Wind Developers Pressured by Pandemic Concerns & 2020 PTC Deadlines

With concerns about a global recession and looming 2020 PTC deadlines, wind developers and investors are being forced to revisit project strategies.

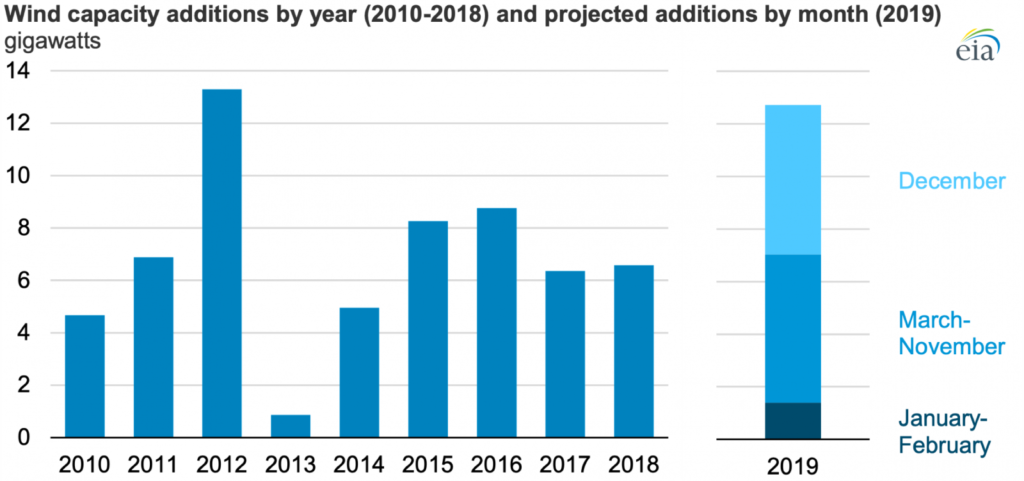

The Production Tax Credit (PTC) has long served as a strong federal incentive for the development of wind facilities by offering 1 to 2 cents per kWh generated by utility-scale wind. Annual wind capacity additions are greatly affected by changes to tax incentives, according to the Energy Information Administration (EIA). For example, when the PTC was set to expire at the end of 2012, the U.S. observed an increase in wind capacity installed that year. Likewise, capacity installation stalled in 2013 before rebounding in subsequent years following legislative PTC renewal.

Under the previous policy, the wind PTC was reduced to 40 percent of its original amount in 2019 and was slated to completely phase out in 2020. However, last December the President signed the Taxpayer Certainty and Disaster Tax Relief Act of 2019 into law, which—among other provisions—extends the PTC for one more year. Any project that begins construction in 2020 and is brought to operation before 2025 will receive the 2018 rate of approximately 1.5 cents per kWh (60 percent). As a result, many industry analysts initially expected to see upticks in wind project construction from developers aiming to qualify before the 2020 PTC cliff.

However, wind developers are scrambling to revise their construction and operation plans for both new and existing projects amidst coronavirus pandemic concerns. Not only do new projects have to break ground by year-end in order to qualify for the extended 2018 PTC level, but also existing projects have to complete installation in 2020 in order to qualify for the pre-phaseout PTC amount.

Market research firm Wood Mackenzie estimates that 9 gigawatts of slated projects are “at risk” of missing their 2020 completion deadlines—potentially worth almost $11 billion in investments. With such tight schedules, these projects are vulnerable to any disruptions in their timelines. Chinese manufacturers in the wind power supply chain were already forced to shut down during the onset of the outbreak. Though these plants are now returning to operation, many in the wind industry fear the potential onset of global recession, which would bring many implications on the wind industry demand side.

An economic slowdown could decrease energy consumption, crimping wind energy revenues and hurting wind project tax appetites. Recession could also limit the availability of tax equity capital, as potential investors earn less profit and have fewer tax liabilities for developers to utilize. Additionally, workforce shortages, permit delays, and other COVID-19 related issues could gravely derail individual projects from their planned schedules.

Some projects will unavoidably miss the current 2020 PTC cutoffs. For developers of these projects, this means revisiting their strategies to shift their finish lines post-2020. Many firms in the wind industry are already highly leveraged and earn slim margins; some are thus pressuring U.S. tax authorities to postpone the wind construction deadline beyond the end of year.

Clean energy industry groups such as the American Council on Renewable Energy, American Wind Energy Association, and Business Network for Offshore Wind asked congressional members to provide project developers with more time in the coronavirus relief package, though such appeals were left unanswered. Among developers who can weather the storm, some are still optimistically looking forward to a PTC-free wind market.

Opponents of the PTC have often argued that reliance on the PTC subsidy creates unnecessarily complicated financing arrangements and regulatory uncertainty. In a post-PTC environment, new types of investors may participate in the market, causing capital costs to decrease. Wind investors and developers will no longer rush to complete projects during deadline years, which will allow for a more consistent and predictable supply chain. Furthermore, the death of the PTC may allow wind industry advocates to focus their efforts on broader and more resilient federal action on energy and environmental policy.

Ryan Kim

Undergraduate Seminar FellowRyan Kim is an undergraduate student studying economics and environmental studies in the College of Arts and Sciences. Kim was also a 2020 Undergraduate Student Fellow.