The Inevitable Policy Response Theory

Christina Simeone writes about Inevitable Policy Response (IPR) which predicts a rapid and forceful international policy reaction to climate change with widespread financial implications.

As PennFuture recognizes climate month and the state of Pennsylvania enjoys its newly minted clean energy week with a proclamation from Gov. Tom Wolf, a new thought provoking theory is introduced from the international financial community that I thought I’d share.

The theory is called the Inevitable Policy Response (IPR), and it predicts a rapid and forceful international policy reaction to climate change with widespread financial implications.

The theory was introduced by the Principles for Responsible Investment (PRI), which is an independent, institutional investor-driven proponent of responsible investment, with signatories representing over $59 trillion in assets. PRI works internationally, in partnership with the UN Global Compact and UNEP Finance Initiative.

PRI issued a series of policy and technical papers on the IPR to inform institutional investors about the IPR risks, and to help prepare them to navigate pending market turbulence.

So, let’s breakdown the IPR theory.

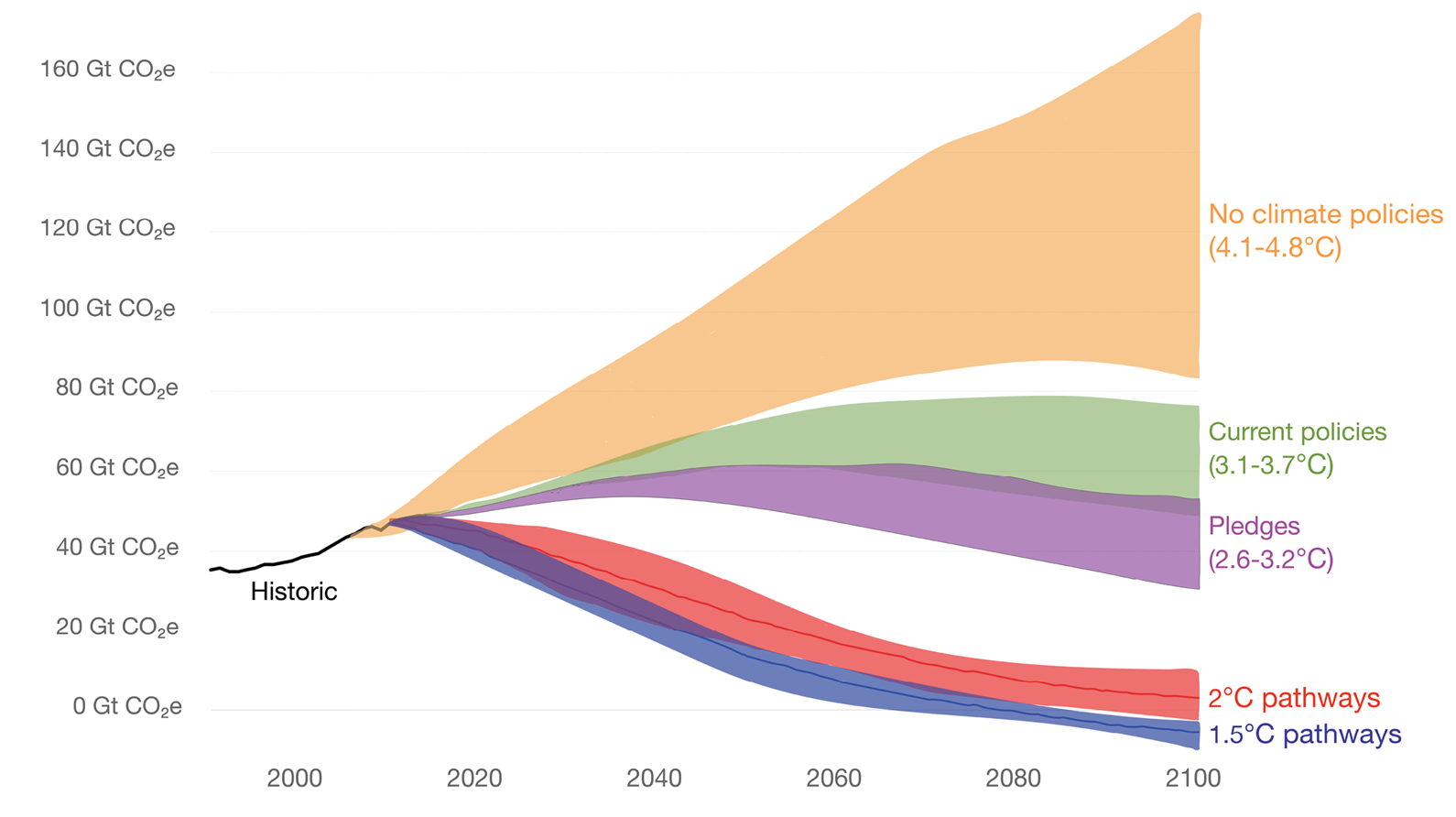

The Policy Ambition Gap. The logic from the folks at PRI starts with recognizing there is a “policy ambition gap” in the Paris Agreement serving as an uncertainty in avoiding the worst impacts of climate change. This is the white space between the national pledges (i.e. the nationally determined contributions) and the 2°C pathway in red.

What is IPR? IPR is the missing, but required, policy action to move the world towards a target of 1.5°C to 1.75°C with 50 – 66% probability (i.e. closing the Policy Ambition Gap). The longer there is a delay in emissions reduction policy implementation now, the greater the need for more rapid, forceful, and disruptive policy action in the future.

PRI is concerned about the IPR, because they believe companies and investors will essentially be price-takers during a period of immense volatility. This volatility is expected to occur after announcement of the IPR, as the markets adjust to expected policy-driven actions.

Why is this Inevitable? PRI contends several factors will coalesce to trigger the IPR. As the physical (e.g. extreme weather) and economic (e.g. insurance industry) impacts of climate change become more visible, attitudes will change and place social pressure on policymakers. Security issues related to climate impacts—from migration to regional destabilization—will increase. Investors will push to reduce regulatory uncertainty and risk on greenhouse gases to inform long-term investments, and the cost-competitiveness of low-carbon technologies will continue to improve.

When, What, and How? After examining the forthcoming schedule of post-Paris national pledges, PRI concludes the IPR will occur by 2025 (around the time of the “Global Stocktake”). The IPR could consist of coordinated global action, or could be comprised by enhanced commitments from leadership nations, states, and economies. PRI doesn’t specify the substance of the IPR, but believes it would likely consist of demand-side (e.g. carbon pricing at $54 – $190/tonne CO2e) and supply-side (e.g. eliminate fossil fuel subsidies) policies, as well as promotion of negative emissions strategies (e.g. sequestration).

Impact on Institutional Investors. PRI states that as soon as the IPR is announced, it would immediately change how investors value assets and would trigger a period of high volatility until policy and implementation details are determined and analyzed. In general terms, PRI indicates the IPR would rapidly shift capital from high- to low-carbon activities and could result in stranded assets and losses.

Recommendations. PRI believes institutional investors should engage in forward looking scenario and strategic planning to better prepare for transition and mitigate financial losses associated with the IPR. They believe careful attention should be paid to strategic asset allocation, portfolio structure, governance approaches, and risk management responses. Specifically, PRI outlines a framework for integrating IPR transition into strategic asset allocation and portfolio construction that investors can use to prepare for the high volatility period that will ensue once the IPR is announced. In addition, PRI prepared a list of investor actions in each phase of the IPR(i.e. pre-policy announcement, post-policy announcement, and during implementation).

What is at Stake? As stated in a terrific report from The Economist, “Regulation has largely failed to confront the risks associated with climate change borne by long-term institutional investors.” The report calculated the present value of manageable assets at risk from unchecked climate change, with mean loss to the private sector estimated at $4.2 trillion and mean losses from the societal perspective rising to $13.9 trillion. However, limiting warming to within 2°C (i.e. closing the policy gap) reduces these risk by 50 – 57%.

You may or may not believe in the IPR theory, but you should appreciate what it represents.

A large international network of long-money (i.e. pension funds, endowments, insurance) not only advocating for, but foreshadowing and framing out preparations for a near-term, large-scale shift towards a low-carbon global economy.

Happy climate month.

This piece was first published on PennFuture Blog and is reprinted with their permission.

Christina Simeone

Kleinman Center Senior FellowChristina Simeone is a senior fellow at the Kleinman Center for Energy Policy and a doctoral student in advanced energy systems at the Colorado School of Mines and the National Renewable Energy Laboratory, a joint program.