A Closer Look at the Trump and Juncker Agreement

The recent LNG agreement may not have teeth, but it might have impact.

Last week, in an effort to prevent a possible trade war over U.S. steel and aluminum tariffs, the President of the European Commission (EC) Jean-Claude Juncker met in Washington with U.S. President Donald Trump. They struck an agreement about Europe buying more U.S. LNG. But as noted by many analysts, neither side can really make this happen.

The agreement includes very few details: Juncker committed Europe to significantly increase their volume of U.S. LNG imports, while Trump agreed to send more. Yet neither person making the promises has much influence on fulfilling them. The LNG that originates from U.S. coasts does not belong to the U.S. government but to profit-seeking private companies. The U.S. government can encourage LNG production—by providing a hospitable regulatory and legal environment—but it cannot force companies to send products to a specific region or country.

On his part, Juncker represents the EU but is ultimately dependent on individual EU member decisions. The EU cannot force its members to import U.S. LNG, but it can motivate or make it possible through investment in and financing of LNG infrastructure.

Going further, analysts are not sure whether additional LNG importing capacity would ultimately attract U.S. LNG. Some point to the existing capacity that is currently underused, a result of inadequate LNG demand and LNG prices that are high in comparison to the piped Russian gas. In addition, there is the question of LNG competition from cheaper and/or more proximate producers such as Norway, Qatar or, most recently, Russia.

Today’s U.S. producers are lured to Asia, where higher prices provide higher profit margins. Thus, even if more terminals are built, it is not a given that these terminals will maximize capacity or draw LNG from the U.S.

In the meantime, Russia has noted record-level highs in natural gas delivery to Europe in 2016 and 2017. And new, more secure transport routes are being built (Nord Stream 2, Turkish Stream) to deliver the abundant and low-cost Russian gas to Europe.

But while Juncker’s promise of large U.S. LNG imports may never materialize, his commitment to building new LNG terminals may actually be an important part of the U.S.-EU natural gas and energy security strategy.

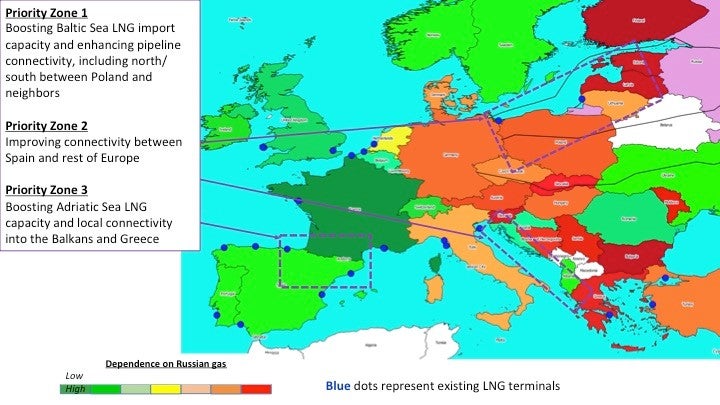

Strategically placed (see Figure 1), new terminals could impact Russian pipeline gas deliveries—if not in volume, then at least in price—while dulling the geopolitical benefits Russia is deriving from its dominant supplier position. My recent research with Gabriel Collins identifies in detail the elements needed to achieve this goal. In a nutshell, the EU must:

- Build terminals in areas that are currently highly dependent on Russian gas;

- Ramp up underutilized LNG import capacity—with pipelines and interconnectors that take gas into areas that lack gas diversity;

- Push harder for market-based rules to govern the natural gas market within EU member states, to encourage competition and spawn interest from U.S. LNG producers.

Figure 1. Priority Zones for Geoeconomic Gas Investments

Would all this bring a rush of U.S. LNG onto the European shores?

Unlikely. U.S. LNG is expected to continue to flow to Asia, where prices and demand are advantageous for U.S. producers.

But as much or as little of the U.S. LNG that would actually reach Europe would not be inconsequential.

LNG infrastructure in Europe would provide ability for the U.S. LNG to feed into the market whenever price disruptions emerge. As such it would provide a price floor and protection from extraction of economic rents by a dominant supplier.

In addition, the deliveries would neutralize geopolitical influence Russia as such supplier has yielded (also a major win for the U.S.). In economic terms, activating more LNG capacity and more potential demand, would be beneficial for U.S. LNG producers. Even if their products never reach European shores, European LNG demand it will impact the industry via displacement: non-U.S. LNG delivered to Europe makes space for U.S deliveries elsewhere, including China or India, for example.