Transparency, Capping Returns a Must for Nuclear Subsidies

Pennsylvania policymakers are contemplating new subsidies for existing nuclear power plants. Honestly, I could argue for or against these subsidies, but that is for another day.

Here are some principles Pennsylvania lawmakers should keep in mind if they are interested in supporting nuclear power.

Transparency on Plant-Level, Corporate Economics. Numerous analysis estimate two nuclear plants are economically distressed, Three Mile Island (owned by Exelon) and to a lesser extent, Beaver Valley (owned by FirstEnergy**). Pennsylvania’s other three nuclear plants – Peach Bottom (Exelon/PSEG), Susquehanna (Talen/Riverstone) and Limerick (Exelon) – are profitable.

For these profitable plants, it is unclear if they are making enough money to justify future capital expenditures (e.g. replacement of equipment), let alone generating profits sufficient to compete against the parent company’s other existing or potential investments (i.e. internal capital competition).

So which plants should be subsidized and what is the smallest subsidy sufficient to keep the plant open? Are consumers paying so plants don’t lose money, or are they paying to increase plant profit margins?

The only way to know is to make plant-level and even corporate-level financial data available to regulators. This is a must.

Capping Plant Returns. Consumers should not subsidize padding plant profit margins or making plant assets more attractive against other investments in the company’s portfolio. On the other hand, business shouldn’t be expected to keep money-losing assets. If there are ratepayer subsidies, they should be limited to the minimum amount needed to provide the public interest value (i.e. local jobs, avoided carbon emissions). This means regulators should be continually examining plant and corporate financial data to avoid over (or under) subsidization.

This life-line should be understood by all as an interim step while a longer-term solution is developed, for example, an electricity sector-wide carbon price (not a technology- or unit-specific carbon price).

Capping Return on Equity. To help ease the sting on consumers, support-seekers should make some tradeoffs. If you notice, both Exelon and FirstEnergy also have regulated distribution company affiliates operating in Pennsylvania. Exelon owns PECO, First Energy owns MetEd, Penn Power, Penelec, and West Penn Power.

For distribution utilities, the PA Public Utility Commission (PA PUC) determines a revenue requirement (basically, covering prudent costs plus a reasonable profit) by looking at expenses, plus the utility’s rate base, times a reasonable return on rate base investment. This rate of return is determined by the utility’s cost of capital, which is a mix of debt and equity. Determining the return on debt is straightforward (i.e. interest rate on debt instrument), but the return on equity is…well…controversial. It has to be high enough to attract capital, but low enough to avoid overburdening consumers.

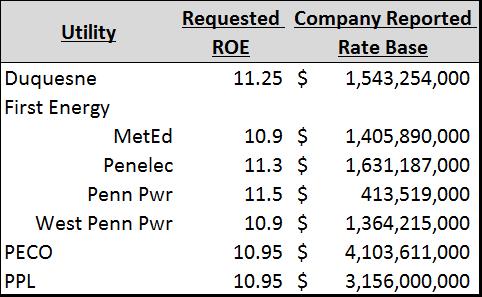

According to EEI data, the average awarded RoE for U.S. electric utilities from Q4 2011 – Q3 2016 was 9.96. Unfortunately, there isn’t transparent data on PA utility awarded RoE’s, as settled (as opposed to fully litigated) rate cases focus on total revenues and are often silent on final RoE’s. The table to the right was compiled using utility requested RoE’s (which likely overstate actual RoE) and rate bases from the most recent rate cases.

Through legislation, Exelon and First Energy could agree to identify and cap awarded and actual ROEs at current levels or (better yet) accept a slightly lower allowed RoE during the time period the interim nuclear subsidies are in place. Regulated utilities are attractive investments for risk-averse investors that like dividends. As interest rates rise, utility stocks may face more competition from traditional bonds and utility borrowing costs increase -making high regulated returns critical and the idea to cap or reduce RoE unpopular with Boards.

But I don’t think nuclear subsidies are popular with consumers either. Everyone needs to compromise.

Capping or decreasing RoE’s will slightly offset the consumer cost-burden, and will incent subsidy-seekers to keep the subsidies in place for the shortest time possible.

Leading PJM States on Market Future. The elephant is still in the room. These subsidies further burden PJM’s competitive capacity market, where prices are already depressed (yet supply keeps rolling in). FERC, PJM, and many others are investigating how to make the combination of nuclear subsidies and competitive markets work.

Pennsylvania should play a leadership role among PJM-stakeholders (e.g. by convening states at Governor’s office level) to work together in finding feasible solutions, if they exist.

** First Energy has expressed interest in selling its generation assets (or declaring bankruptcy for its generation affiliate) and sticking to regulated business. However, it is in First Energy’s best interest to secure subsidies for its nuclear assets, as ensuring continued economic operation will allow for some level of asset sale value (compared to retirement liability).

Christina Simeone

Kleinman Center Senior FellowChristina Simeone is a senior fellow at the Kleinman Center for Energy Policy and a doctoral student in advanced energy systems at the Colorado School of Mines and the National Renewable Energy Laboratory, a joint program.