To meet their goal of net-zero greenhouse gas emissions by 2050, the UK must reduce emissions from their energy mix with innovative approaches. Explore four areas where the government could improve the reach of offshore wind.

Facing the Energy Crisis

In June of 2019, then-British Prime Minister Theresa May announced the government’s ambitious plan to reach net zero greenhouse gas emissions by 2050: household, commercial and industrial emissions would be mitigated to the point that national emissions would be offset completely from natural and manmade carbon sequestration mechanisms.

With support from current Prime Minister Boris Johnson, the UK became the first of the G7 countries to announce such a determined goal. To achieve this, it will be critical for the UK to reduce emissions from their energy mix, with a 2018 government report attributing nearly 27% of the entire nation’s CO2 emissions to energy supply (Department for Business Energy & Industrial Strategy 2019). If the UK is to meet its ambitious 2050 net zero target, the country’s leaders must consider innovative approaches to greening the energy mix.

A New Player: Offshore Wind

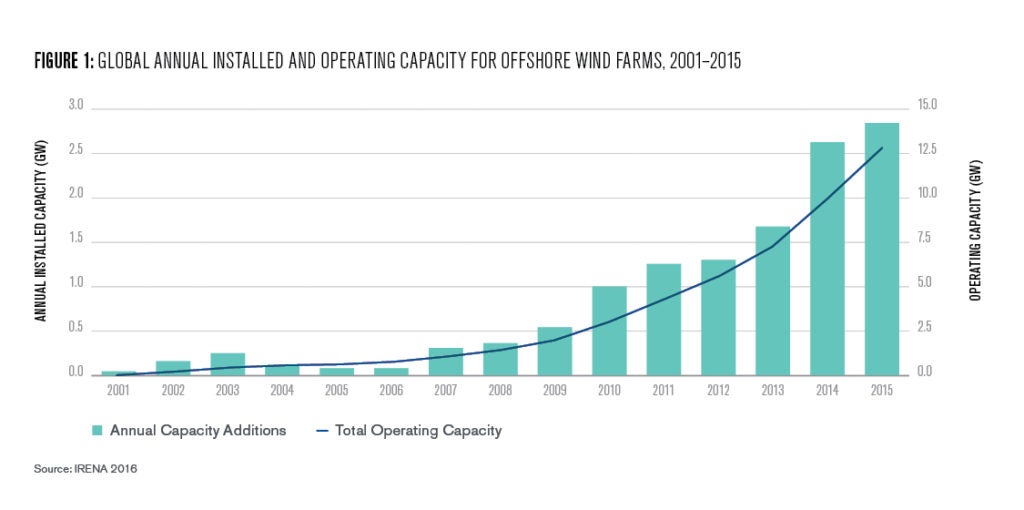

Launched in 1991, Vindeby in Denmark was the world’s first offshore wind (OSW) farm (Wind Europe 2019). Just under 20 years later, OSW has become an integral force in the uptake of renewable energy, having grown over 7,500% from 0.116 gigawatts to over 12 gigawatts in the past 15 years globally.

While solar and onshore wind energy have become core components in the uptake of renewables in the UK due to their relatively cheap cost, they also pose limitations to the UK’s net zero target. Namely, the daily intermittency of onshore wind relative to offshore wind (American Geoscience Institute 2017) and public resistance to onshore development due to perceptions of inadequate land usage (Roberts 2016) make offshore wind (OSW) an attractive alternative. Furthermore, current planning regulations in the UK restricting the height of onshore wind turbines prevents onshore facilities from capitalizing on recent innovations resulting in larger and more productive turbines (Cornwall Insight 2019).

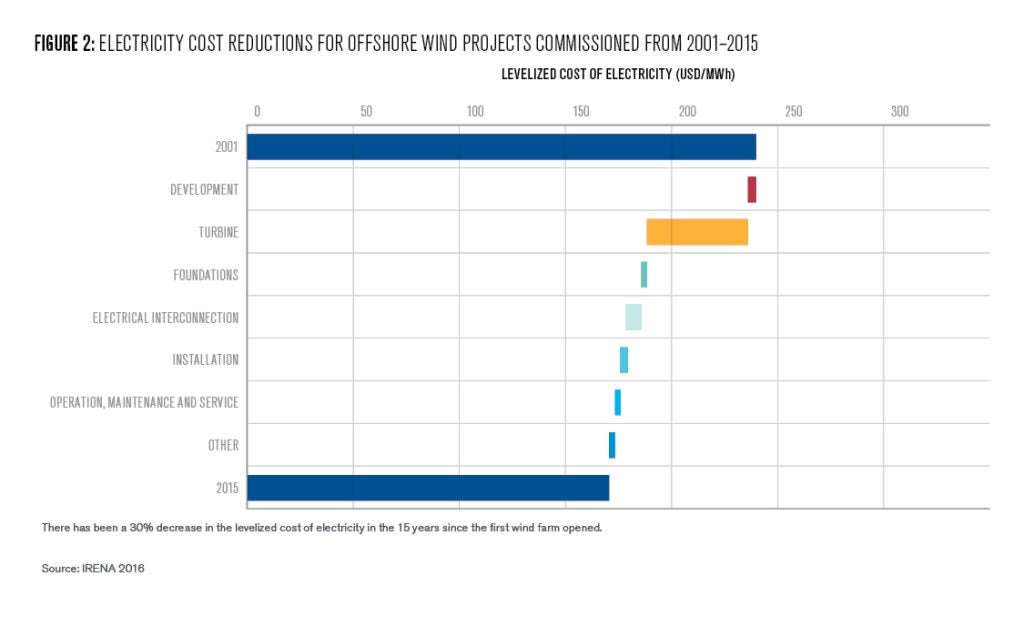

In spite of these advantages, OSW poses a major obstacle: it has been historically more expensive than other renewables. But as shown in Figure 2, those costs are falling.

The cost of generating electricity, known as the levelized cost of energy (LCOE), is calculated by taking the discounted lifetime cost of building and maintaining an electricity generating plant and dividing it by the plant’s lifetime electricity generation (International Renewable Energy Agency, 2017). In fact, “the levelized cost of energy (LCOE) of offshore wind could fall below onshore wind by 2028” as the OSW develops economies of scale in the production and deployment turbines (Cornwall Insight 2019). This reduction in costs of OSW relative to onshore wind is also because “as more [onshore] wind is being deployed the available sites onshore become less attractive in terms of wind conditions and capacity factor and more resistance from population groups affected in the deployment areas” (Hevia-Koch and Jacobsen 2019).

The Need for an Innovation Ecosystem

Collaborative research and development (R&D) is an emerging trend that offers more benefits for participants than traditional and siloed R&D processes. Studies have shown that more organizations are beginning to collaborate with “consumers, partners, suppliers, industry organizations and even competitors” to increase both the quality and speed of innovation (Bader 2016).

Historically, R&D has been undertaken by private companies, which have footed the entire bill only to end up discovering and commercializing innovations that resemble those of their competitors. However, looking at innovation as a collective activity that occurs within an “innovation system” has shifted the way R&D is approached (European Commission 2012). Collaborative R&D entails various stakeholders pooling assets to co-develop technologies or processes that further the entire industry.

Within the context of OSW, collaborative R&D initiatives have played an integral role in commercializing new technologies. In a 2014 interview, Henrik Stiesdal, the chief technical officer at Siemens Wind Power and colloquially known as the “father of wind turbines,” stated that “there is no way in the world that one single player can do the necessary innovation on the infrastructure. It takes cross-sector collaboration to get there” (2014). Over the past decade, we have seen more and more of the “cross-sector collaboration” referred to by Stiesdal.

In fact, collaborative R&D initiatives in OSW have been responsible for cost reductions that have led to major decreases in sector wide LCOE. Jan Matthiesen, the director of offshore wind at the Carbon Trust, stated in a 2018 interview that “150 R&D projects later, and we are [producing offshore electricity] at a cost of £50/MWh” compared to the 2008 cost of £170/MWh. “What we have seen is […] over 15% of cost reductions, if you are using some of the technology that we have commercialised in our program” (Matthiesen 2018).

However, the role of collaborative R&D is not over quite yet. While extensive research has been done on developing more efficient “next-generation” turbines that drive down the LCOE, other areas of the OSW value chain have been left underdeveloped. In fact, many of the projected cost-reduction initiatives that will be integral to the exponential deployment of OSW until 2045 are in areas outside of turbine R&D—including operations and maintenance technologies and seabed foundations (IRENA 2016).

Given the importance of collaborative R&D in commercializing OSW, it is imperative to understand the current innovation ecosystem to ensure that policy lines up with industry and consumer needs.

The UK Offshore Wind Innovation Ecosystem

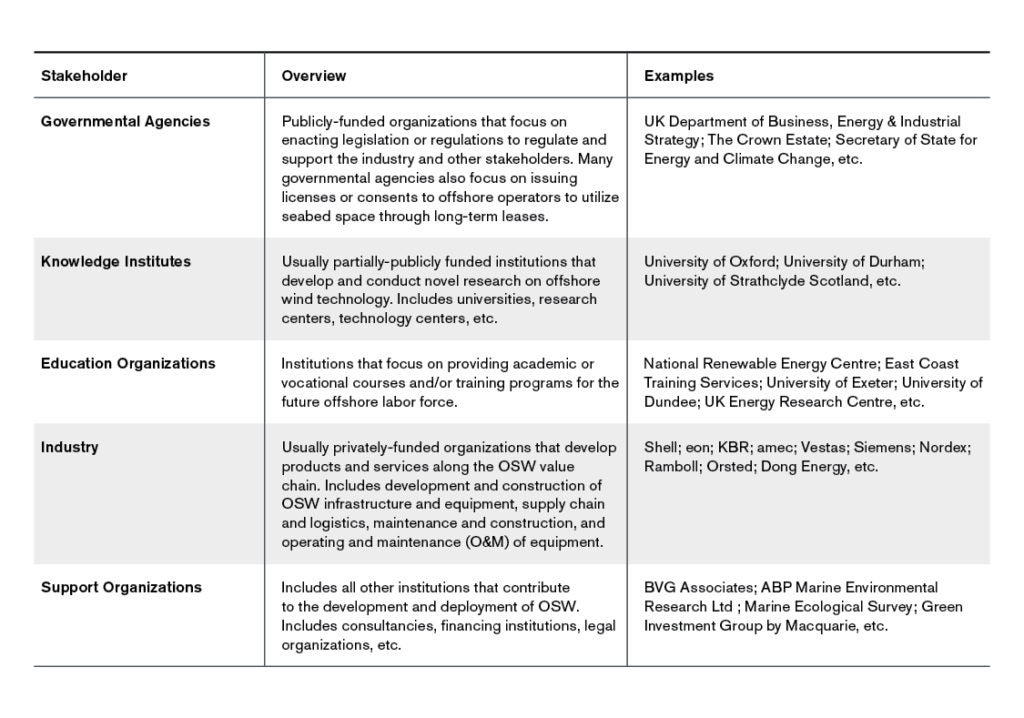

The current OSW innovation ecosystem is composed of five main groups of stakeholders: government agencies, knowledge institutes, education organizations, industry, and support organizations. ¹

While all five groups of stakeholders play a crucial role in the OSW innovation ecosystem, this paper will focus on one particular class of institution: public-private innovation collaborations. In the context of OSW in the UK, there are two notable public-private collaborative innovation schemes: The Carbon Trust’s Offshore Wind Accelerator (OWA), and the Offshore Renewable Energy (ORE) Catapult.

Case Study #1: The Carbon Trust’s Offshore Wind Accelerator (OWA)

The Carbon Trust describes itself as a “world-leading organisation helping businesses, governments and the public sector to accelerate the move to a sustainable, low carbon economy through carbon reduction, energy-saving strategies and commercialising low carbon technologies” (Carbon Trust 2019).

Established in 2008 between the Carbon Trust and nine offshore wind developers, the OWA has become the Carbon Trust’s flagship collaborative R&D program. With assistance from the developers, the OWA identifies key technological industry challenges and prioritizes them based on projected cost savings. The OWA then works with innovators and the supply chain, usually through international competitions that call on lean and dynamic small and medium sized enterprises (SMEs) to submit offers on their potential solutions to the identified technological barrier. The OWA then provides financial and strategic support to develop, de-risk and commercialize the winning innovations. The OWA is partly funded by the Scottish government, with the remaining funding coming from industry.

The impact of the Carbon Trust has been significant, with internal analysis indicating that over the duration of its last 150 R&D projects, the trust has contributed to a 15% cost reduction in LCOE of OSW (Carbon Trust 2019). “Therefore, the £100 million investment into the OWA to-date will be recouped in the first few years of a single project, resulting in an impressive return on investment for the industry and government funders. This equates to a European-wide cost saving of £34 billion based on European government’s build targets out to 2030” (Carbon Trust 2019). While much of these £34 billion savings might have been captured by cost saving innovations from other stakeholders regardless of the Carbon Trust’s OWA, it is evident that collaborative R&D institutions play an important role in OSW commercialization.

Case Study #2: The Offshore Renewable Energy (ORE) Catapult

A press release by the UK government announced that “the Technology Strategy Board has confirmed £54.1m of funding to the ORE Catapult over its first 5 years of operation. The aim of the ORE Catapult is to be the “go to place” for organisations in offshore renewables innovation; integrating the key players from the sector and acting as a powerful hub to galvanise all UK innovation work streams and test assets” (HM Government 2014).

Founded and funded primarily by the UK government, the ORE Catapult describes itself as “delivering the UK’s largest clean growth opportunity by accelerating the creation and growth of UK companies in offshore renewable energy” (ORE Catapult 2019). The ORE Catapult also recently launched the Offshore Wind Growth Partnership (OWGP), a “major 10-year development programme to drive increased productivity and competitiveness for UK businesses […] with up to £100m investment by Offshore Wind Industry Council members, the supply chain, and regional collaborators” (ORE Catapult 2019).

While the ORE Catapult is not a direct grant giving body, it works closely with industry to coordinate a prioritized approach to innovation that ensures learning is shared. Operating on a model largely inspired by the Carbon Trust’s OWA, the impact of the ORE catapult has been significant, having supported over 597 SMEs through 648 industry collaborations by providing technical expertise and access to shared testing facilities (ORE Catapult 2019).

Improving the Innovation Ecosystem

With an understanding of the current innovation ecosystem, this policy digest synthesizes findings from expert interviews and academic literature to determine ways in which the system can be improved to increase returns from government spending on public R&D initiatives.

For the purposes of this research, interviews were conducted during the summer of 2019 with more than 30 experts across the innovation ecosystem, with representatives from the majority of the largest OSW developers, the ORE catapult, the Carbon Trust’s OWA, regulators, government, NGOs, financing institutions, and clean energy think tanks. Results of the interviews were synthesized anonymously to encourage truthful responses separate from the official views and priorities of the institutions the experts were associated with.

Below are four recommendations amalgamated from results of the expert interviews and recent academic literature on OSW and collaborative R&D processes:

1. To foster investment in R&D and long-term infrastructure, government must be more transparent with the long-term project pipeline by raising their commitments to offshore capacity targets.

Currently, a lack of commitment from the UK government in confirming long-term industry-wide capacity targets prevents the OSW industry from attaining the level of predictability and stability required to de-risk and foster investments in longer-term assets. While government capacity targets should be taken with a grain of salt as there is always the risk of the government defaulting on commitments, the industry requires more long-term clarity than they currently have to foster the level of investment required.

A study synthesizing recommendations to improve the OSW supply chain argued that “the investment in offshore wind technology, infrastructure and wind farm is a long term and substantial commitment for any business. In order to encourage the necessary investment and prioritisation within the supply chain, the government must continue to demonstrate a substantial, ambitious, long-term and rolling commitment” (Whitmarsh 2019). Many expert interviewees also explicitly agreed (and none were opposed) to the idea that a long-term capacity commitment by the government would be one of the easier first steps in de-risking and fostering private sector investment.

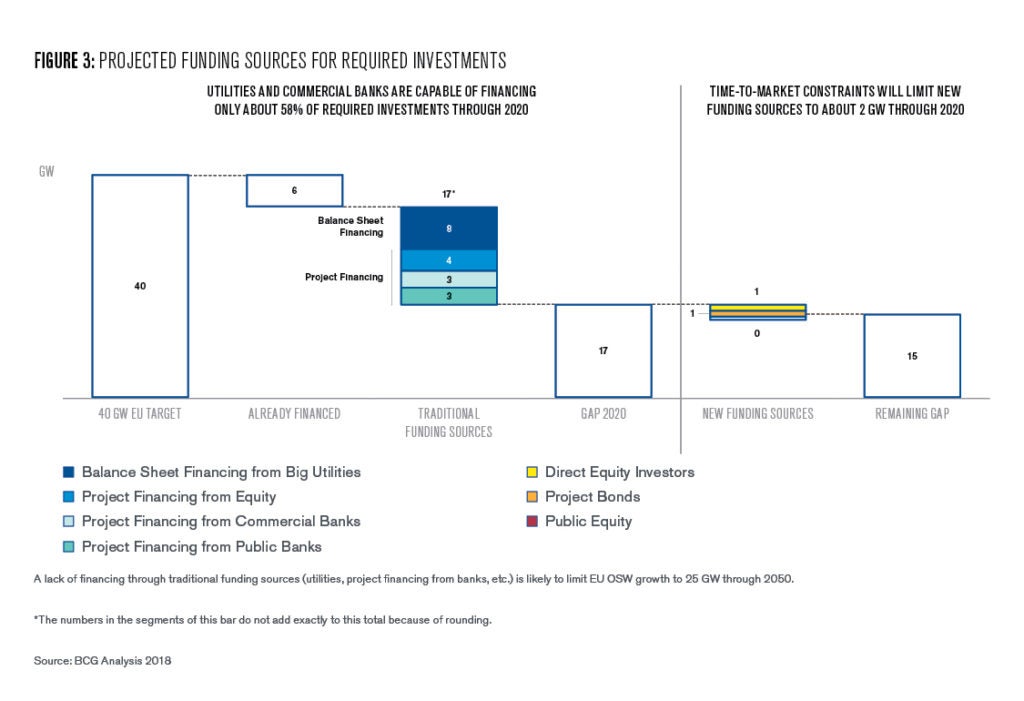

2. Focus on working with financing institutions to meet investment needs by prioritizing de-risking initiatives.

Public-private innovation partnerships have historically been driven by the priorities of OSW developers, with the support of innovation partners and government officials. While being industry-driven should remain a priority, industry and academia agree that a larger effort to meet investment needs of financing institutions should be made. Estimates indicate that project developers will need upwards of £20bn per year by 2020 to reach the UK’s clean energy targets (Carbon Trust 2008). Such an influx of capital will only be possible if risks are reduced, or returns are increased, to make the opportunity more attractive.

Studies have posited tangible paths to incentivizing investments by decreasing risk and increasing returns “through regulatory reform in grid and planning and technology developments [and] releasing site constraints to reduce costs and ensuring the incentive regime delivers” respectively (Carbon Trust 2008). It might not be in the jurisdiction of private-public innovation partnerships to enact many of the policies suggested but including financing institutions in the innovation and commercialization process is a first step in better understanding and integrating investment requirements when considering different technologies in the bidding and deployment process.

3. Create a collaborative supply chain ecosystem.

While private-public innovation partnerships have been instrumental in driving technological innovations, industry experts and academics alike agree that innovations aren’t as fruitful if there is not a clear path to mass deployment. The importance of developing the supply chain foundations to facilitate future production of seabed foundations, turbines, and pillars on a mass scale was emphasized by an expert who referenced the production bottlenecks currently hindering OSW deployment.

Another expert agreed, claiming that “there are some gaps in how we foster innovation more, but we don’t really have the answers in terms of how we can build [the infrastructure] out. Foundations in the UK are there to get this moving, but what is necessarily needed to build these smart grids [and other long-term infrastructure], we don’t really know.”

Researchers at the Institute for Renewable Energy echoed these sentiments, finding that “research and technology organisations should ensure that all areas of the industry progress to market in step; for example, there is little value in developing next-generation turbines if the required innovations to install them have not been developed” (IRENA 2016). To improve the capacity of private-public innovation partnerships to serve the industry, a larger emphasis should be placed in developing innovations in tandem with supply chain representatives who can better integrate industrial production requirements into the development of technologies.

4. Increase both quantity and focus of government collaborative R&D funding to earlier stage, and multi-sector investments.

The ultimate goal of government funding towards public-private R&D is to compensate for market failures that would have otherwise led to a lack of funding in a critical stage or area. Increasing the absolute value of investments towards OSW R&D is an easy way to boost benefits across the industry, with studies finding that “public R&D funding typically needs to support around 15-35% of total R&D funding. […] This is an order of magnitude greater than public R&D funding to date” (Carbon Trust 2008). However, academic literature and experts agree that a more feasible method to unlock additional value from current investment levels include focusing investments on earlier stage innovations, and multi-sector developments.

Government policy should focus public R&D funding on earlier stage innovations as “significant publicly funded R&D will be necessary where paybacks are too long for the market” (The Carbon Trust, 2018) Furthermore, “Funders should maximise the benefit of grant funding for small and medium-sized enterprises (SMEs) by including an incubation support element” (IRENA 2016). Supporting earlier-stage and entrepreneurial SMEs would ensure that government funding is not being channeled towards more developed projects that have the traction to be completely market-driven.

Government policy should also focus public R&D funding on multi-sector investments that have benefits beyond OSW. Having additional grant funding available to “new entrants proposing solutions based on experience from other industries […] will stimulate interest from other industries to consider if their own innovative solutions can be adapted to the offshore wind sector” (Whitmarsh 2019). This would allow for R&D costs to be split between several industries, rather than having OSW foot the entire bill. Furthermore, “the case for public investment in [testing and research] facilities is stronger if they can be used for other sectors, as the offshore wind market alone is unlikely to be able to support dedicated open-access [testing and research] facilities without subsidy” (IRENA 2016). By targeting solutions that have multi-sector applications, collaborative R&D can create more value from innovations.

The Future of Offshore

It is clear that OSW will need to play an integral role in helping the UK achieve their 2050 net zero goal. Research and experts alike agree on the importance of building a resilient innovation ecosystem in making the mass deployment of OSW a reality. Given the current stakeholders in the UK OSW innovation ecosystem, this study combined insights from academics and industry experts to propose four areas the government could improve to bolster the return on investment of public spending on public-private collaborative R&D: setting clear and long-term capacity targets, working with financing institutions to integrate investment requirements into commercialisation and deployment strategy, further involving supply chain companies in the innovation process, and increasing both the quantity and focus of current government spending on earlier-stage and multi-sector investments.

Brandon Nguyen

Undergraduate Seminar FellowBrandon Nguyen is an undergraduate student studying economics and political science at the Wharton School and the College of Arts and Sciences. Nguyen was also a Kleinman Center 2020 Undergraduate Student Fellow.

An overview and examples of the five major buckets of stakeholders in the OSW innovation ecosystem are provided below. They were omitted from the policy brief for brevity.

American Geosciences Institute. 2019. “What Are the Advantages and Disadvantages of Offshore Wind Farms?” American Geosciences Institute, www.americangeosciences.org/critical-issues/faq/what-are-advantages-and-….

Bader, Bill. 2016. “Why R&D Is More Successful with Collaboration.” International Electronics Manufacturing Initiative (iNEMI), https://www.inemi.org/blog/why-rd-is-more-successful-with-collaboration

Broom, Douglas. 2019. “Renewable Energy Prices Have Fallen – This Is How Much.” World Economic Forum, www.weforum.org/agenda/2019/05/this-is-how-much-renewable-energy-prices-….

Business, Energy & Industrial Strategy, Department for. 2019. “2018 UK GREENHOUSE GAS EMISSIONS, PROVISIONAL FIGURES.” National Statistics.

Business, Energy & Industrial Strategy, Department of. 2014. “Overview of Support for the Offshore Wind Industry.” HM Government.

Carbon Trust. 2008. “Offshore Wind Power: Big Challenge, Big Opportunity Maximising the Environmental, Economic and Security Benefits.” Carbon Trust.

Chater, Nick, et al. 2016. “Next Steps for UK Heat Policy.” Committee on Climate Change, www.theccc.org.uk/publication/next-steps-for-uk-heat-policy/.

Chinn, Matthew. 2014. The UK Offshore Wind Supply Chain: A Review of Opportunities and Barriers. Offshore Wind Industry Council.

Dedecca, João Gorenstein, et al. 2016. “Market Strategies for Offshore Wind in Europe: A Development and Diffusion Perspective.” Renewable and Sustainable Energy Reviews, vol. 66, pp. 286–296., doi:10.1016/j.rser.2016.08.007.

Department for Business, Energy & Industrial Strategy. 2018. “Energy Minister Claire Perry Hails Success Story of Offshore Wind in Newcastle Today.” United Kingdom Government, www.gov.uk/government/news/energy-minister-claire-perry-hails-success-st….

Henze, Veronika. 2019. “Battery Power’s Latest Plunge in Costs Threatens Coal, Gas.” BloombergNEF, about.bnef.com/blog/battery-powers-latest-plunge-costs-threatens-coal-gas/.

Hevia-Koch, Pablo, and Henrik Klinge Jacobsen. 2019. “Comparing Offshore and Onshore Wind Development Considering Acceptance Costs.” Energy Policy, vol. 125, pp. 9–19., doi:10.1016/j.enpol.2018.10.019.

Holm, Lars, et al. 2018. “Will Your Offshore-Wind Strategy Sink or Swim?” The Boston Consulting Group (BCG).

IEA. 2019. “Global Energy Demand Rose by 2.3% in 2018, Its Fastest Pace in the Last Decade.” International Energy Agency, www.iea.org/newsroom/news/2019/march/global-energy-demand-rose-by-23-in-….

IRENA. 2018. “Renewable Power Generation Costs in 2017.” International Renewable Energy Agency, Abu Dhabi.

Louden, Alex. 2019. “Driving Cross-Sector Innovation in Offshore Wind Strategies, Synergies and Barriers.” Offshore Renewable Energy Catapult.

Luo, Lin, et al. 2012. “A Systemic Assessment of the European Offshore Wind Innovation.” JRC Scientific and Policy Reports, European Commission.

Mooney, Chris, and Brady Dennis. 2019. “In Blow to Climate, Coal Plants Emitted More than Ever in 2018.” The Washington Post, WP Company, www.washingtonpost.com/climate-environment/2019/03/26/blow-climate-coal-plants-emitted-more-than-ever/?utm_term=.9c29cc4aab7f&wpisrc=al_news__alert-hse–alert-national&wpmk=1.

Poulsen, Thomas, and Rasmus Lema. 2017. “Is the Supply Chain Ready for the Green Transformation? The Case of Offshore Wind Logistics.” Renewable and Sustainable Energy Reviews, vol. 73, pp. 758–771., doi:10.1016/j.rser.2017.01.181.

Renewable Energy World. 2019. “Report Says Offshore Wind Could Beat Onshore Wind on Cost.” Renewable Energy World, www.renewableenergyworld.com/articles/2019/01/report-says-offshore-wind-….

Reynolds, Matt. 2019. “The UK’s Shift to Clean Energy Is about to Get Really, Really Tough.” WIRED, www.wired.co.uk/article/uk-fossil-fuels-electricity.

Roberts, Holly. 2016. “WHERE THE WIND BLOWS – ONSHORE VS. OFFSHORE WIND ENERGY.” The Future of Energy, futureofenergy.web.unc.edu/2016/04/06/where-the-wind-blows-onshore-vs-offshore-wind-energy/.

Rubel, Holger, et al. 2013. “EU 2020 Offshore-Wind Targets,” The Boston Consulting Group (BCG).

Reality Check Team. 2018. “Reality Check: Which Form of Renewable Energy Is Cheapest?” BBC News, www.bbc.com/news/business-45881551.

Whitmarsh, Martin. 2019. “He UK Offshore Wind Industry: Supply Chain Review.” Offshore Wind Industry Council.