It’s Time for a Market-Oriented Approach to Clean Energy Investment in Pennsylvania

Pennsylvania has $9 billion worth of economically-justifiable distributed clean energy and energy efficiency projects waiting to be developed. Yet, there is little private sector activity in these markets beyond the minimum needed to meet modest state requirements for alternative energy and energy efficiency. Renewables comprise just four percent of the electricity consumed in the state.

What’s needed to unleash this market potential?

The answer is: a Green Bank.

These are the conclusions of two new reports released last week by the Pennsylvania Chapter of The Nature Conservancy (TNC), which sponsored research by the Coalition for Green Capital (CGC). (Full disclosure: I participated in some meetings and discussions with TNC and CGC on this topic before and during the course of their research.)

The Pennsylvania Clean Energy Market Report finds that, while there’s a large number of public and quasi-public programs in Pennsylvania intended to enhance the clean energy market, they’re not aligned or focused. In addition, they are not using the most innovative financial tools to drive clean energy investment at scale. Tapping into these tools is key to growing the clean energy economy.

Historically, Pennsylvania’s various clean energy programs have relied on grant funding—rather than financing—to support the deployment of clean energy technologies. When grant funds dry up, so does investment, as experience in Pennsylvania has shown. And perhaps most perniciously, reliance on grants results in little, if any, participation in the market by private financial institutions, thus failing to build a sustainable private sector financial base for clean energy.

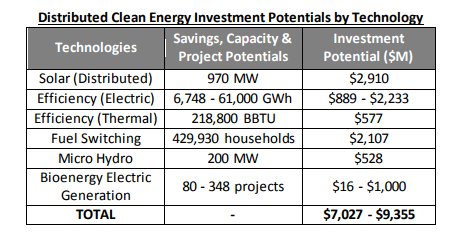

The report finds that Pennsylvania has a clean energy market potential of between $16 and $20 billion. About $7 to $9 billion of that total is in distributed energy technologies such as rooftop solar panels and building efficiency:

How can Pennsylvania unlock this potential?

The Pennsylvania Energy Investment Partnership Report argues that the key is developing and marketing financing products that are tailored to specific clean energy technologies and leverage private capital. The most effective approach to achieve those ends is by creating an Energy Investment Partnership, otherwise known as a Green Bank.

I agree strongly with this analysis. In my time as Secretary of the Pennsylvania Department of Environmental Protection, I argued against new grant-based funding for state clean energy and energy efficiency programs for the reasons cited by CGC—inability of such temporary incentives to scale renewable energy and energy efficiency, a lack of private sector financial leverage, and failure to build private financial market participation. I helped to revive and expand a finance-based approach to residential energy efficiency, and began exploring the Green Bank model in earnest.

The most successful state-level Green Bank is found in Connecticut, where it has had major impact. New York has created a state-sponsored model.

Pennsylvania should join them. The potential is huge.

John Quigley

Senior FellowJohn Quigley is a senior fellow at the Kleinman Center and previously served on the Center’s Advisory Board. He served as Secretary of the PA Department of Environmental Protection and of the PA Department of Conservation and Natural Resources.