Examining the Role of Early-Stage Venture Capital Investment in Energy

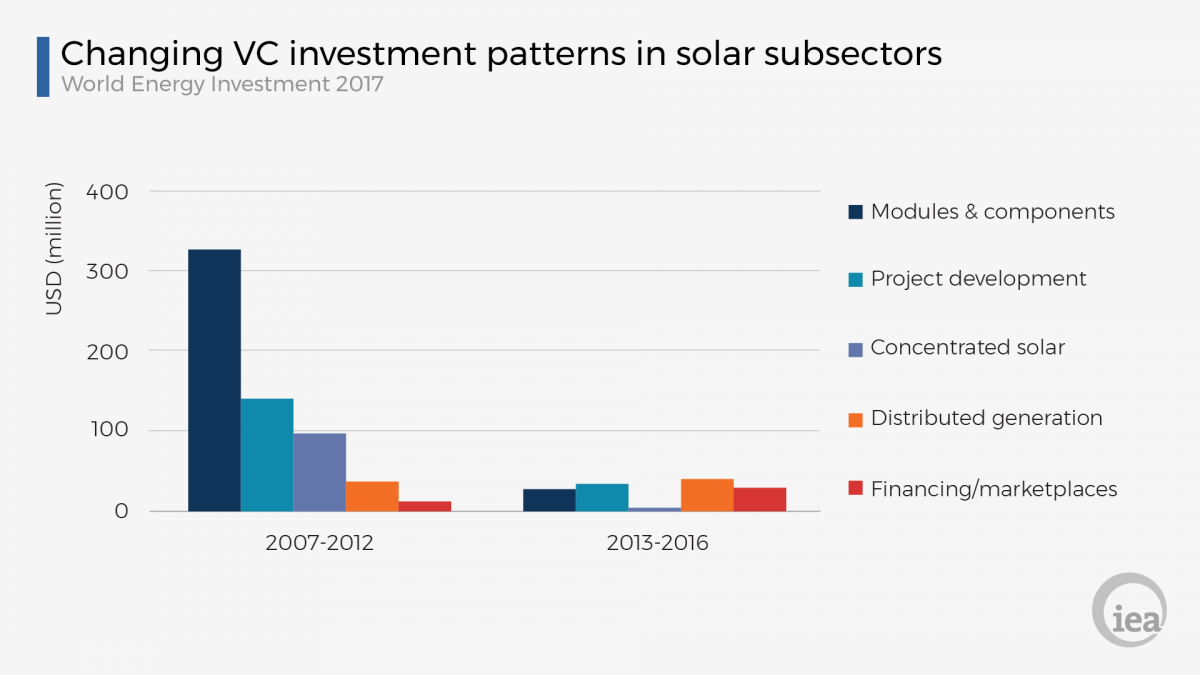

VC deal flows for companies with solar module and component technologies – such as cells, wafers and panels – have fallen in recent years while startups with business models related to providing financial and marketplace solutions for developing solar projects have received relatively more investment

The following is reposted with special permission from the International Energy Agency, where this commentary was first published.

Between USD 1 billion and USD 4 billion of energy-related early-stage venture capital (VC) deals are made every year. Though small relative to the size of total investment in the energy sector, these investment flows provide valuable information about which technologies are favoured by investors and which ones could make their mark in coming years. These deals also has implications for government policy whose goal is to help make sure that public and private innovation is delivering the technologies needed to meet energy-system objectives.

VC investing has been an important component of new technology development over many decades. This is especially true in the United States, where it plays a role in funding start-up companies to bring promising research results to the market. These early stages of innovation are typically risky but VCs make money by investing in portfolios of young firms. Some succeed, others don’t.

Early-stage VC activity also fills a gap between research and development – which is often government-funded – and commercialisation. At the same time, it needs to satisfy investor expectations of risk and return.

Using econometric analysis of a dataset of transactions involving over 2,000 energy-related startups, we can show which technologies are well-supported and who are the investors who do so.

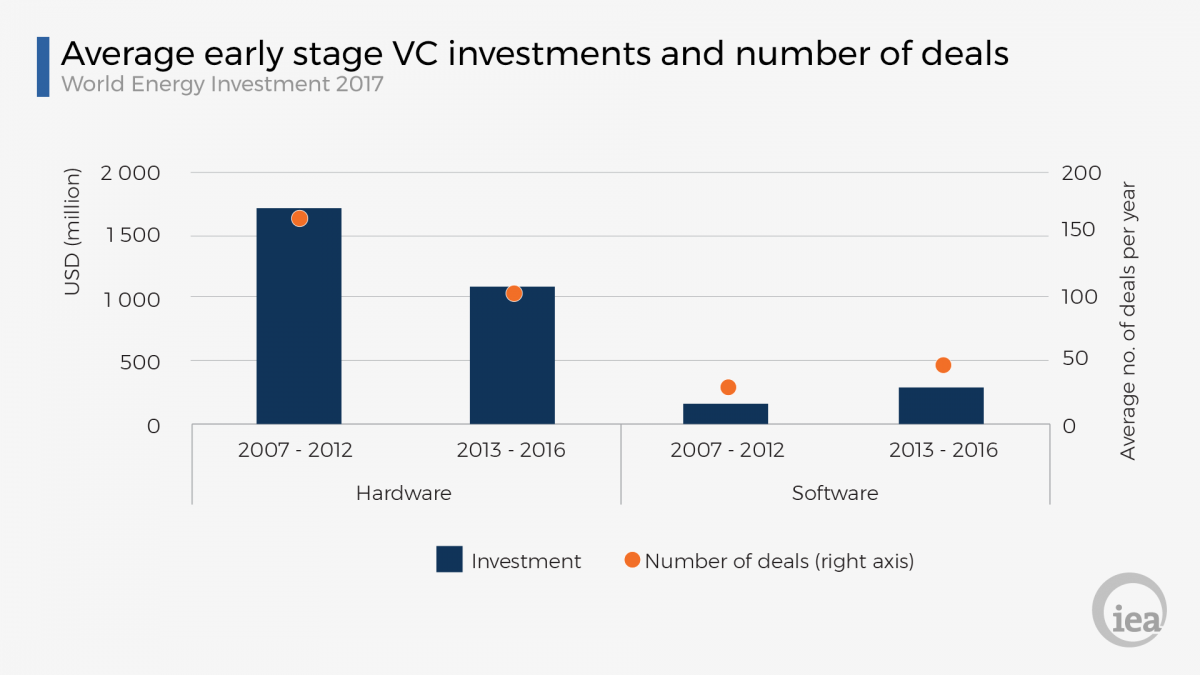

VC finance for clean-energy technologies fell sharply after 2011. While its growth has since been slow, there has been a noticeable shift in the types of companies attracting financing. Energy-oriented hardware companies, such as those with newl solar-panel or wind-turbine designs, have found it increasingly difficult to attract early-stage capital. Meanwhile, early stage financing has increased for energy-oriented companies more focused on software. Furthermore, VC investors have been twice as likely to exit successfully (i.e. through an acquisition by a larger firm or sale on a public exchange) from software-focused companies compared with their hardware counterparts.

A possible explanation for this shift are expectations by investors of greatly enhanced productivity and decreased costs thanks to automation, remote control, platforms to connect users and service providers, and other forms of software. In addition, the average software deal requires about half the capital as the average hardware deal, meaning that investors can hold more software startups in a portfolio of a given size, diversifying risk and increasing their chance of finding a particularly profitable business.

The solar sector illustrates this trend nicely. VC deal flows for companies with solar module and component technologies – such as cells, wafers and panels – have fallen in recent years. Meanwhile startups with business models related to providing financial and marketplace solutions for developing solar projects have received relatively more investment over the past four years.

Again, there are some possible explanations. As solar and wind have matured and been widely deployed, the opportunities for a radical new technology to make significant profits have slipped away and been surpassed by the gains from business model innovation and cost reductions from mass production. Second, after VC investor confidence was bruised in 2011, there was some recognition that hardware, which can take many years of capital outlays to generate returns, has a less attractive risk-return profile for these investors compared to less capital-intensive business ideas. This is particularly the case for concentrated solar technology, which failed to meet VC investor expectations. While these technologies continue to play an important role in the clean-energy transition, further innovation will require investment through other channels.

From a policy standpoint, these trends show the weakness of early-stage VC for fuelling the innovation needed to modernise the energy system and meet collective goals, such as energy access for the world’s poorest people and climate-change mitigation. Better technologies, in the form of hardware, will be critical to improving performance and bringing down costs. Public funding and government policy will be critical.

At the same time, the rise in VC activity to develop new business models needed to support renewables deployment shows how policies that have facilitated solar and wind expansion have already provided a signal to hard-nosed investors that these are profitable sectors. Effective innovation policy requires resources to be directed to multiple parts of the economy in a coordinated way. Understanding the significant potential, but also the limitations, of private actors such as VC funds is critical to inform future energy policy.

Peter Sopher worked at the International Energy Agency for three months from May 2017 as the first recipient of a graduate student fellowship established last year by the Kleinman Center for Energy Policy at the University of Pennsylvania. He contributed to the production of World Energy Investment 2017 including investigating the role of early stage venture capital investment in the energy sector. The preliminary findings presented above will be further developed for publication by the IEA later this year. He is currently working to complete his Masters of Business Administration at the Wharton School at the University of Pennsylvania.

Peter Sopher

The Wharton SchoolPeter Sopher is the first recipient of a graduate student fellowship established last year by the Kleinman Center for Energy Policy and a masters of business adminstration student at the Wharton School