A More Effective Approach to Carbon-Zero Real Estate

Regulation may not be enough for the real estate sector to address its carbon impact. Investments by real estate owners in climate research and development and technology can help bridge the gap.

This insight was a finalist in our fall blog competition.

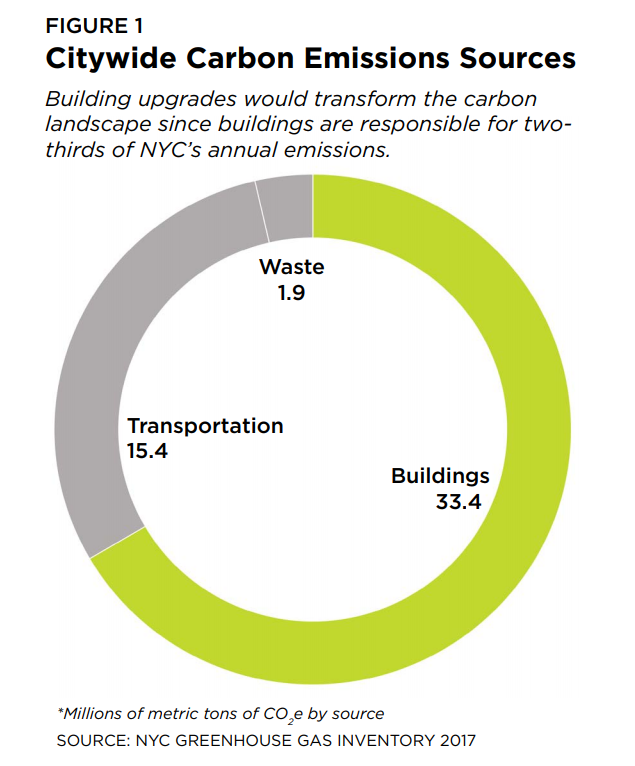

As the global climate conversation matures into its adolescent years, the discussion around the most carbon intensive sector of the economy—real estate—is only just being born. The real estate industry broadly speaking contributes roughly 30% of global greenhouse gas emissions and 40% of global energy use.

Yet, up until recently the real estate industry has been largely overshadowed in the public dialogue by its less carbon intensive peers such as the transport and food industries. Fifth Wall, the world’s largest real estate venture capital firm, articulates this point quite well in its pitch for their newly launched real estate climate tech fund. In short, Fifth Wall argues that the culmination of several forces have permanently and rapidly changed real estate’s relationship with carbon. These forces include:

- Tenant demand for carbon-free buildings (particularly from big tech companies)

- Preferential debt and equity capital allocation toward “greener” company’s (i.e. Blackrock’s recent announcement)

- Local regulation forcing the issue

Regulation may be the greatest catalyst of the three. Recently, the European Union announced its Renovation Wave program, which will require a 60% reduction in carbon emissions from buildings and an 18% reduction in their heating and cooling demand by 2050. Bloomberg estimates that the EU will need to triple its current energy efficiency spending levels to meet this target, at a cost exceeding several trillion dollars over the coming decade.

Los Angeles and NYC made headlines last year when they announced similar mandates. Failure to comply with these mandates will result in costly fines in both cities. Regardless of your political views, the consequences to real estate owners are enormous.

But unfortunately, these regulations are sub-optimal means for decarbonizing real estate. This is mainly because such effective future dated carbon taxes go into the pockets of the local cities rather than the R&D budget that is needed to make these types of efficiency improvements more economic. Furthermore, in my conversations with several NYC office landlords, I learned that many are not committing to retrofits because they believe this tax may be overturned by future administrations. Committing to retrofits is akin to accepting the validity of the law.

A far better solution then, would be to require real estate owners to invest in climate R&D and technology ventures commensurate with their emissions level—effective immediately. This money would not be a tax squandered by local governments, but a potentially ROI positive investment in the technology solutions that could make the building decarbonization challenge more doable.

Real estate owners could appreciate the upside in investing in this opportunity set—and as a result—would be more likely to agree to such a proposition in exchange for a more achievable standard.

Ironically, the real estate community has the most to gain from a declining cost curve in climate technologies. Dramatic improvements in battery storage and heat pumps, for instance, have the potential to turn operating expenses into revenue generating centers for large buildings.

The global climate tech R&D budget is just $22 billion a year—a fraction of the trillions of dollars that will be needed on energy retrofits given today’s technology. We should be asking our real estate community to significantly bridge this R&D gap—rather than bear the entire penalty for the fact that our economy takes place indoors. Or perhaps like most issues, the solution lies somewhere in the middle: a healthier blend of capital spent on R&D and retrofitting as mandated by local governments.

Stephen Rothstein

Stephen Rothstein is in a joint degree MBA and MSE program at the Wharton School and Penn Electrical Engineering.