Part 1: Wholesale Electricity Markets: Is It the LMP, or the LMP Alone?

The evolving landscape of wholesale power markets raises questions about the sustainability of the locational marginal price (LMP) mechanism, reflecting shifts in the resource mix.

This is part one of a two-part blog series. To continue to part two, please visit this page.

Growing concerns about possible wholesale market price impacts in systems made up of mostly renewable resources have led two current FERC Commissioners to call for significant changes to the pricing structure of wholesale power markets in the United States.

Commissioner James Danly states that price signals in FERC-jurisdictional markets are so distorted that they are in need of “dire repair.” Commissioner Mark Christie takes this further, and argues that prices based on a single clearing price are the problem and we should abandon the locational marginal price (LMP) altogether.

Both highlight the challenge of relying on prices alone to coordinate the reliable transition of the electricity sector. But rather than focusing on policy as the problem, we should instead recognize the limits of markets for electricity.

What is an LMP?

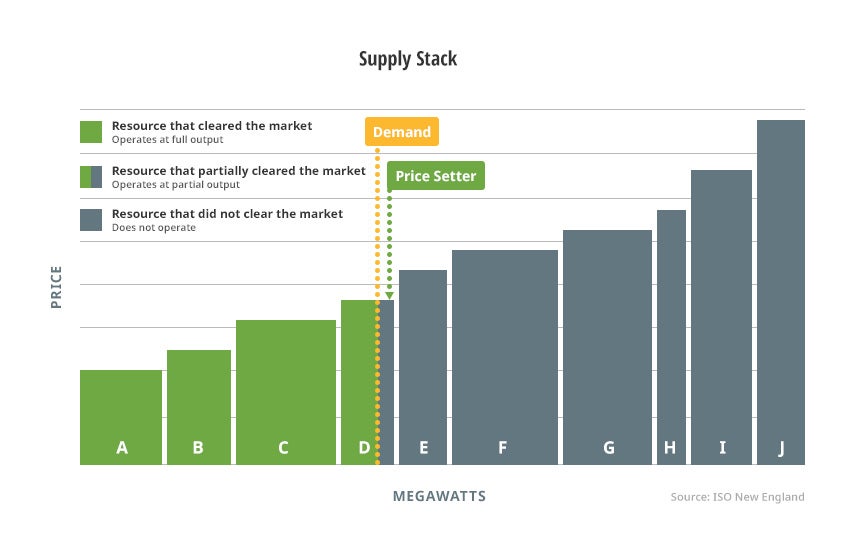

In wholesale markets for electricity, the marginal cost of meeting the next increment of demand sets the price at a given location. All generators that are producing energy at a given time and in a given location are paid a single clearing price—the locational marginal price, or LMP. The idea is that this price (the ”LMP”) reflects specific system needs, and all available generation resources—producing or providing other grid services within a given location—should be paid that price.

In theory, as long as the highest cost generator (the marginal unit) needed to meet load at a given location fully reflects its costs, then all generation resources that are producing below the costs of the most expensive generator receive what are called “infra-marginal rents,” or revenues above their operating costs that help recover investment costs, too. That is, these generators earn a profit. Generators that do not earn enough to recover their operating costs, because they do not run enough, or do not run at times when prices are high, should exit the market.

Why use an LMP?

The LMP is an important mechanism for enabling the optimal dispatch of generation resources to meet load at different locations, while taking generator limitations, transmission constraints, and all required reliability standards into account.

Regional Transmission Organizations (RTOs) and Independent System Operators (ISOs) ensure the reliable operation of the bulk power system (high-voltage transmission lines used in interstate commerce—i.e. “the grid”), conduct long-term system planning, and optimize the dispatch of generation resources to meet demand in real-time power market operations.

RTOs and ISOs use security-constrained-economic-dispatch (SCED) and security-constrained-unit-commitment (SCUC) models that price and dispatch the least-cost generation resource mix to meet load, while keeping power flows within transmission security limits, and while meeting all mandatory and enforceable standards for operating reliability.

A pricing mechanism that allows for the least-cost dispatch of generation resources that can meet load across various locations, while respecting transmission constraints, helps enable reliable power system operations and the integration of various generation resources across a wide footprint.

Why are there concerns about the LMP in wholesale markets made up of mostly renewables?

In systems made up of mostly fossil assets, there is a marginal cost for generation resources: the price of fuel (e.g. coal, natural gas). Renewable assets, on the other hand, have very low, or no, marginal costs, because there is no fuel cost. As more renewable resources come online, there are several possible pricing impacts, leading to concerns about the viability of the LMP.

First, as renewable assets are increasingly the marginal generation resource, over time they risk being unable to fully recover their investment costs because there are fewer periods where they receive infra-marginal rents in energy markets. Second, as more expensive resources are dispatched less, they may seek to exit the market. If these assets (usually fossil) are still needed to maintain system reliability, there are concerns that subsidizing renewable resources distorts market signals for these assets. Third, there could be significant price volatility, as power market prices range throughout the day, or season, from very low to very high, depending on the marginal generation resource. This price volatility may lead to a regulatory response that interferes with an efficient market price signal, or the increased revenue uncertainty may increase the cost to invest in clean energy technologies.

Kelli Joseph

Senior Fellow, Kleinman CenterKelli Joseph is a Kleinman Center Senior Fellow. She works at the intersection of policy and markets, with a focus on transitioning the electricity sector to support a decarbonized, climate resilient economy.