sources and strength of support and opposition that these policies will receive from various constituencies. These insights can be combined with lessons from environmental and innovation economics to develop policy choices that are simultaneously politically feasible, environmentally effective, and as efficient as possible.

What follows then is one possible path for climate progress that attempts to take seriously the political economy of carbon pricing and the importance of environmentally effective and economically efficient policy outcomes.

The core of this strategy is a moderate carbon price that generates substantial revenues dedicated primarily to subsidize and invest in measures that drive carbon reductions in the near-term—clean energy sources, clean vehicles and fuels, public transportation infrastructure, carbon capture in industry, carbon sequestering agricultural practices, etc.—and reduce the cost of climate mitigation over time.12

A modest carbon price on the order of $10 per metric ton of CO2 and rising gradually over time13 would achieve some of the broad economic efficiency benefits associated with internalizing a portion of the social costs of carbon pollution. It would also generate roughly $40-50 billion annually in revenues in the United States14 that would enable expanded subsidies for (or direct investment in) clean energy and other climate mitigation measures as well as targeted transfers to certain vulnerable constituencies.

To minimize public opposition, this approach is designed to blunt the impact of the policy on energy prices. Doing so should ameliorate opposition from households as well as industrial and commercial interests that employ energy-intensive processes but do not directly emit CO2 themselves (e.g., aluminum smelters, data centers, manufacturing).

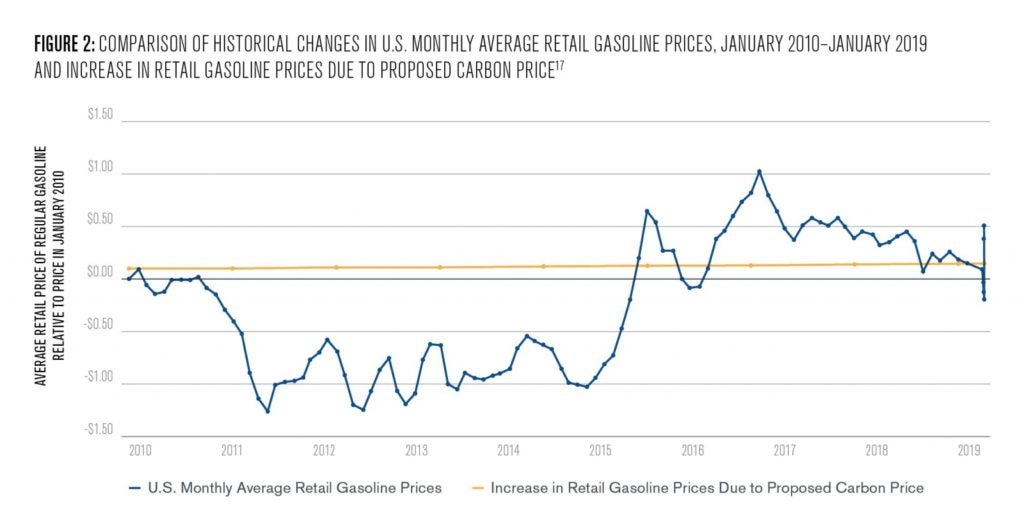

A $10 per ton price would raise gasoline prices by $0.09 per gallon, for example (Hafstead & Picciano 2017). The price of a gallon of regular gasoline commonly differs by that much (or more) at two gas stations on opposite sides of the street, and this magnitude of price increase would be lost in the noise of regular monthly volatility in gasoline prices (Fig. 2).

–15

A carbon price of this magnitude would increase total expenditures on electricity, fuels, and goods and services (prior to any behavioral or technological change) by roughly $250 to $500 per household per year (Jenkins 2014). That likely exceeds the typical U.S. household’s tolerance for increased costs in the name of climate mitigation. A number of surveys estimate that a majority of U.S. voters will support household energy cost increases of no more than approximately $80 to $180 per year (EPIC 2018; Kotchen et al. 2013, 2017; Villar & Krosnick 2010).

However, directing a substantial portion of carbon revenues to subsidize additional clean energy supplies will also suppress energy prices in subsidized sectors, all else equal. This effect will offset a substantial portion of the impact of the carbon price on final energy prices (Jenkins & Karplus 2016) and make alternative, low-carbon technologies more affordable for both households and firms.16 If the final impact on household expenditures can be limited to a few dollars per month, that is likely to prove acceptable to most households (EPIC 2018; Kotchen et al. 2013, 2017; Villar & Krosnick 2010), especially if the public believes the revenues will be put to productive and popular uses (Carratini et al. 2018). In addition, targeted recycling of a fraction of revenues to low income households can further offset or eliminate the impacts on the most vulnerable and counteract the regressive initial incidence of carbon pricing.17

As economists will warn, distorting energy prices by subsidizing clean energy incurs a hidden but real cost. Since households and business do not see the full cost of their economic decisions, they may consume more energy or other goods and services than is truly efficient or fail to invest in energy efficiency measures that can reduce emissions at a lower cost than other options. However, in cases where the social cost of carbon is not fully internalized by a carbon price, subsidies for additional mitigation can have a net positive effect on total welfare (Jenkins & Karplus 2016). So long as the marginal reduction in social damages from emissions reductions achieved by the clean energy subsidy exceeds the marginal economic loss caused by the distortion of energy prices, society is better off.18

Why not use revenues to deliver income or payroll tax breaks or per capita dividends to households to offset the costs of the policy and attempt to enact a higher carbon price that internalizes the full social cost of carbon?19

From the perspective of public choice theory, broad personal or income tax cuts or per capita dividends are an unattractive strategy for three reasons:

- Recycling revenue to households does little to concentrate the benefits of climate policy. Advocates of this approach point to entitlement payments (social security) or Alaska’s permanent oil trust fund payments to argue that this policy will create politically durable demand to maintain the policy. But carbon pricing rebates or dividends are of an entirely different nature from entitlements or Alaska’s oil payments. Carbon dividends or rebates simply offset increases in household expenditures on energy and goods caused by the carbon price itself. While this may mute opposition from the voting public, it is unlikely to generate organized and concentrated demand for strong carbon pricing. After all, households may simply prefer to keep the money in the first place by avoiding higher energy prices.20

- Transfers to households completely fail to address opposition from concentrated industrial interests with high asset specificity.21 Given that collective action and public choice theories predict these interests will mount the most effective opposition to carbon pricing, that is likely a fatal flaw.

- The tax shift/dividend strategy leaves no revenues available for transfer to concentrated beneficiaries that can be organized into a supportive coalition.

In contrast, directing revenues to activities that produce additional mitigation would link the carbon pricing policy with direct, salient, and popular outcomes. Uses of revenues could include investments in renewable energy and other low-carbon energy sources, incentives for energy efficiency, subsidies for electric vehicle manufacturing or adoption, investment in public transit systems, or incentives for industrial carbon capture or carbon-fixing agricultural practices. Surveys of the public (Baranzini & Carattini 2017; Kotchen et al. 2017), laboratory experiments (Kallbekken et al. 2011), focus groups (Kallbekken & Aasen 2010), and other public opinion research (Carattini et al. 2018) have repeatedly demonstrated that directing or “earmarking” revenues for these purposes is politically popular and may increase voter support for climate policy and other environmental taxes.

Crucially, using carbon pricing revenues to deliver salient, near-term, and direct benefits also offers the potential to mobilize organized constituencies in support of the legislation by creating concentrated beneficiaries, such as renewable energy firms, low-carbon industries, and investors, employees, and communities who benefit from these sectors. These constituencies could then become key counterweights to organized opposition expected from concentrated, carbon-intensive sectors. Strengthening these coalitions over time can also create important dynamic feedbacks that can enhance the political durability of climate policy and even create demand for greater policy ambition (Meckling et al. 2015, 2017; Pahle et al. 2018).22

In fact, given that the benefits of these expenditures are likely to be more popular and political salient than the carbon price itself, one might consider communicating the policy to the public as first and foremost about delivering clean energy investments and subsidies for low-carbon technologies and activities. In this framing, the modest carbon price is simply an efficient, fair, and appropriate way to raise the revenues needed to deliver popular benefits.23

Finally, well designed subsidies and investments in technology research and deployment supported by carbon taxing revenue can induce innovation and cost declines in clean energy and other climate mitigation solutions over time (Fischer & Newell 2008; Acemoglu et al. 2012, 2016; Gillingham & Stock 2018). These dynamic effects can be powerful in a politically-constrained context (Shellenberger et al. 2008; Pielke 2011; Jenkins 2014). The costs of solar and wind power have both declined by roughly two-thirds to three-quarters over the last decade alone, for example. That means three to four times more carbon reductions can be accomplished with these technologies while expending a fixed amount of “political will” or public willingness to pay.

At the same time, the availability of cheaper climate solutions can bolster politicians’ confidence in adopting more stringent climate policies in the future (Wagner et al. 2015).

Innovation is thus a powerful lever—perhaps the greatest at our disposal—to accelerate carbon reductions and climate ambition over time.

The above strategy is simply one possible pathway that attempts to internalize lessons from political theory and economics alike to overcome the pitfalls that have hamstrung carbon pricing efforts across the globe. Other insights and strategies are possible.

What is clear is that we ignore the political economy of carbon pricing at our peril. Creative solutions are needed, now more than ever, to overcome the carbon pricing gap and accelerate carbon reductions.

Jesse Jenkins

Assistant Professor, Princeton UniversityJesse Jenkins is an assistant professor of mechanical and aerospace engineering at Princeton University. In 2017-2018, Jenkins was a visiting scholar at the Kleinman Center.

Acemoglu D., Aghion P., Bursztyn, L, & Hemous, D., 2012. The Environment and Directed Technical Change, American Economic Review 102(1): 131-166.

Acemoglu, D., Akcigit, U., Hanley, D., & Kerr, W., 2016. Transition to Clean Technology, Journal of Political Economy, 124(1): 52-104.

Aldy, J.E., & Pizer, W.A., 2015. The Competitiveness Impacts of Climate Change Mitigation Policies, Journal of the Association of Environmental and Resource Economists 2(4): 565-595.

Aldy, J.E., & Stavins, R.N., 2012. The Promise and Problems of Pricing Carbon: Theory and Experience, Journal of Environment & Development 21(2): 152-180.

Alt, J.E., Carlsen, F., Heum, P., Johansen, K., 1999. Asset Specificity and the Political Behavior of Firms: Lobbying for Subsidies in Norway, International Organization 53(1): 99-116

Arrow, K. J., 1951: Social Choice and Individual Values. Yale University Press: New Haven, Conn., 2nd edition: 1963, ISBN 978-0300013641

Baker, J.A., Paulson, H.M., Feldstein, M., Shultz, G.P., Halstead, T., Stephenson T., Mankiw, N.G., & Walton, R., 2017. The Conservative Case for Carbon Dividends. Climate Leadership Council. https://www.clcouncil.org/media/2017/03/The-Conservative-Case-for-Carbon-Dividends.pdf

Baranzini, A., & Carattini, S., 2017. Effectiveness, Earmarking and Labeling: Testing the Acceptability of Carbon Taxes with Survey Data, Environmental Economics and Policy Studies 19: 197-227

Biber, E., Kelsey, N., & Meckling, J. 2017. The Political Economy of Decarbonization: A Research Agenda, Brooklyn Law Review, 82(2): 605-643

Black, D., 1958. The Theory of Committees and Elections. Springer, 1987 edition: ISBN

978-0898381894

Boyce, J.K. & Riddle M.E., 2007. Cap and Dividend: How to Curb Global Warming While Protecting the Incomes of American Families. Political Economy Research Institute, University of Massachusetts-Amherst

Boyce, J.K. & Riddle M.E., 2010. Cap and Dividend: A State-by-State Analysis. Political Economy Research Institute, University of Massachusetts-Amherst

Breetz, H., Mildenberger, M., & Stokes, L., 2018. The Political Logics of Clean Energy Transitions, Business and Politics 20(4): 492-522

Buchanan, J. and G. Tullock, 1962. The Calculus of Consent. Liberty Fund, Inc., collected edition: 1999, ISBN 978-0865972186

Burtraw, D., Walls, M., & Blonz, J., 2009a. Distributional Impacts of Carbon Pricing Policies in the Electricity Sector. Resources for the Future, DP 09-43. http://www.rff.org/files/sharepoint/WorkImages/Download/RFF-DP-09-43.pdf

Burtraw, D., Sweeney, R. & Walls, M., 2009b. The Incidence of US Climate Policy: Alternative Uses of Revenues from a Cap-and-Trade Auction, National Tax Journal 62(3): 497–518

Carattini, S., Carvalho, M., & Fankhauser, S., 2018. Overcoming Political Resistance to Carbon Taxes, WIREs: Climate Change 9.

Cantwell, M., & Collins, S., 2010. A Cap-and-Dividend Way to a Cleaner Nation and More Jobs, Washington Post June 18, 2010. http://www.washingtonpost.com/wp-dyn/content/article/2010/06/17/AR2010061704564.html

Cronin, J.A., Fullerton, D., & Sexton, S.E., 2017. Vertical and Horizontal Redistributions from a Carbon Tax and Rebate, NBER Working Paper 23250. http://www.nber.org/papers/w23250

Downs, A., 1957. An Economic Theory of Democracy. Harper and Row, 1st edition. ISBN 978-0060417505

Fan, Q., Fisher-Vanden, F., & Klaiber, H.A., 2018, Climate Change, Migration, and Regional Economic Impacts in the United States, Journal of the Association of Environmental and Resource Economists, 5(3): 643-671.

Fischer, C., & Newell, R.G., 2008. Environmental and Technology Policies for Climate Mitigation, Journal of Environmental Economics and Management 55: 142-162.

Fowlie, M., Regaunt, M., & Ryan, S.P., 2016. Market-Based Emissions Regulation and Industry Dynamics, Journal of Political Economy 124(1): 249-302.

Gawel, E., Strunz, S., & Lehmann, P., 2014. A Public Choice View on the Climate and Energy Policy Mix in the EU — How Do the Emissions Trading Scheme and Support for Renewable Energies Interact? Energy Policy 64: 175-182.

Gillingham, K. & Stock, J.H., 2018. The Cost of Reducing Greenhouse Gas Emissions, Journal of Economics Perspectives 32(4): 53-72.

Global Carbon Project, 2018. Global Carbon Budget 2018. http://www.globalcarbonproject.org/carbonbudget/18/files/GCP_CarbonBudget_2018.pdf

Hafstead, M. and Picciano, P., 2017. Calculating Various Fuel Prices under a Carbon Tax. Resources for the Future, November 28. http://www.rff.org/blog/2017/calculating-various-fuel-prices-under-carbon-tax

IEA, 2018. IEA fossil-fuel subsidies database, International Energy Agency, https://www.iea.org/media/publications/weo/Subsidies%202015-2017.xlsx , accessed March 6, 2019.

Jenkins J.D., 2014. Political Economy Constraints on Carbon Pricing Policies: What are the Implications for Economic Efficiency, Environmental Efficacy, and Climate Policy Design? Energy Policy 69: 467–477.

Jenkins, J.D. & Karplus, V.J., 2016. Carbon Pricing Under Binding Political Constraints. UNU-WIDER Working Paper No. 44/2016. https://www.wider.unu.edu/publication/carbon-pricing-under-binding-political-constraints

Johnson, E., Nemet, G.F., 2010. Willingness to Pay for Climate Policy: A Review of Estimates. University of Wisconsin, La Follette School Working Paper No. 2010-011.

Joskow, P.J., 1988. Asset Specificity and the Structure of Vertical Relationships: Empirical Evidence, J. L. Econ. & Organization 4(11): 95-117.

Kallbekken S. & Aasen, M., 2010. The Demand for Earmarking: Results from a Focus Group Study, Ecological Economics 69: 2183-2190.

Kallbekken, S., Kroll, S., & Cherry, T.K., 2011. Do You Not Like Pigou or Do You Not Understand Him? Tax Aversion and Revenue Recycling in the Lab, Journal of Environmental Economics and Management 62: 53-64.

Klenert, D., Mattauch, L., Combet, E., Edenhofer, O., Hepburn, C., Rafaty, R., & Stern, N., 2018. Making Carbon Pricing Work for Citizens, Nature Climate Change 8 (August): 669-677.

Kotchen, M.J., Boyle, K.J., Leiserowitz, A.A., 2013. Willingness-to-Pay and Policy Instrument Choice for Climate-Change Policy in the United States, Energy Policy 55: 617–625.

Kotchen M.J., Turk, Z.M., & Leiserowitz, A.A., 2017. Public Willingness to Pay for a U.S. Carbon Tax and Preferences for Spending the Revenue, Environmental Research Letters 12.

Leiserowitz, A., Maibach, E., Roser-Renouf, C., Rosenthal, S., Cutler, M., & Kotcher, J., 2018. Politics & Global Warming, March 2018. Yale University and George Mason University. New Haven, CT: Yale Program on Climate Change Communication. http://climatecommunication.yale.edu/wp-content/uploads/2018/05/Global-Warming-Policy-Politics-March-2018.pdf

Li, M., Zhang, D., Li, C-T., Mulvaney, K.M., Selin, N.E., & Karplus, V.J., 2018. Air Quality Co-Benefits of Carbon Pricing in China, Nature Climate Change, 8: 398-403.

Meckling, J. Kelsey, N., Biber, E., & Zysman, J., 2015. Winning Coalitions for Climate Policy, Science 349(6253): 1170-1171.

Meckling J., Sterner, T., & Wagner, G., 2017. Policy Sequencing Toward Decarbonization, Nature Energy 2(12): 918-922.

Metcalf, G.M., 1999. A Distributional Analysis of Green Tax Reforms, National Tax Journal 52(4): 655-681

Metcalf, G. E., & Weisbach, D., 2009. The Design of a Carbon Tax, Harvard Environmental Law Review 33(2): 499-556.

Murphy, D.D., 2002. The Business Dynamics of Global Regulatory Competition. In: Kagan, R., Vogel, D. (Eds.), Dynamics of Regulatory Change: How Globalization Affects National Regulatory Policies. University of California Press, Berkeley, CA, p. 385.

Nordhaus, W.D., 1994. Managing the Global Commons: The Economics of Climate Change. MIT Press: Cambridge, MA.

OECD, 2018. Effective Carbon Rates 2018: Pricing Carbon Emissions Through Taxes and Emissions Trading. https://read.oecd-ilibrary.org/taxation/effective-carbon-rates-2018_9789264305304-en#

Olson, M., 1965. The Logic of Collective Action. Harvard University Press: Cambridge, MA.

Oye, J.A., & Maxwell, J.H., 1994. Self-Interest and Environmental Management, Journal of Theoretical Politics 6(4): 593-624.

Pahle, M., Burtraw, D., Flachsland C., Kelsey, N., Biber, E., Meckling, J., Edenhofer, O., & Zysman, J., 2018. Sequencing to Ratchet Up Climate Policy Stringency, Nature Climate Change 8(10): 861-867.

Peltzman, S., 1976. Toward a More General Theory of Regulation, Journal of Law and Economics 19: 211-240.

Pielke Jr., R., 2011. The Climate Fix. Basic Books: New York, NY.

Pizer, W., Canchirico, J.N., & Batz, M., 2010. Regional Patterns of U.S. Household Carbon Emissions, Climatic Change 99(1-2): 47-63.

Proterba, J.M., 1989. Lifetime Incidence and the Distributional Burden of Excise Taxes, American Economic Review, 79(2): 325-330.

Rausch S., Metcalf, G.E., & Reilly, J.M., 2011. Distributional Impacts of Carbon Pricing: A General Equilibrium Approach with Micro-Data for Households, Energy Economics 31: S20-S33.

Shellenberger, M., Nordhaus T., Navin, J., Norris, T., & Van Noppen, A., 2008. Fast, Clean & Cheap: Cutting Global Warming’s Gordian Knot, Harvard Law and Policy Review 2: 93-118.

Stavins, R.N., 1997. Policy Instruments for Climate Change: How Can National Governments Address a Global Problem? University of Chicago Legal Forum 6: 293–329.

Stavins, R.N., 2008. Addressing Climate Change with a Comprehensive U.S. Cap-and-Trade System, Oxford Review of Economic Policy 24 (2): 298–321.

Stigler, G. J., 1971. The Theory of Economic Regulation, The Bell Journal of Economics and Management Science 2(1): 3–21.

Stiglitz, J.E., Stern, N., Duan, M., Edenhofer, O., Giraud, G., Heal, G., La Rovere, E.L., Morris, A., Moyer, E., Pangestu, M., Shukla, P.R., Sokona, Y., & Winkler, H., 2018. Report of the High-Level Commission on Carbon Prices. Carbon Pricing Leadership Coalition. https://www.carbonpricingleadership.org/report-of-the-highlevel-commission-on-carbon-prices/

Thompson, T.M., Rausch, S., Saari, R.K., & Selin, N.E., 2014. A Systems Approach to Evaluating the Air Quality Co-Benefits of U.S. Carbon Policies. Nature Climate Change 4: 917-923.

U.S. Global Change Research Program, 2018. Fourth National Climate Assessment, Volume II: Impacts, Risks, and Adaptation in the United States, https://nca2018.globalchange.gov/

Villar, A., Krosnick, J.A., 2010. American Public Opinion on Global Warming in the American States: An In-Depth Study of Florida, Maine, and Massachusetts. Stanford University. https://www.eenews.net/assets/2010/09/29/document_cw_02.pdf

Wagner, G., Kaberger T., Olai, S., Oppenheimer, M., Rittenhouse, K., & Sterner, T., 2015. Push Renewables to Spur Carbon Pricing, Nature 525: 27-29.

Wang, Q., Hubacek, K., Feng, K., Wei, Y-M., & Qiao-Mei, L., 2016. Distributional Effects of Carbon Taxation, Applied Energy, 184: 1123-1131.

Williams, R.C., Gordon, H., Burtraw, D., Carbone, J.C., & Morgenstern, R.D., 2014. The Initial Incidence of a Carbon Tax Across U.S. States. Resources for the Future, DP 14-25. http://www.rff.org/files/sharepoint/WorkImages/Download/RFF-DP-14-25.pdf

Williamson, O.E., 1985. The Economic Institutions of Capitalism, Free Press, New York, NY.

World Bank, 2018. State and Trends of Carbon Pricing 2018. Washington, D.C. https://openknowledge.worldbank.org/bitstream/handle/10986/29687/9781464812927.pdf

- More technically, Nordhaus (2017) defines the social cost of carbon as “the change in the discounted value of economic welfare from an additional unit of CO2-equivalent emissions.” [↩]

- Argentina, Canada, Singapore, and South Africa are scheduled to implement additional carbon pricing policies in 2019, and China plans to launch a national emissions trading system for its power sector in 2020. World Bank (2018) estimates that these policies will extend the coverage of carbon pricing to an additional 6% of global greenhouse gas emissions. [↩]

- In fact, many governments subsidize carbon-intensive fossil fuel production and/or consumption (IEA, 2018), meaning that the implicit price on carbon may actually be negative in numerous jurisdictions. [↩]

- Carbon pricing data from World Bank (2018). Social cost of carbon estimates from Nordhaus (2017) that reflect results from DICE-2016R under different fixed discount rates. [↩]

- This concept was originally employed in the analysis of industrial organization and transactions where, as per Williamson (1985), asset specificity refers to “durable investments that are undertaken in support of particular transactions, and that would lose considerable value if the transaction were prematurely terminated.” See also Joskow (1988). It is also a useful concept for application to the political economy of regulation, where it can be used to describe how dependent the value of a fixed asset is on the maintenance of the current regulatory regime (see Alt et al. 1999; Murphy 2002) and is useful in predicting the preferences of firms for particular regulatory outcomes. [↩]

- The exact incidence of the tax on households is somewhat more complex, depending both on the different carbon intensity of household consumption, different impacts on earnings from labor and capital across households, as well as the different degree of pass through of the carbon price from firms to consumers, which may also differ geographically. See Rausch et al. (2011) and Cronin et al. (2017) for further treatment of this heterogeneity. [↩]

- Based on estimates from Jenkins (2014) and data gathered by Boyce & Riddle (2010), average household emissions from direct energy use and embedded in consumption ranges from approximately 25 to 48 metric tons per year across the U.S. states and D.C. This estimate reflects economic conditions circa the mid-2000s. The carbon intensity of household consumption has likely changed somewhat since this time. Pizer et al. (2010) use similar Consumer Expenditure Survey data for the period 1984-2000 and find a similar magnitude of variation in household carbon intensity from the direct household consumption of electricity and fuels (ranging from 9.7 to 23.5 metric tons per household; this figure excludes carbon emissions associated with consumption of other goods and services). [↩]

- Carbon intensity of household consumption spans a similar range across income as geography, ranging from approximately 23 metric tons per year for the average household in the lowest income decile across the U.S. and 44 metric tons for the mean household in the wealthiest decile. See note above for more on this estimate.

[↩] - Annual incomes fluctuate over an individual’s lifetime due to changes in employment status (temporary unemployment, enrollment in educational programs, etc.), changes in health status or family status (e.g. raising children), and contributions to/withdrawals from savings prior to/during retirement. Students and retirees may therefore appear to be members of the lowest annual income deciles, for example, while actually being relatively secure financially when considering lifetime income. In contrast, consumption patterns exhibit much less annual fluctuation, as individuals use savings and debt to smooth consumption changes as they experience income shocks or changes in status. Measuring the incidence of carbon pricing policies across consumption decile rather than income decile may therefore be a more appropriate measure of the economic regressivity or progressivity of the policy (Poterba 1989; Cronin et al. 2017). [↩]

- For more on the effect of revenue recycling or allowance allocation on the distributional incidence of carbon pricing policies, see: Metcalf (1999), Boyce & Riddle (2007, 2010); Burtraw et al. (2009a, 2009b); Rausch et al. (2011); and Cronin et al. (2017). For a recent review, see also Wang et al. (2016). [↩]

- See, for example: Arrow (1951), Downs (1957); Black (1958); Olson (1965); Buchanan and Tullock (1962); Stigler (1971); Peltzman (1976). For more recent applications of public choice theory to environmental regulation and climate policy, see: Oye & Maxwell (1994); Alt et al. (1999); Gawel et al. (2014); and Jenkins (2014).

[↩] - Cost declines should result from both induced innovation from increased market demand for mitigation solutions as well as direct investment in increased public research, development, and demonstration funding or subsidies for private research for low-carbon solutions. [↩]

- To generate consistent revenues while emissions fall, the carbon price should rise in real terms at the same pace as emissions decline. To achieve an 80% reduction in economy-wide GHG emissions below 1990 levels, U.S. emissions would need to fall by roughly 5% per year on average through 2050. (This compares to an average decline of approximately 1.6% from the peak in U.S. emissions in 2007 through 2016.) The carbon tax could thus rise by approximately 5% plus the rate of inflation. [↩]

- U.S. fossil energy-related greenhouse gas emissions were an estimated 5.3 billion metric tons in 2018 (Global Carbon Project, 2018). A carbon price of $10 per ton would thus raise roughly $53 billion in annual revenues. However, many government transfer payments as well as income tax exemptions and deductions are indexed to costs of goods and services consumed by households. Transfer payments would thus increase and income tax receipts may fall after imposition of a carbon price, offsetting the net increase in government revenues. Cronin et al. (2017) estimate that these offsetting effects would reduce net revenues from a carbon price by roughly 23.5%. [↩]

- Monthly retail average U.S. gasoline price data from the U.S. EIA. Historical prices shown for each month from January 2010 to January 2019 relative to the price in January 2010 and compared to proposed phase-in of $10 per ton CO2 price increasing at 5% per year over the same length of time. [↩]

- Estimating the magnitude and distribution of household impacts from this combined approach is well worth additional research. A higher initial carbon price may in fact be palatable to voters if the use of revenues to subsidize additional abatement has a sufficiently offsetting effect on household expenditures. [↩]

- Targeted revenue recycling can be distributed through means-tested rebates or by increasing the Earned Income Tax Credit (EITC) for low- and moderate-income working households. Burtraw et al. (2009b) estimates that expanding the EITC by 50% would require 14% of revenues raised under a $21 per ton CO2 price, for example. [↩]

- This is, admittedly, a second-best solution, but this essay is premised on the fact that we live in a second-best world. [↩]

- This is a durable concept that has frequently been proposed as a solution to the political obstacles to carbon pricing. See e.g. Boyce & Riddle (2007, 2010); Cantwell & Collins (2010); Washington State Initiative 732 (2016); Baker et al. (2017); and the federal Energy Innovation and Carbon Dividends Act of 2018 (S. 3791 / H.R. 7173). [↩]

- Given the theory of loss aversion, it is also possible that a $100 increase in the cost of gasoline or home heating bills will be a lot more salient to people than a $100 rebate check or reduction in payroll taxes. The behavioral economics and psychology of these dividend, rebate, or tax shift strategies is ripe for additional research. [↩]

- This includes both firms producing carbon-intensive fuels and products, such as fossil fuels, cement, or steel, but also energy-intensive manufacturing and services businesses that would be impacted by much higher energy prices and not see offsetting rebates or dividends. The latter group would be less affected by the moderate carbon price and investment strategy proposed by this paper. [↩]

- Building economic coalitions for climate policy while avoiding rent seeking and lock-in of suboptimal policies is challenging, and this important dynamic must be carefully considered (see Rodrik, 2014; Meckling et al. 2017). In addition, the political institutions and coalitions that may foster earlier stages of technology development and industry maturation for various low-carbon technologies may not be the same as is necessary to support their widespread use or overcome incumbent opposition (Breetz et al., 2018). [↩]

- Note that allocating carbon tax revenues to clear public purposes is also in keeping with public perceptions about the role and purpose of taxation. The public is generally unaccustomed to the logic of Pigouvian taxes meant to internalize external damages or discourage certain behavior (Kallbekken & Aasen 2010; Baranzini & Carattini 2017). Exceptions include the recent proliferation of plastic bag fees, soda taxes, and more long-standing “sin taxes” on cigarettes and alcohol. As a result of this unfamiliarity with Pigouvian taxes, empirical research finds that individuals are skeptical that carbon taxes themselves are an effective way to discourage high-carbon behavior and consider low-carbon subsidies as a more powerful way to reduce emissions (Carratini et al. 2018). In contrast, voters are very familiar with the logic of raising taxes to support important public expenditures on health care, schools, infrastructure, etc. While generally averse to higher taxes, voting publics routinely support tax increases in specific instances when justified by the need to raise revenues for important public expenditures. [↩]