Powering Up the Next Blockchain Disruption with Web3

An emerging startup joins forces with a leading Vietnamese electricity provider—and in doing so, exemplifies how blockchain may come to revolutionize the energy industry.

Buying electricity might not sound like fun. For most of us, there’s not much to it besides the occasional utility bill. But given the recent global proliferation of electric vehicles, rooftop solar, battery storage, and other distributed energy resources (DERs), we may soon find this once unremarkable task forever changed.

The decision to embrace DERs among economies and regulators tells a familiar tale of decentralization–meaning that end-users gain greater control over the network upon which they operate. In energy markets, we may be witnessing a shift from the traditional utility business model, where large geographic regions rely on electricity distribution from a few power plants to a future where communities can turn to a diverse mix of smaller-scale producers.

Blockchain enables this vision. You’ve heard of it before–a novel data management system, blockchain underlies cryptocurrencies and NFTs by executing transactions between individuals without an intermediary. The technology has generated substantial buzz in financial services and arts and entertainment, attracting $94 billion of capital from investors over the past seven years.

Is the energy industry next in line for a blockchain makeover? Australian company Powerledger may have an answer.

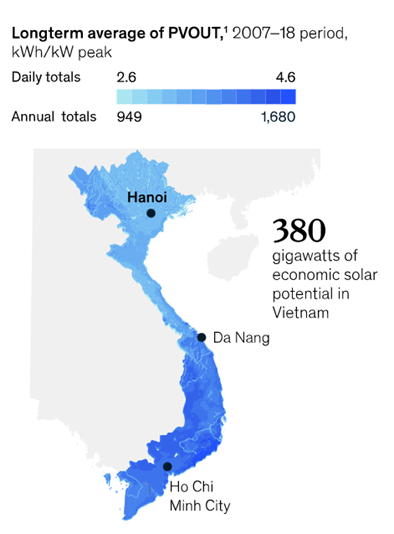

The startup recently partnered with Vietnam’s state-owned power distributor to launch the nation’s first peer-to-peer electricity trading platform, enabling buildings with rooftop solar appliances to sell surplus energy to other consumers. The move incentivizes continued renewables adoption, in line with the country’s pledges to phase out coal and reach net-zero carbon emissions by 2050.

Powerledger’s blockchain-based energy trading platform spans 30 projects across 12 countries. The company is best known for a 2018 solar trading trial in which 48 households in Western Australia bought and sold excess electricity from each other and, as a result, reduced most residences’ net energy expenses.

Why is blockchain necessary to facilitate energy decentralization? It comes down to transparency. As communities add more energy stakeholders to the grid, producers and consumers need verifiable, granular information about electricity flows.

Transactions between parties will grow complex–a household with its own generation source may be a net consumer of electricity at one moment and a net producer the next. Prices will fluctuate dynamically based on supply and demand, changing optimal energy consumption patterns. Eventually, consumers may even specify the type of power they wish to purchase (wind, geothermal, or nuclear) or whom they get it from (neighbor, community solar farm, or traditional utility). Blockchain’s real-time data logs will prove invaluable in ensuring that these interactions occur securely and cheaply.

Recent news about Bitcoin mining operations may give off the impression that all blockchain products are computationally expensive and environmentally costly. However, a significant group of blockchains (including Powerledger) now utilize proof-of-stake (PoS) networks, which can reduce energy consumption by more than 99% compared to the flagship algorithm.

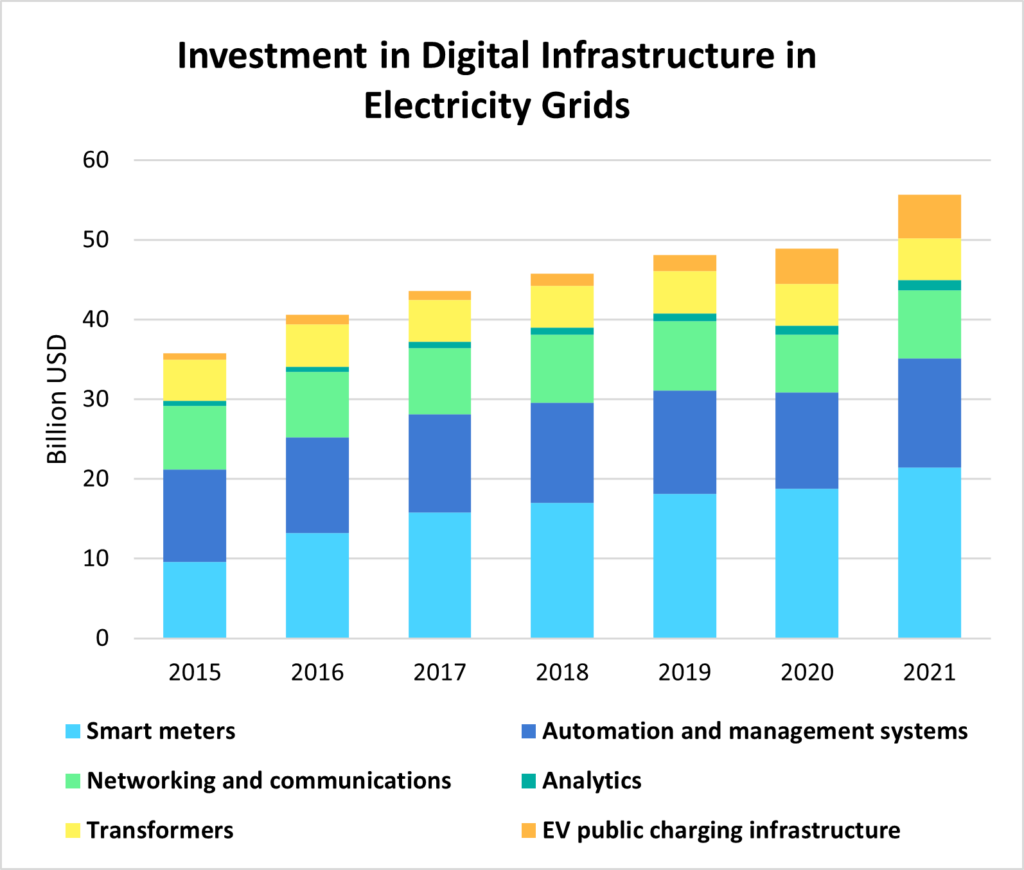

Before the technology becomes mainstream, however, communities must invest in sufficient smart energy infrastructure. Examples include deployments of smart meters, artificial intelligence, and IoT devices–the ways and means by which grid resources “communicate” on the blockchain.

Mobilizing sufficient capital around these upgrades remains a challenge. During the second quarter of 2022, U.S. regulators only approved $478.7 million of a staggering $12.86 billion of proposed grid modernization actions, amounting to less than 4%. Moreover, utilities have been especially cash-strapped due to accelerating climate change events (e.g. West Coast wildfires, Texas winter storms, and Hurricane Ida), cybersecurity threats, and energy transition initiatives like the retirement of existing coal plants. Improved capital provisioning at the national and local levels will be vital to a truly modern grid.

In the interim, many executives have high expectations for blockchain’s applicability across the sector. Shell, Brookfield Renewable, Volkswagen, and Equinor are among a team of global brands in partnership with the Energy Web Foundation, a nonprofit seeking to develop new blockchain use-cases within the energy transition movement.

With enough time and refinement, their efforts may leave the industry greener and more interconnected than ever before.

This insight is a part of our Undergraduate Seminar Fellows’ Student Blog Series. Learn more about the Undergraduate Climate and Energy Seminar.

Andrea Yang

Undergraduate Seminar FellowAndrea Yang is an undergraduate student studying Economics in the Wharton School. Yang is also a 2023 Undergraduate Student Fellow.