Part 4: The Speculative Future of Philadelphia Energy Solutions

Philadelphia Energy Solutions forecasts a rosy picture following a Chapter 11 reorganization. But the refinery still faces some fundamental challenges.

Now that we’ve explored the basics of the Philadelphia Energy Solutions bankruptcy, established the real reasons behind its failing financials, and demonstrated these challenges were largely foreseen, let’s explore the potential future of PES.

PES’ bankruptcy filings include financial forecasts for 2018 to 2021, presenting the company’s estimates of future performance upon successful completion of the Chapter 11 reorganization. PES forecasts net income of $386 million (M) for 2018, $33 M in 2019, $99 M in 2020, and $121 M in 2021. (Exhibit E)

But are these rosy forecasts realistic? Will PES continue to face challenges in its future, or will reorganization open new doors to success?

Ongoing Challenges

Bankruptcy will delay the debt service burden on PES, but it will do nothing to change the fundamental challenges facing the business. While refining margins could improve, PES will continue to largely be shut out from cheap domestic crude, unless there is significant development of oil from the Utica formation or the Jones Act is amended to improve the economics of waterborne delivery of domestic crudes.

PES will continue to be subject to RIN market price volatility, unless a better partnership contract or strategic investment is developed. Conversely, the Trump administration could potentially waive, cap, shift, or otherwise reduce the RFS compliance burden on PES.

But there are many other challenges.

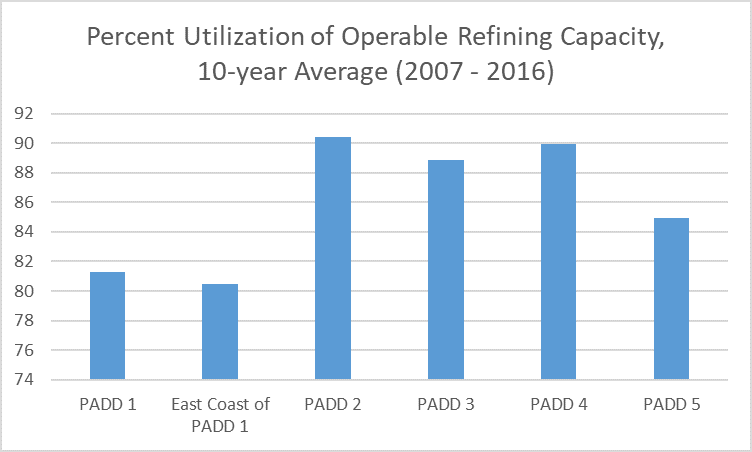

Low Utilization. As shown in this chart, the non-inland east coast portion of PADD 1 has the lowest refinery utilization rates in the country (EIA Data), indicating less competitive refining capacity. PES is the largest East Coast refiner, and likely contributes significantly to these data.

Capital Investments Needed. As mentioned in the first blog of the series, the Chapter 11 plan includes an infusion of $230 M of new capital, but it is unclear how this capital will be used. PES notes $139 to $191 million in annual capital spends and turnarounds, (Exhibit E) plus is likely to require capital investments related to regulatory compliance with air quality maintenance, for example:

Compliance with Tier 3 Standards. EPA’s Tier 3 motor vehicle standards established more stringent vehicle emissions requirements expected to reduce the sulfur content of gasoline beginning in 2017. As of August 2016, the gasoline currently manufactured by the Philadelphia refining complex did not fully meet the Tier 3 requirements. (F-46) It is unclear whether these compliance investments occurred, or if they did not occur and PES secured a compliance waiver from the EPA.

Compliance with International Maritime Organization (IMO) Low Sulfur Rules. Reports indicate that PES has not yet made the investment to produce cleaner fuel for oceangoing vessels, which will be required to reduce sulfur emissions 85% by 2020. It is expected these vessels will opt to use cleaner fuel rather than invest in costly retrofits, creating opportunities for Gulf Coast refineries and disadvantaging less complex East Coast refineries.

While PES suffers from low utilization rates and will likely require costly upgrades, it is also facing greater competition.

Competition from Midwest Refineries: Midwest refineries in PADD 2 have invested heavily to increase capacity and their ability to process heavy crudes in expectation of new Canadian feedstock priced at the Western Canada Select (WCS) that currently trades below WTI and Brent prices. Morningstar maintains that Midwestern refinery heavy crude crack spreads will continue to be more attractive than light crude spreads, as long as Canadian crude production stays high and pipeline takeaway capacity is constrained.

Laurel Pipeline Reversal. PES is objecting to a proposal pending at the Pennsylvania Public Utility Commission (PA PUC) that would allow the existing Laurel Pipeline to reverse direction of oil flow on a portion of its line. PES maintains that 20 percent of its total production is delivered to the Pittsburgh area on the Laurel line and flow reversal would materially damage its business. A final ruling on this issue is anticipated by the PA PUC sometime in Q1 to Q3, 2018.

Adelphia Gateway Pipeline Project. Morningstar believes the PES and the Monroe refineries are the weakest performers on the East Coast. It may be that only one of the two refineries can survive (in 2017, Monroe hired consultants to investigate various impacts related to closing the refinery). If it is a race to the bottom, then the recent application to FERC to convert an existing oil pipeline to move Marcellus natural gas to southeastern Pennsylvania, including building a 16-inch lateral (the “Tilghman Lateral”) to deliver gas (presumably as fuel, not feedstock) to the Monroe refinery may not bode well for the future of PES.

A collection of other issues may negatively impact PES. For example:

- If and how the Federal Reserve finalizes its proposed rule to limit financial holding company activities in physical commodity activities. PES believes finalizing this rule as proposed would harm its business.

- The degree to which PES can negotiate an attractive extension or replacement to its collective bargaining agreement with the United Steelworkers (USW) union, that expires on September 9, 2018. (footnote on 14) Approximately 650 of PES’s 1,100 employees belong to USW.

- The degree to which northeastern demand for heating oil continues to decline in the presence of attractive alternatives, like cheap Marcellus shale natural gas. (3)

- After December 31, 2023, PES will lose the attractive Keystone Opportunity Zone state and local tax benefits and will be subject to full state and local tax rates. (F-39)

So, it seems the future may still be quite rocky for PES, even if it can successfully shed its past RIN obligations and emerge from Chapter 11. If PES is unable to successfully complete Chapter 11 reorganization, it may be forced to enter into Chapter 7 liquidation. The combined liquidated value of the refinery and rail terminal are around $800 M.

Note: A more detailed publication on the Philadelphia Energy Solutions bankruptcy is in development.

Christina Simeone

Kleinman Center Senior FellowChristina Simeone is a senior fellow at the Kleinman Center for Energy Policy and a doctoral student in advanced energy systems at the Colorado School of Mines and the National Renewable Energy Laboratory, a joint program.