How Will the Solar Market React to ITC Cuts?

Since 2005, the solar industry has benefited from the federal Investment Tax Credit. This year marks the first cuts. What impacts will this have on solar adoption?

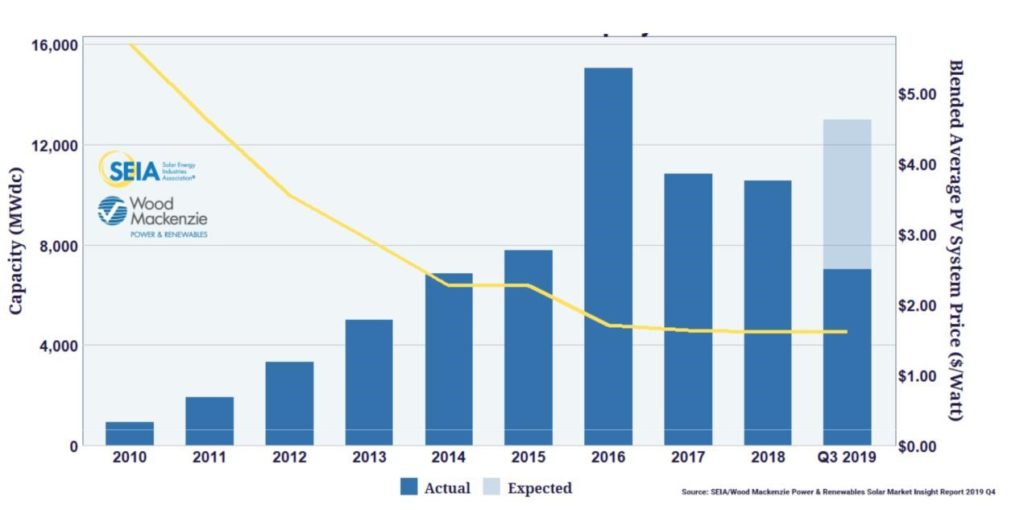

The last decade saw a remarkable growth in solar capacity in the United States. This increase can be largely attributed to technological improvements that reduced the cost of solar panels and to state and federal subsidies that incentivized solar adoption in the early stages of this market. This year, the most important federal incentive to renewable energy, the investment tax credit (ITC), decreased for the first time since 2005. It went from 30% to 26% and will decrease to 22% and 10% in 2021 and 2022, respectively. In light of these cuts, it is important to understand the historic role of solar subsidies in the growth of the industry in order to understand how the solar market will respond to the changes in the ITC.

The argument for solar subsidies, and in particular the ITC, is that solar energy generates a positive externality by displacing other less environmentally friendly sources of energy. To understand the potential effects of the ITC on solar adoption it is helpful to think of the effects of subsidies in the short and a long run.

In the short run, subsidies increase demand by lowering the price consumers face. It is hard to quantify ex-ante how large the drop in demand will be after the cuts in the ITC. However, we know from several academic papers that subsidies to solar energy have played a key role in increasing demand in markets like California, Connecticut, and Belgium. There is no reason to believe that reducing the ITC by 60% (and by a 100% for residential projects) by 2022 will not have a significant effect on solar demand.

The short-run effect that subsidies have on demand can generate permanent changes in the industry that increase adoption in the long run. For example, there is evidence that periods of high demand created by solar subsidies allowed manufacturers of solar panels to invest in technological improvements. These investments translated into more efficient panels and lower costs of installation.

Given that the United States is the second largest solar market in the world and the ITC is the primary subsidy for solar, the 2022 reduction in the tax credit might reduce world manufactures’ investments in technological improvements. The cuts to the ITC might also affect the incentives of firms to invest in better energy storage technologies, which is one of the major challenges that the solar industry faces.

These cuts to the ITC come at a time when solar still represents a small share of total electricity generation (2% in 2019 according to the EIA). However, the market has experienced an extraordinary growth rate in the last two decades and the ITC contributed to this rapid expansion. Solar capacity grew from an estimated less than 1 GW in 2008 to 51 GW in 2018. Reducing the ITC now will probably lead to a significant slowdown in solar installations, before the market reaches a point where this technology plays an important role in the country’s energy grid.

Felipe Flores-Golfin

Doctoral StudentFelipe Flores-Golfin is a Ph.D. student of business economics and public policy at the Wharton School.