Informing the Fuel Security Debate

PJM's recent Fuel Security Analysis moves the debate forward, and some results may be surprising. Although criticisms of the analysis abound, at least PJM is informing the discussion and moving it away from blanket bailouts for resources that stockpile fuel.

As you might recall, the Trump Administration has been pursuing a variety of efforts aimed at saving economically struggling coal and nuclear power plants on the auspices they are needed for “fuel security.”

So far, these bailout efforts have failed due to lack of evidence. But politics aside, as power systems rely more heavily on natural gas and renewables—that receive fuel as needed or are fuel-free—is there cause for concern?

On December 17, PJM interconnection released its much anticipated Fuel Security Analysis. This is the RTO’s attempt to inform the debate with data and analysis. And, the results are indeed informative.

Recall that in March 2017, PJM released its Evolving Resource Mix and System Reliability report, which found the PJM system could maintain reliability even with considerable changes to the grid resource mix (e.g. up to 86% natural gas-fired generation supply). But, questions still remained about how these changes could impact system resilience (i.e. the ability to recover from an adverse event) or if outcomes could change as more baseload resources retire.

The Fuel Security Analysis explores the fuels-related component of the broader resilience debate using computer modeling to examine 324 different winter-season stress-test scenarios, occurring over a 14-day period. The scenarios incorporate a range of sensitivities in key assumption areas (e.g. weather, load, future retirements, firm gas availability, pipeline configuration and disruptions, fuel oil levels and refueling, forced outage rates, etc.) in order to determine when the grid would have to respond with emergency procedures (e.g. emergency demand response, voltage reduction, load shed). The takeaways may surprise you:

No Reliability Issues Expected. Factoring in generation retirements already announced through 2023-2024—with a 25.8% reserve margin—there would be no loss of reliability even when incorporating extreme winter load levels and fuel delivery issues. Only emergency demand response and operational procedures would be triggered.

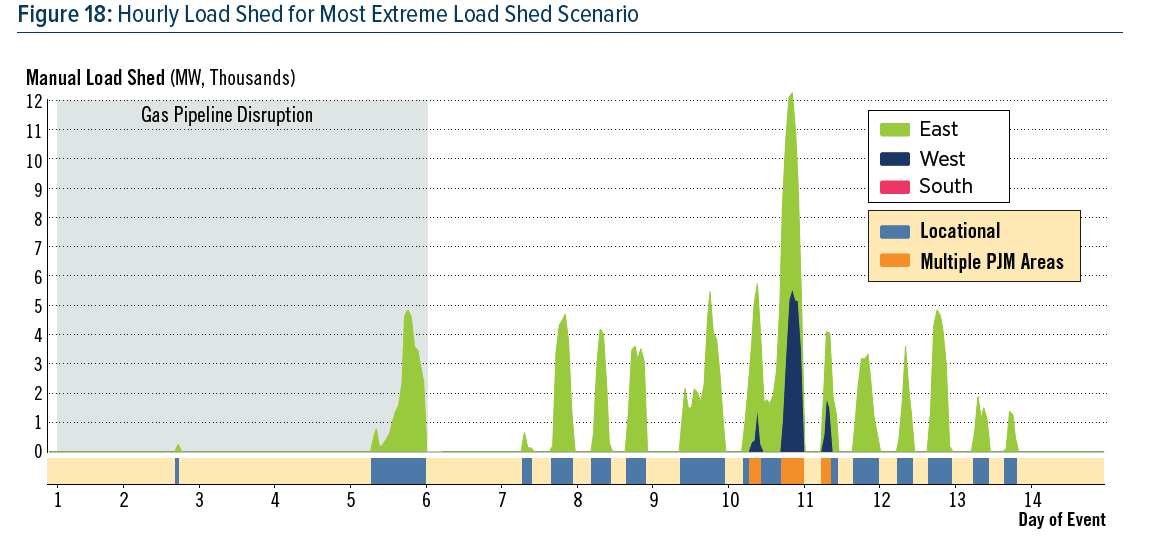

Some Rolling Blackouts in Extreme Scenarios. Incorporating extreme generation retirement assumptions in 2023-2024—where the reserve margin drops to 15.8%— yielded no reliability issues under typical load conditions. Reliability issues were indicated under extreme winter conditions. These impacts ranged from 3 to 83 hours of load shed. This does not mean the entire PJM area would black out, rather some load shedding would occur somewhere in the system for a period of time. In addition, PJM has tools available to rotate the area of load shed in order to minimize customer impacts.

Location, Location. Most of the load shedding in the extreme retirement/extreme winter scenario occurred in confined locations (rather than multiple areas), predominantly in the eastern portion of PJM (i.e. PA, NJ, DE, MD) during peak demand hours of the day.

Sensitivity to Assumptions. The most extreme load shed scenario of 83 hours could be reduced to 22 hours by relaxing back up oil refueling assumptions. These 22 hours could then be eliminated by assuming 62.5% non-firm gas availability instead of 0% availability.

Oil Refueling Rate is a Big Deal. In fact, PJM noted the availability of truck-based oil refueling (e.g. to support dual-fueled gas generators) was one of the most important factors in triggering emergency procedures. There are about 21.8 GW of dual-fuel generators with non-firm gas contracts in PJM.

Non-Firm Gas Availability Important Too. PJM performed two sensitivities for the 16.5 GW of gas-only generators that have non-firm gas contracts, one with 0% non-firm capacity available and one with 62.5% of non-firm capacity available (based on procurement from the secondary market). Availability of non-firm gas capacity turned out to be an extremely important variable in avoiding emergency procedures.

Pipeline Disruptions Not a Significant Factor. Contrary to the political debate, PJM’s analysis suggests pipeline disruptions had a small impact on triggering emergency procedures.

PJM’s Fuel Security Analysis is a step in the right direction because it adds data and analysis to what has so far been a debate driven by politics, speculation, and fear.

Of course, no analysis is perfect and there are critics of PJM’s approach. Some argue it focuses too much on fuel rather than resource performance (i.e. is not technology-neutral), ignores transmission enhancements in place of fuel supply solutions, ignores industrial consumer demand response, and ignores new entry in response to generator exit (i.e. retirements). In addition, PJM put a great deal of effort justifying its assumptions, but didn’t opine on how realistic the combination of events may be. In absence of probabilities, it is unclear if the most extreme scenarios are probable or just theoretically possible.

The next steps on fuel security are likely to be more contentious. PJM intends to engage in another round of modeling, based on scenarios developed by federal agencies (e.g. DOE, DHS, FERC). PJM also plans on beginning a stakeholder process on fuel security in early 2019, with the intention to file with FERC in 2020. Early indications from PJM point towards a competitive market solution either through the capacity market or a winter reserve product in the energy market.

Whether you love or hate the fuel security debate, at least PJM is moving the discussion in the right direction… that is, away from blanket bailouts for resources that stockpile fuel.

Christina Simeone

Kleinman Center Senior FellowChristina Simeone is a senior fellow at the Kleinman Center for Energy Policy and a doctoral student in advanced energy systems at the Colorado School of Mines and the National Renewable Energy Laboratory, a joint program.