The U.S.’s Critical Mineral Supply Challenge

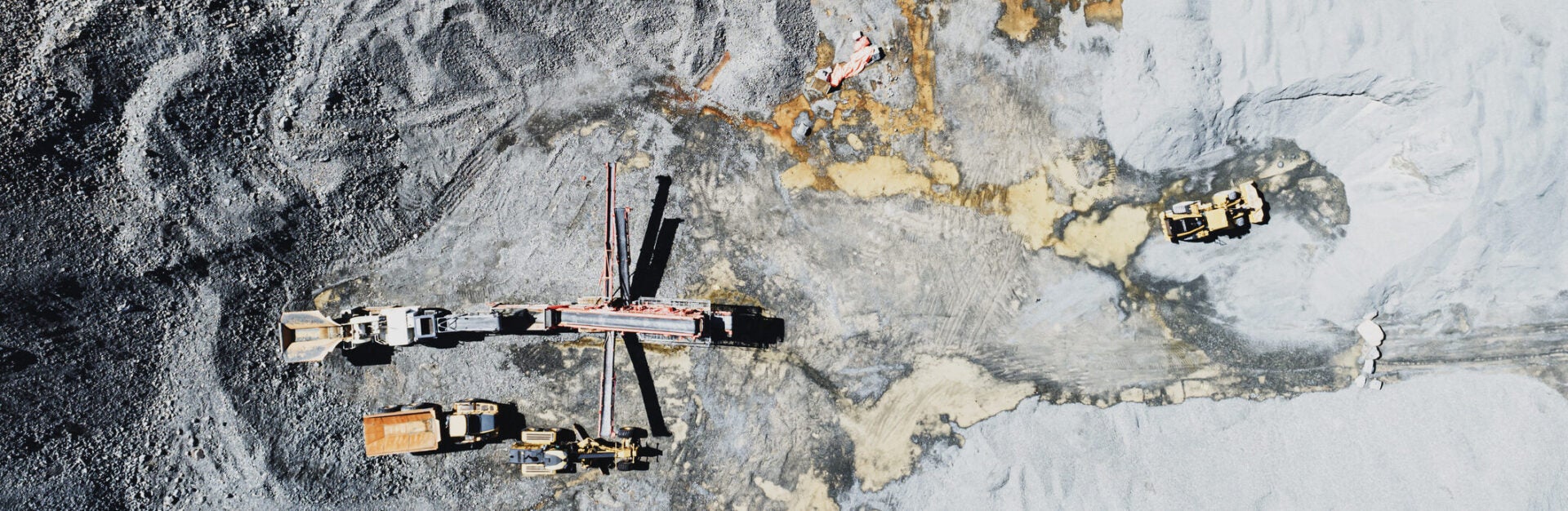

A metals industry executive explores the race to develop alternative supplies of critical minerals essential to the energy transition.

For over a century the global energy system has been dominated by fossil fuels, and governments and industry have gone to great lengths to secure reliable supplies of oil, natural gas, and coal. All along, scarcity and competition over fossil resources has been fuel for geopolitical conflict, and a root cause of energy insecurity when access to resources appears threatened or limited.

Yet as the world shifts toward clean energy technologies, certain minerals like cobalt and lithium increasingly replace fossil fuels as the basis of our energy system. Where governments once sought to gain secure supply of fossil fuels, energy security in the future will depend on access to dozens of critical minerals needed for an increasingly electrified and carbon-free energy system.

Brian Menell, chief executive of critical minerals supply chain company TechMet, explores the challenges that come with dependence on resources that are by and large produced outside of the United States and, in notable cases, by countries with which the U.S. has strained diplomatic ties. Menell, whose company has received significant funding from the U.S. government’s International Development Finance Corporation, also discusses the challenges involved in developing new sources of supply, and the prospects for scaling the production of key minerals to support the pace of decarbonization.

Andy Stone: Welcome to the Energy Policy Now podcast from the Kleinman Center for Energy Policy at the University of Pennsylvania. I’m Andy Stone.

For over a century, the global energy system has been dominated by fossil fuels, and governments and industry have gone to great lengths to secure reliable supplies of oil, natural gas, and coal. All along, scarcity and competition over fossil resources has been fuel for geopolitical conflict and a root cause of energy insecurity when access to resources appears threatened or limited. Yet as the world shifts today toward clean energy technologies, certain minerals like cobalt and lithium and exotic-sounding rare earth metals like neodymium increasingly replace fossil fuels as the basis of our energy system. Accordingly, where governments once sought to gain secure supply of fossil fuels, energy security in the future will depend on access to dozens of critical minerals needed for an increasingly electrified and carbon-free energy system.

On today’s podcast, we’re going to explore the criticality of minerals to our rapidly transitioning energy system. We’ll look at the myriad challenges that come with our dependence on resources that are by and large produced outside of the United States and in notable cases by countries with which the US has strained diplomatic ties.

My guest is Brian Menell, a minerals industry executive whose companies are working to develop alternative supply chains for energy metals and which have received significant financing from the US government. Brian will discuss the challenges involved in developing new sources of supply and provide his assessment of the prospects for scaling the production of key minerals to support the pace of decarbonization. Brian, welcome to the podcast.

Brian Menell: Thank you, Andy. It’s good to be with you.

Stone: As I understand, you are a graduate of the University of Pennsylvania. Is that correct?

Menell: I am. I graduated in ’88.

Stone: Well, it’s great to have you back, even if it’s virtually today. So the US government, through its International Development Finance Corporation, is a substantial investor in TechMet, which is the mining sector company that you lead. Could you start us out by introducing the company and why it has attracted federal investment?

Menell: Sure. TechMet is a private investment holding company, domiciled in Ireland, that invests largely equity in private projects and private companies across the middle portion of the value chain, so distributed approximately evenly across primary production, processing and refining, and recycling of the metals where we see the most severe supply demand dislocation between inefficient scalability of supply and exponential growth in demand, driven by the energy transition more broadly, but more specifically by the EV rollout, Cloverly, and by renewable energy systems.

So we do focus exclusively on lithium, cobalt, and nickel for rare lithium-ion batteries, rare earth metals for permanent magnets for obviously electric motors and wind turbines, vanadium for vanadium redox flow batteries, tin for everything, and tungsten. And we focus exclusively on projects — late-stage development or expansion of existing production across South America, North America, Europe, and Africa.

Why we came to the attention of the US government funding agencies and were the recipient of the DFC, the International Development and Finance Corporation’s first equity investment ever in 2020, when they first invested in TechMet. Since then, they further invested last year in our most recent equity round and have a further 80 million dollars’ authority to invest to do more equity, which they want to execute over the next year. And the reason was simple. At that time in 2020, we were three years old. We had already established a very attractive portfolio of projects that we were funding and developing. The realization across a range of government agencies in Washington that we were at the beginning of really a very severe structural short supply of these critical minerals.

All of them were dominated by China across the global supply chain, China having had a free rein for 15 years to build this dominant position while everybody else was sleeping, and the realization not only of the enormity of this challenge geopolitically vis-a-vis China, and structurally in terms of adequately supplying climate change mitigation obviously led to them focusing on us because we are high ESG, we’re very well governed and transparent, and we are completely free of Chinese investment or significant partnerships or counterparties, and have been since our inception, and that is very, very unusual in our industry.

Stone: So the transition to clean energy shifts the focus of energy supply and security concerns from fossils to minerals. And this really is a paradigm shift which is getting underway. Could you broadly comment on the nature of this shifting focus, and I guess more specifically, talk about the implications for energy security?

Menell: Yes, I can’t exaggerate the scale and significance of the implications of this shift. I don’t think it’s an exaggeration to say we are at an inflection point in our transformation from a world that, for the last couple of hundred years, has been one where the global industrial infrastructure has been fed by fossil fuels, to one in which the global industrial infrastructure is going to be fed by specialty metals going into clean energy and clean industry technologies. And that shift is obviously not going to be quick. It’s going to be a 30-year transition, but it’s a 30-year transition that has enormous implications. One of the implications is the fact that the supply/demand dislocation for these critical minerals is more severe than any other structural shortage of a mined material since the impact of demand for coal and iron ore in the 1790s and early 19th century, as the Industrial Revolution progressed. It really is epic. So that’s the one broad picture reality that we all have to understand is now unstoppable and inevitable. It prompted two big problems inherent in that shift.

One is our industry and the markets radically failed the world to transform the production and processing and recycling of metals and minerals to meet their exponential growth in demand that is accelerating. We needed, as an industry, to deploy 100 billion dollars three or four or five years ago to avoid the now largely inescapable cliff of undersupply that we’re heading towards over the next three or four years. And unfortunately, it takes eight to fifteen years to build a mine, and only two or three years to build a battery gigafactory. So that’s the one stark reality that has created a gap. At the moment, it’s still widening, and we have to do everything we can to narrow that gap, if we’re going to not radically retard the energy transition and climate change mitigation.

The other dimensions, obviously, as we’ve touched on a little bit earlier is the fact that while everybody was sleeping, China won a war that nobody knew they were fighting until they had lost it — full control of these global supply chains, both in terms of primary resource and processing capacity to produce metal chemicals to go into energy transition technologies. And that has caused massive geopolitical and national security implications quite clearly.

Stone: I want to take a moment here just to emphasize how the volumes of these minerals, the amounts of these minerals that will be necessary per the International Energy Agency: By the year 2040, growing demand for EVs and battery storage will lead to 40 times greater demand for lithium for those markets for batteries, and 25 times greater demand for graphite, cobalt, and nickel. Copper demand for transmission lines will double.

You’ve just mentioned that we’ve got two challenges here. One is to simply develop more supply very quickly, and the second is to make sure that supply is reliable and safe from geopolitical disruption. I’d like to dive a little bit more deeply on this one. In your view, how vulnerable is the US and its trade allies to critical mineral supply disruption, based upon the concentration particularly of processing in China and in other parts of the value chain that you see right now?

Menell: There is no question that US industry and the United States as a whole, as is the case in Europe and India and Japan and Korea, is enormously vulnerable to China’s dominant position because they’re not going to fail to use their dominant position. It has cost them hundreds of millions, billions of dollars, and it has acquired and been allowed to acquire tools that are very powerful in two ways. One is to advantage their domestic industry relative to those industries in the US and elsewhere. Their objective is clearly to sell electric vehicles to the world, not to sell lithium hydroxide to the world. And they will do that. The other is to use it as a tool or a weapon in escalation of a new cold war environment, diplomatically or otherwise, on the global geopolitical stage, which again is a reality that will persist and have many ups and downs for the remainder of our lifetimes.

So there is enormous vulnerability, and at the scale of — that the challenges in reducing that vulnerability in the face of what you’ve mentioned of the quantum leaps in supply that we need to feed this transformation. If we use Tesla as an illustrator, Tesla ought to reach its target of 20 million electric vehicles a year in 2030. That’s only seven years away. That alone would require almost seven times the present total global supply of lithium. And that’s Tesla. That’s before GM and Ford and VW and the Chinese continue to produce two-thirds of the world’s lithium-ion batteries and two-thirds of the world’s electric vehicles and are growing more quickly than us. And they’re going to increasingly struggle to supply their own EV eCare system, let alone continue to support the Teslas of this world, who today are totally dependent on supply of inputs from China to move the needle on that, which obviously is an enormous amount of focus and effort being devoted towards doing — most notably the Inflation Reduction Act in the US — is a really tough multi-year task to dislodge China’s position in parallel with scaling overall global supply and doing it with high ESG standards and low-carbon footprint as a Western-oriented energy transition demands. It’s a ten to twenty year job and hundreds and hundreds of billions of dollars. And we’re scratching the surface of what needs to be done in order to successfully execute on that over the next decade, in alignment with US interests and the interests of US economic allies, which is what we at TechMet are dedicated to be a part of.

Stone: Could you tell us what are the reasons for the historic underinvestment in the US into critical minerals?

Menell: It’s quite simple. It has been a lot easier to export the requirements to fund and environmentally license and build and manage projects of the Chinese. If you are Tesla, and you needed x tons of nickel for nickel sulfate, and nickel sulfate and lithium hydroxide are going into your battery cells, the Chinese having done what they’ve done over the last 15 to 20 years, were willing and able to supply you very, very competitively, much more competitively than you were able to supply yourself or anybody else building capacity in the US or in alignment with US interests were able to do.

And that is for obvious reasons. The Chinese have been doing it with plentiful and largely free state money. They have been doing it with much lower environmental licensing requirements for domestic-sited processing. They have been doing it with massive economies of scale, which are difficult to duplicate, having been building capacity while everybody else was doing nothing. And therefore today, it’s incredibly difficult to compete in order to balance that Chinese position, for all of those reasons. It can only happen with massive government intervention, which we are starting to see because that is the realization. Left to the market, we are going to continue to fail, both in terms of climate change mitigation and in terms of US industrial competitiveness, jobs, and national security.

Stone: It’s interesting because you just pointed out that a lot of the reasons for the US supply chain, for critical minerals to not be developed past a certain point, was because the economics and regulatory construct outside the United States made development of those industries relatively easier.

I just want to take a step back to one thing that you mentioned a few minutes ago. We focused a lot here on geopolitical tension being a driver of insecurity for these mineral supply chains, but you also mentioned briefly, and I want to go back to that, the economic reasons that China might want to control all of these resources and not provide those resources to other countries when supplies may be limited. I wonder if you could tell me a little bit more about that?

Menell: Yes, if Europe is to meet their 30, 40, 50% EV penetration targets over the next ten years, there is no way that is achievable without importing 50 or 60 or more percentage of those EVs, and that’s China’s plan. I think the US will do a better job of protecting US industry from that economic reality, but Europe may well not. And that is a clear objective of Chinese manufacturers and the Chinese state, and it’s quite a realistic one and a reasonable one, given what they have invested and done to create supply chains and create the industrial capacity and technologies that they’ve done over the last decade.

Stone: I want to note that the US and the EU are not seeking to achieve self-sufficiency here in terms of their critical mineral supply. The goal is diversification of supply among countries with which these countries have trade agreements. This really gets to the root of what your companies do. You’re focusing on developing these alternative sources of critical minerals and rare earths. Where are the notable new supplies located, as well as the processing opportunities?

Menell: That is what we do. We’re building high ESG compliant and low-carbon footprint production and processing and recycling across these key metals in alignment with US interests. And we’re doing that in different ways, in different places that are relevant to different metals, so there’s a diversity of different drivers of what will create that independent US line of supply globally. As you say, the answer is not localization. The answer is controlled, or at least friendly supply chains that are not in the hands of one’s strategic adversaries.

Lithium is somewhat of an outlier amongst our metals in the sense that there is a lot of lithium in the world. So the issue is not the structural short supply of primary resource. The issue is the economics and process technologies and environmental impacts of scaling supply. In our view, a lot of growth in supply of lithium to fill this gap that is widening has got to be from direct lithium extraction from both cold brines and geothermal hot brines. And we are very engaged as the primary financier of energy source minerals, which is pioneering direct lithium extraction from deep, hot geothermal brines in the Salton Sea in California, and there’s [UNINTEL] and [UNINTEL] in Utah and Texas and Arkansas and Argentina. We’re also busy with brine paste lithium production in Cornwall and hard rock lithium production.

So while lithium production globally will continue to be dominated over the next four or five years by hard rock’s spodumene-based lithium production out of Australia, and a few emergent productions in Africa, and the production from the big Senegal [?] salt brine lakes, with evaporation pond systems that are presently deployed in Chile and Argentina; but this DLE from brines will be a major driver in growth and demand. And we are obviously very involved in that and committed to playing hopefully a significant role in scaling some of these technologies and projects, because they are in their infancy in terms of commercial scaling.

Cobalt is again an outlier at the other end. It’s very constrained in terms of geological occurrence and totally dominated by the Congo, so it’s much more of a security issue. It’s much more of a fundability issue. It’s largely a byproduct from cobalt in the Congo and Zambia, and nickel in Canada and Australia and elsewhere. So there’s a whole other range of challenges to scale it as a byproduct of copper and nickel to meet demand. Nickel, likewise — we’re very involved in pioneering new nickel processors in the form of one atmosphere and room temperature heat bleach process that we’ve pioneered as Brazilian nickel for extraction of nickel chemicals, battery manufacturing from a certain type of nickel nitrate resource, which we’re doing in Northern Brazil and building a big nickel/cobalt project there.

So rare earth is completely different. We’re building a rare earth separation plant in Norway, together with Norwegian state and Swedish state. And again, that’s a whole other range of challenges with respect to separation technologies and further manufacturing of nickel, rare earth powders and alloys for permanent magnet manufacturing. So I don’t want to drone on about each one of our metals, but they’re over 30 different landscapes of opportunities and challenges to pioneer new processes, turn out new resources to meaningfully narrow the gap over the next ten years in the supply/demand specification.

Stone: According to some more information from the International Energy Agency, the rising cost of critical minerals has led in recent years to increases in the cost of some clean energy technologies, following many years of price declines. And as the technologies themselves become less expensive, the minerals themselves make up a larger part of the overall cost of those technologies. Are these prices going to be detrimental to the pace of the energy transition? I think this is a particularly important question to ask, as we’re looking for new sources of supply that may not have the built-in volume, existing infrastructure advantages to cost that you would already find, for example in China, with the processing of different minerals.

Menell: I think you’ve put your finger on the key issue, that critical mineral supply constraints and pricing will have a massively retarding impact on the energy transition. The fact is that as lithium-ion batteries and other technologies scale in production, and configurations and chemistries continue to be refined and to become more efficient, and hopefully thrift out some of these less available materials, or we need a little bit less of them. As you have greater economies of scale and new manufacturing technologies, those will all be continuing to drive down costs to make these units and the cars they go into more competitive and stimulate demand, so we accelerate adoption. That’s all great.

And fortunately, as you say, the metals going into those systems are going to be — are in fact in short supply. Their price will have to go up a lot further and stay up a lot longer, and they will be a much bigger portion of the value of those units over the next one, two, three, five, ten and fifteen years. And overall, the pace of decline in the cost of lithium-ion batteries and electric motors and wind turbines will slow, relative to the buy-in costs of the industries which have evolved over the last ten years, and in some cases reversed and become more expensive.

So obviously that has an effect on demand and penetration and the pace of the energy transition, as well as on inflation and on climate change goals. It’s a very major issue that requires hundreds of billions of dollars and a lot of focus on governments and private sector in order to avoid the worst of the impact on that equation.

Stone: Earlier in our conversation, you mentioned the amount of time that it takes to develop new mines. Mines are obviously long-term investments. They can take, as you said, ten, maybe even twenty years to fully develop and start to earn returns. To what extent might the vacillating climate politics here in the US increase investment risk, make these long-term investments look a little risky? And to what degree might the IRA address some of those concerns?

Menell: Do you mean a politically driven reversal of commitment to climate change mitigation and the energy transition in the US?

Stone: Quite possibly, or some variation on that.

Menell: Yes, I’m not too worried about that. The global energy transition, the global penetration of electric vehicles to replace diesel and petrol engine vehicles is pretty much unstoppable. It might go quicker, or it might go a little bit less quick, depending on multiple political, regulatory, economic factors. But it’s not going away. And even in a very, very, very down-side scenario of global recession and of political backlash in the US and elsewhere that reduces the regulatory support for this transition, there’s still a very severe shortfall of supply of these metals. So I’m not worried as an investor in lithium projects, nickel mines, cobalt mines, and tin mines. And I’m going to be investing into an environment where suddenly in five years time, everybody is back pumping oil and increasing usage of diesel and petrol, and we’ve taken a bet on the wrong global transformation. I think the risk of that is close to zero.

Stone: So even if the pace is slowed or fast, there’s still going to be demand.

Menell: Yes, and demand is still going to continually outstrip supply over the next three, four, five, eight years. The distribution of shortages across critical minerals will obviously vary as technologies evolve, as they will. So some will be in more severe short supply than others because prices will drive innovation and change battery chemistries and configurations. So there’s a lot of nuance within the equation, but the overall equation and macro tailwind for our industry is inescapably compelling.

Stone: To get back to that shortage of supply or to take it a little bit further, under the Inflation Reduction Act, EVs that source battery components from foreign entities of concern — most notably being China — will not be eligible for the EV tax credit. EVs that contain critical minerals from China generally will not qualify for the credit, as of 2025. This is really quick. This is a quick timeframe that we’re looking at. The issue has obviously been all over the news. What is your view on the availability of these minerals to replace Chinese supply, let’s say? And will there be adequate supply of critical minerals from non-states of concerns within the timeframe that we need?

Menell: It’s a massive challenge, and we’ve got a lot of work to do to try and make that a possibility. It’s not inconceivable, but it’s really tough, and we as an industry are going to need a lot of support in order to do that. And support not just from Inflation Reduction Act agencies and other elements of the US government ecosystem. You obviously are very powerful and have good budgets and have a big role to play, however you’re committed. But I also fund rockets [?]. And from institutional providers of funding who, up until now have not chosen to largely ignore our industry because it’s perceived as being high risk from an ESG/PR/exposure point of view, and therefore best left to the Chinese or somebody else. And that’s a mass problem. Governments don’t only need to de-risk projects by providing funding and protection, as our IRA is, but also need to perhaps incentivize or regulate in some way deployment of capital from private sector institutions in order for them to play the role they have to play — because we need hundreds of billions of dollars over the next five to ten years.

And we’re being failed, not only by the markets, by scaling of the industry outside of Chinese players, but we are also being failed by the institutions, but also being failed by big global mining companies who have also been largely absent from the critical minerals because they haven’t historically been big enough to move the dial for them, and they therefore have been much happier continuing to mine iron ore in the Pilbara, Australia and ship it to China and pay massive dividends, when they should have been redeploying capital with all their expertise and capacity and technical abilities into building more nickel capacity, more lithium capacity, more cobalt capacity, more rare earth capacity, more tin capacity. And they largely haven’t been.

Stone: Given the volume of all these metals that are going to be needed in the future, the concepts of the circular economy seem to be really important. We’re going to need to recycle some of these resources going down the line. Recycling has emerged as an alternative to displace some portion of newly mined material, although the volumes, I believe, at this point, are pretty low. You have a company that TechMet has invested in, Rainbow Rare Earths, which is in South Africa, that focuses on recycling. Can you tell us what potential is there for recycling at this point? And how big might it be?

Menell: There are two sides to it, in the context of the TechMet portfolio. One is waste treatment for critical minerals, and we’ve got two plants in Arkansas and US Vanadium taking industrial waste and producing high purity vanadium chemicals, including the electrolyte for the vanadium redox flow batteries, which needs to be one of the winners in the grid scale, fixed battery storage development. And as you mentioned, Rainbow Rare Earths is preparing to build a big dump treatment for rare earth oxides, a project in South Africa from the waste material from historical phosphate mining.

So that’s waste treatment recycling. We were the primary funders of Li-Cycle, which we’ve just funded on the New York Stock Exchange and then exited from it about a year ago. They are now the biggest lithium-ion battery recycling company in North America, and we’re now investing in a next-generation lithium-ion battery recycling technology company, Momentum Technologies in Texas, and building our first plant in Ohio. That’s a very important part of the ecosystem — lithium-ion batteries. First they do get damaged, or they are defective, and they do reach the end of their lives. Environmentally they have to be dealt with. You have to deal with them in a way that captures that need to reduce the cost of new ones, and you have to recover the metals in them in order to feed the production of new batteries without having to go to Chinese sources or go to new mined materials. And that’s happening with Li-Cycle, Redwood, and other incumbents, and what we are building has a much lower Capex, more modular membrane-based solution and momentum in Texas and Ohio.

And it is important, but it’s not the answer. If we were to fully develop their recycling ecosystem in the US over the next ten years, maybe we could supply 20% of the battery metals going into new manufacturing — which is material, but it doesn’t replace needing to have a lot more mines and a lot more primary processing.

Stone: So the fact is that critical mineral mining will continue to take place outside of the US. A couple of years ago, this podcast had an episode on the supply of cobalt, which you’ve already mentioned, from the Democratic Republic of the Congo. The episode focused on the detrimental human and environmental impacts of resource development in that country. To what extent are there global protocols to manage these environmental and social impacts? Again, understanding that regardless of how quickly supply chains can be developed in the US and amongst other countries, certain resources such as cobalt are going to be coming from countries that have a lot of challenges.

Menell: There are a lot of protocols and standards that we apply to ourselves at TechMet and all of our projects, and the DFC is a government development funding agency which obviously oversees that. We follow all their guidelines. It’s a mistake to think that mining is fundamentally offensive. It can be well governed. It can be low-impact environmentally, and it can be very constructive from a social and political and community interface point of view. And it has to be, in terms of how our industry needs to evolve and transform to play our role in the energy transition.

A country like the Congo is a complicated country, with a complicated history, and it’s never going to be a simple environment in which to ensure high ESG standards. However, a number of the players there are doing so, and there are a lot of frameworks and standards that players in the industry adhere to, which are being applied. So to tarnish the Congo with a uniform brush of a lack of acceptable governance and standards is wrong. Unfortunately, the Congo is dominated by Chinese interests who do not hold themselves to as high a standard as we do. But there are other players who do. The element of Chinese cobalt production that comes from artisanal, informal sector production, which is particularly difficult to regulate and particularly difficult to be confident of the transparency with respect to issues of environmental impact or child labor or other problems that we don’t want to pollute our supply chains. It is small. It’s 10% of the Congolese production, which probably means that it’s 6 or 7% of global production.

So it’s a big issue. It needs to be dealt with. In a way, I know I’m unpopular for saying this, but it’s a bit of a distraction. We need to deal with it, but we don’t need to focus on it like that’s what the industry is. It’s a little corner of the industry that we need to deal with and minimize the negative impact of.

Stone: Let me ask you a final question here. The IRA has gone a long way towards incentivizing critical mineral supply chain development in this country through tax incentives, but what policies would you like to see going forward to additionally promote and accelerate development of the critical mineral supply chain within the United States, as well as amongst its trade allies?

Menell: I think what we need is more of what we’re getting. We need the IRA to be implemented efficiently and effectively, and a lot of the jury is somewhat out with respect to effective and efficient regulations and implementation. We need to further empower, both budgetarily and in terms of latitude to work outside of the US, as well as inside of the US, programs such as the DOE loan program, which is very material and doing great work. It leads to a lot more on a much wider landscape. What the DOD is doing through the DLA [?] and the DPA and Title III is very important. It needs to be scaled.

So all of the things that are going on need to be done quicker and bigger. So that’s the one side of it, but it’s possibly even with that happening, is not enough because we should have been doing what we’re doing now five years ago. We need to be very imaginative to really move the dial and fill or narrow this gap. And therefore we do need innovative additional measures that government has to engage in, in order to make even more of a difference than they are starting to do already. In my view, the one area that hasn’t been dealt with at all is how one incentivizes or encourages or forces large private sector instructional pools of capital to engage in responsible projects in these critical mineral supply chains that we all need for US security, US industrial competitiveness and jobs, and to play our role in mitigating climate change globally.

So somehow these institutions need to be encouraged or forced to contribute to the hundreds of billions of dollars that we need as an industry to do our job.

Stone: Brian, thank you for talking.

Menell: Great, Andy. It was a great pleasure.

Stone: Today’s guest has been Brian Menell, Chief Executive Officer of TechMet.

Brian Menell

Chairman and CEO, TechMet LtdBrian Menell is Chairman and CEO of TechMet Ltd. He graduated in Political Science & Economics from the University of Pennsylvania.

Andy Stone

Energy Policy Now Host and ProducerAndy Stone is producer and host of Energy Policy Now, the Kleinman Center’s podcast series. He previously worked in business planning with PJM Interconnection and was a senior energy reporter at Forbes Magazine.