Texas Sea Wall Shows Inadequate Disclosure on Climate Risk

Are companies along the Gulf Coast being honest with investors about climate change risks?

Are companies along the Gulf Coast being honest enough with investors about climate change risks?

Late last week, the Associated Press reported Texas is seeking more than $12 billion—mostly from federal taxpayers—to help protect its coastline from the effects of climate change, such as sea-level rise and more powerful storm surge. This investment would help protect communities and businesses from the effects of climate change.

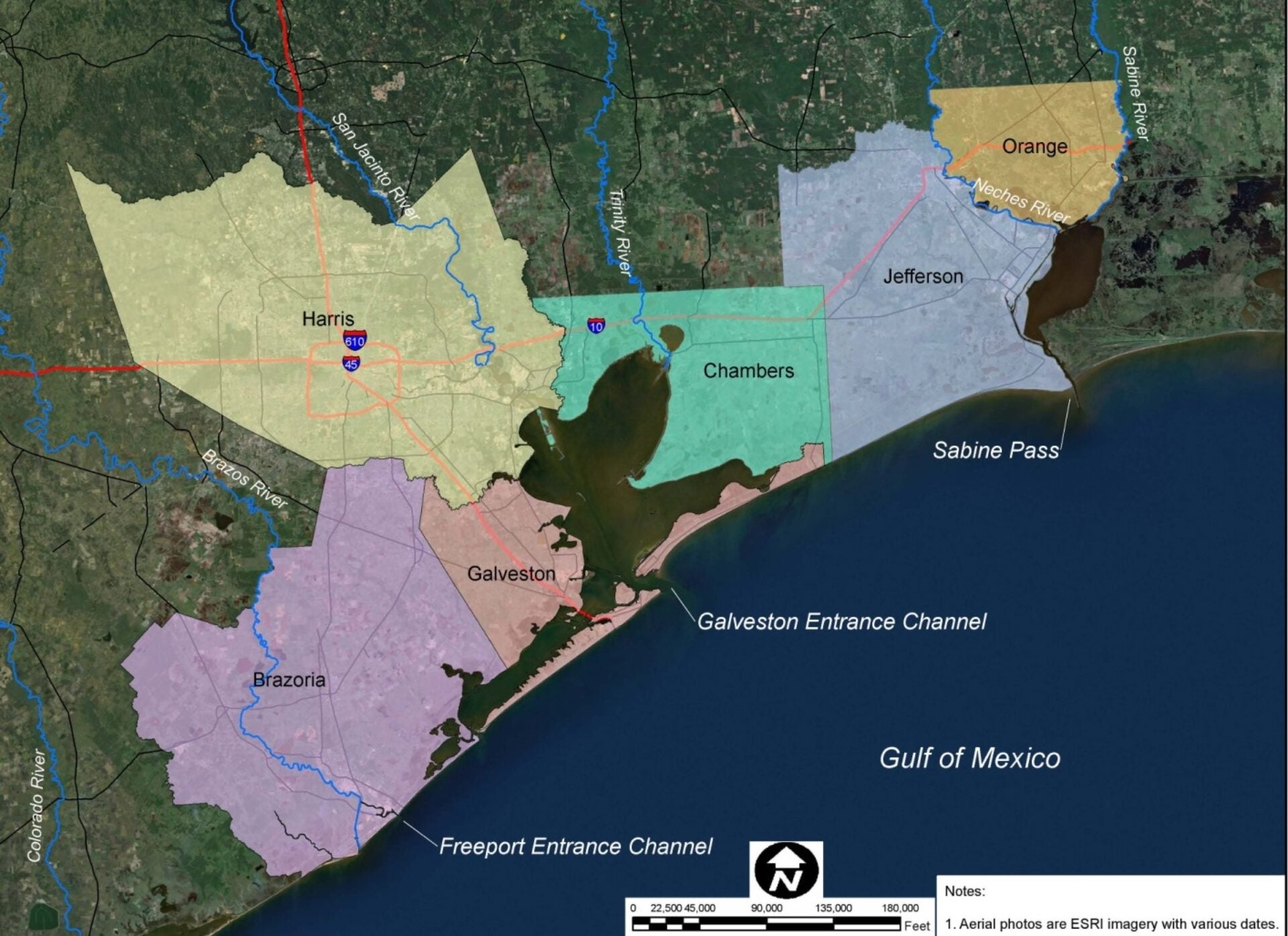

The 120-mile Sabine Pass to Galveston Bay Costal Storm Risk Management and Ecosystem Restoration project (also called the Ike Dike or Coastal Spine) would also protect 40 percent of the nation’s petrochemical industry and 25 percent of the nation’s petroleum refining capacity, as well as many oil and gas pipeline assets.

It makes sense to invest federal dollars into protecting infrastructure and private assets that are critical to the nation’s oil and gas-dependent economy. The fact the strategic petroleum reserve would be protected by this investment is correspondingly notable.

As a side note, one can’t escape the irony seeping from this situation. Federal taxpayers are being asked to protect fossil fuel assets from the impacts of climate change—a problem caused by the combustion of fossil fuels.

But I digress.

The Texas costal spine project highlights the reality that many public companies are not being honest with investors about climate change risks.

Investor Disclosure on Climate Risks

Public companies are required to disclose trends, events, uncertainties, and other things that may reasonably have a “material” effect on the company’s financial or operational performance, via periodic filings with the U.S. Securities and Exchange Commission (SEC).

In 2010, the SEC issued “Commission Guidance Regarding Disclosure Related to Climate Change” to provide direction to companies on how disclosure requirements may apply to climate change. In 2016, SEC issued a proposed rule that would update business and financial disclosures in Regulation S-K—including a section pertaining to sustainability disclosures that related in part to climate change—but this proposal has yet to be finalized.

Risks Not Adequately Disclosed

For refineries on Texas’ Gulf Coast—like the ones that would benefit from the proposed coastal spine—material climate risks could include impacts to operations, if sea level rise and storm surge increasingly threaten refinery operations and require costly investments in sea walls to protect these assets. There are also business risks from climate change, for example, if public desire to reduce carbon causes a decline in demand for fossil fuels.

The costal spine project would protect a variety of petrochemical and petroleum refining assets owned by companies like Valero, Exxon, DuPont, Honeywell, Chevron, Phillips 66, Premcor, Total, Motiva Enterprises, DOW Chemical, Freeport LNG, and Huntsman Petrochemical, just to name a few, along with many oil and gas pipeline assets and the strategic petroleum reserve.

In February 2018, the GAO issued a report highlighting SEC actions to clarify climate risk disclosure requirements, which also identified constraints facing the commission when reviewing climate disclosures. One such constraint was frequent use of generic language that is not tailored to the company and that does not provide metrics quantifying risks.

Case in point, check out the climate disclosure language listed below from some of the public companies that would benefit from the Texas coastal spine project. In general, the disclosures become more meaningful as the list advances.

However, I’m not sure any rational investor would read these disclosures and understand the gravity of the Texas coastal situation, or the need for an enormous taxpayer investment to protect Gulf Coast assets from climate-related impacts.

For example, would an investor know the following from reading these disclosures?

- The costal concern is not new—the study leading to the project was authorized in 2004 by the U.S. Senate in response to severe coastal erosion and storm damages, then re-scoped and expanded in 2011.

- The estimated sea level rise for the first 20 years of the coastal spine project is between 0.83 to 2.38 feet. (p. 3-19)

- The existing infrastructure that is in place (i.e. the hurricane flood protection project) is at risk of failure in multiple locations. (see the no action alternative)

You be the judge. Given what you now know about the Texas coast situation, are impacted companies adequately disclosing climate risks to investors?

Chevron, 10-K disclosure (Note: Chevron does not mention climate change in the context of operational disruptions related to extreme weather)

“The company’s operations could be disrupted by natural or human causes beyond its control. Chevron operates in both urban areas and remote and sometimes inhospitable regions. The company’s operations are therefore subject to disruption from natural or human causes beyond its control, including physical risks from hurricanes, severe storms, floods and other forms of severe weather, war, accidents, civil unrest, political events, fires, earthquakes, system failures, cyber threats and terrorist acts, any of which could result in suspension of operations or harm to people or the natural environment. Chevron’s risk management systems are designed to assess potential physical and other risks to its operations and assets and to plan for their resiliency. While capital investment reviews and decisions incorporate potential ranges of physical risks such as storm severity and frequency, sea level rise, air and water temperature, precipitation, fresh water access, wind speed, and earthquake severity, among other factors, it is difficult to predict with certainty the timing, frequency or severity of such events, any of which could have a material adverse effect on the company’s results of operations or financial condition.” (p.19)

Valero, 2018 10-K

“Severe weather events may have an adverse effect on our assets and operations. Some members within the scientific community believe that the increasing concentrations of greenhouse gas emissions in the Earth’s atmosphere, among other reasons, may produce climate changes that have significant physical effects, such as increased frequency and severity of storms, droughts and floods and other climatic events. If any such climatic events were to occur, they could have an adverse effect on our assets and operations.” (p. 17)

Exxon, 10-K disclosure

“Preparedness. Our operations may be disrupted by severe weather events, natural disasters, human error, and similar events. For example, hurricanes may damage our offshore production facilities or coastal refining and petrochemical plants in vulnerable areas. Our facilities are designed, constructed, and operated to withstand a variety of extreme climatic and other conditions, with safety factors built in to cover a number of engineering uncertainties, including those associated with wave, wind, and current intensity, marine ice flow patterns, permafrost stability, storm surge magnitude, temperature extremes, extreme rain fall events, and earthquakes. Our consideration of changing weather conditions and inclusion of safety factors in design covers the engineering uncertainties that climate change and other events may potentially introduce. Our ability to mitigate the adverse impacts of these events depends in part upon the effectiveness of our robust facility engineering as well as our rigorous disaster preparedness and response and business continuity planning.” (p.4)

Phillips 66, 2018 10-K

“Climate change may adversely affect our facilities and our ongoing operations. The potential physical effects of climate change on our operations are highly uncertain and depend upon the unique geographic and environmental factors present. Examples of such effects include rising sea levels at our coastal facilities, changing storm patterns and intensities, and changing temperature levels. As many of our facilities are located near coastal areas, rising sea levels may disrupt our ability to operate those facilities or transport crude oil and refined petroleum products. Extended periods of such disruption could have an adverse effect on our results of operation. We could also incur substantial costs to prevent or repair damage to these facilities.” (p.21)

Huntsman, 2018 10-K

“While we maintain business recovery plans that are intended to allow us to recover from natural disasters or other events that could disrupt our business, we cannot provide assurances that our plans would fully protect us from the effects of all such disasters or from events that might increase in frequency or intensity due to climate change. In addition, insurance may not adequately compensate us for any losses incurred as a result of natural or other disasters. In areas prone to frequent natural or other disasters, insurance may become increasingly expensive or not available at all. Furthermore, some potential climate‑driven losses, particularly inundation due to sea‑level rise, may pose long‑term risks to our physical facilities such that operations cannot be restored in their current locations.” (p.27)

Christina Simeone

Kleinman Center Senior FellowChristina Simeone is a senior fellow at the Kleinman Center for Energy Policy and a doctoral student in advanced energy systems at the Colorado School of Mines and the National Renewable Energy Laboratory, a joint program.