Moody’s to Rate Companies on Paris Carbon Risk

This week, Moody’s Investor Service announced it would be using Paris Agreement emissions reduction commitments as its baseline scenario to assess potential credit impacts to industries and companies exposed to carbon transition risk.

“Carbon transition risk” is the credit impact of increased business costs and business model adjustments associated with the trend towards materially reducing global greenhouse gas emissions. For example, implementation of greenhouse gas reduction regulations increases carbon transition risk.

Moody’s is one of “the big three” rating agencies – along with Standard & Poor’s and Fitch Ratings – that establish entity-specific credit ratings, which indicate the ability of the organization to pay back debt, and related default risk. Ratings are assigned to an organization’s debt instrument (e.g. bond issuance), have significant impacts on debt interest rates (high rating equals lower interest rates), and are used by potential investors.

Moody’s believes the national carbon reduction commitments made by 174 countries on the April 22, 2016 Paris Agreement signify near universal adoption, and therefore, are likely to result in policies that will materially reduce carbon and will be a significant driver of ratings for certain industries.

In determining carbon transition risk, Moody’s uses a global emissions forecast that assumes all nations implement their “intended nationally determined contributions” (INDCs) to emissions reductions, consistent with global warming of 2.5⁰C – 3⁰C relative to pre-industrial levels, slightly less than the Paris Agreement’s goal of avoiding 2⁰C of warming.

Moody’s believes the INDC scenario is a reasonable benchmark, noting emissions reductions could be more or less aggressive depending on factors such as political support, technology development and deployment rates, implementation of the Agreement’s “ratchet mechanism” to establish future reduction commitments, and other factors.

For industries operating globally, the INDC global scenario will be used. For industries operating within national borders, the nation’s specific INDC pledge will be the benchmark.

The agency identified four primary categories of carbon transition risk that will be used to assess corporate and infrastructure sectors, including:

- Policy and Regulatory Uncertainty – for example, regarding the pace and detail of emissions policies, non-compliance costs, impact of related regulations, and political risk.

- Direct Financial Effects – including reduced profitability and cash flows related to increased R&D costs, capital expenditures and/or higher operating costs related to carbon emissions.

- Demand Substitution and Changes in Consumer Preferences – for example, rising carbon-intensive product costs make products uncompetitive and low-carbon substitutes more attractive.

- Disruptive Technology Shocks – including developments that hasten the adoption of lower-carbon technologies.

These categories will also guide Moody’s in examining carbon-related opportunities that might positively impact credit ratings

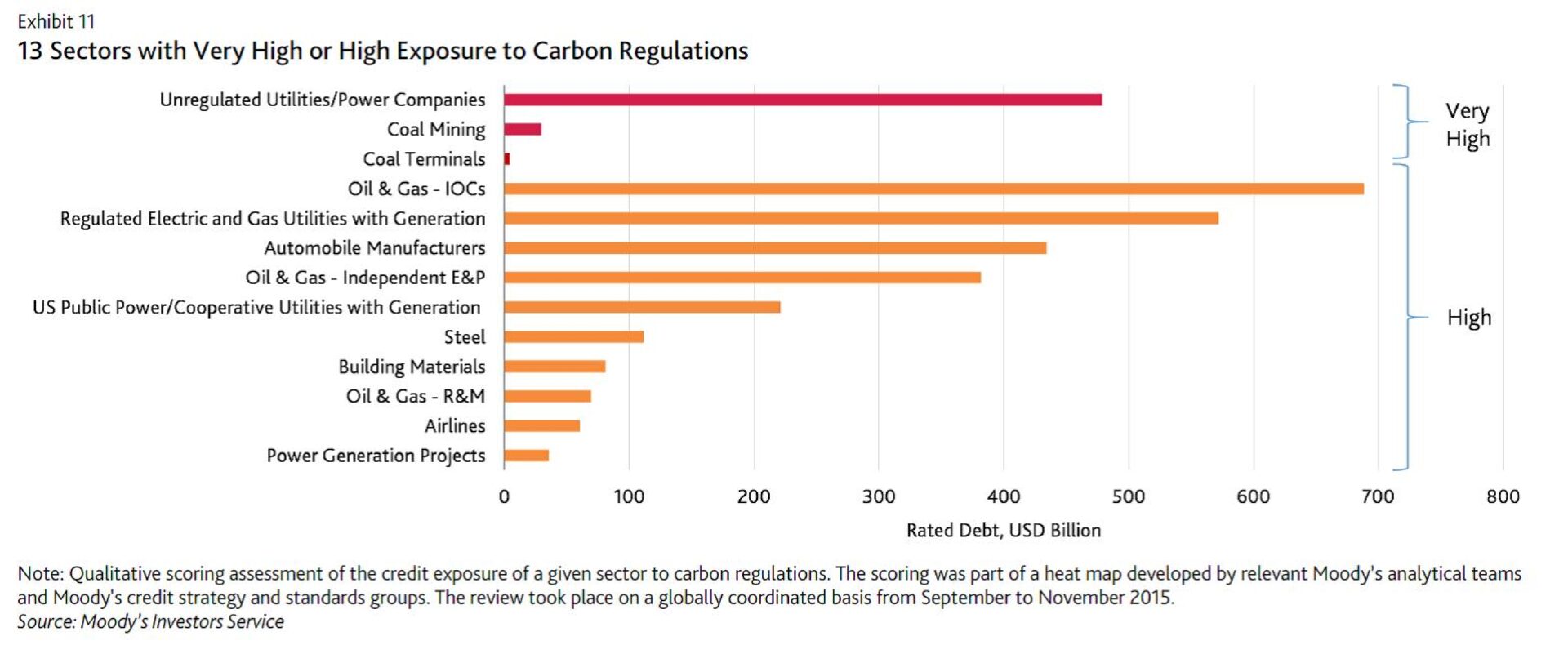

Moody’s identified 13 industries, representing roughly $3.2 trillion in rated debt, that are most exposed to carbon transition risk.

- Material credit impacts are happening now – coal mining, coal terminals, and unregulated utilities.

- Material credit impacts expected in the next three to five years – power generation projects, building materials, steel, automobile manufacturers, independent exploration and production oil and gas companies, and oil and gas refining and marketing companies.

- Material credit impacts expected over the medium to long term (over five years) – airlines, integrated oil and gas companies, regulated electric and gas utilities with generation, and U.S. public power/cooperative utilities.

In response to these risks, investors generally have three options, 1) divest completely from the dirtiest industries, 2) maintain investments in carbon-intensive firms, but engage with management to change behaviors, and 3) revise portfolios towards companies that will benefit as a result of the carbon transition.

The Moody’s in-depth report is not publicly available, but members of the Penn community and subscribers to E&E news can access the report here.

Christina Simeone

Kleinman Center Senior FellowChristina Simeone is a senior fellow at the Kleinman Center for Energy Policy and a doctoral student in advanced energy systems at the Colorado School of Mines and the National Renewable Energy Laboratory, a joint program.