China’s Renewable Energy Curtailment Challenge

China’s ambitious solar and wind projects are shining stars in the country's clean energy efforts, but delivering that energy isn’t always easy.

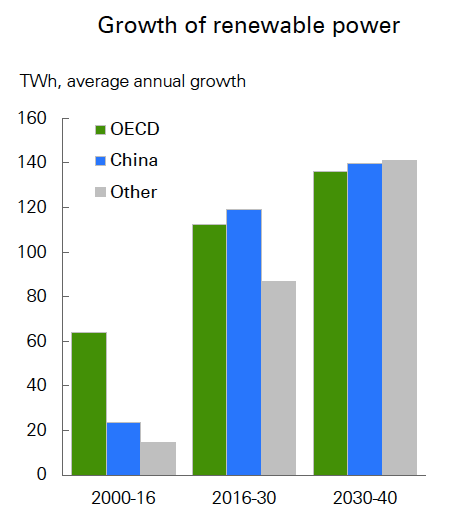

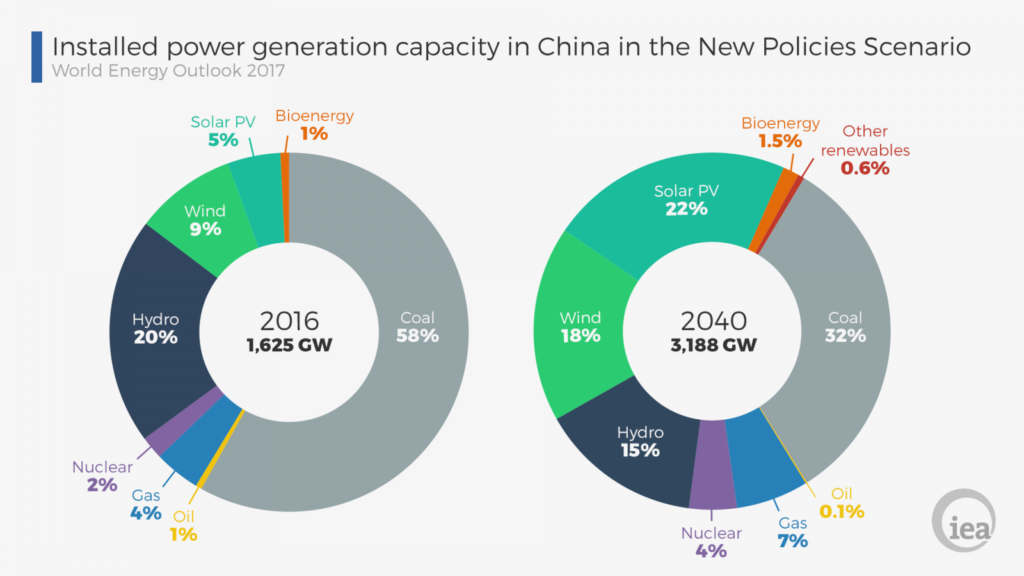

News outlets and analysts have been in awe of the speed of renewable development in China, as the country topped the world’s list for installed solar capacity early this year. Indeed China is and will be the world’s largest source of renewables growth, adding more renewables energy than the entire OECD combined (Fig 1). Renewables are also expected to overtake coal as China’s largest energy source by 2040 (Fig 2). The growth is supported by China’s investment in renewable energy that is currently at 100-fold of its value in 2005 and comprises 1/3 of total global renewable investment.1

But generation capacity and level of investment, especially in renewable generation, rarely tell the whole story. In fact, they can be quite misleading as they often imply that renewables are a direct substitute for coal or natural gas power generation. Meanwhile, given their intermittency, this is hardly the case.

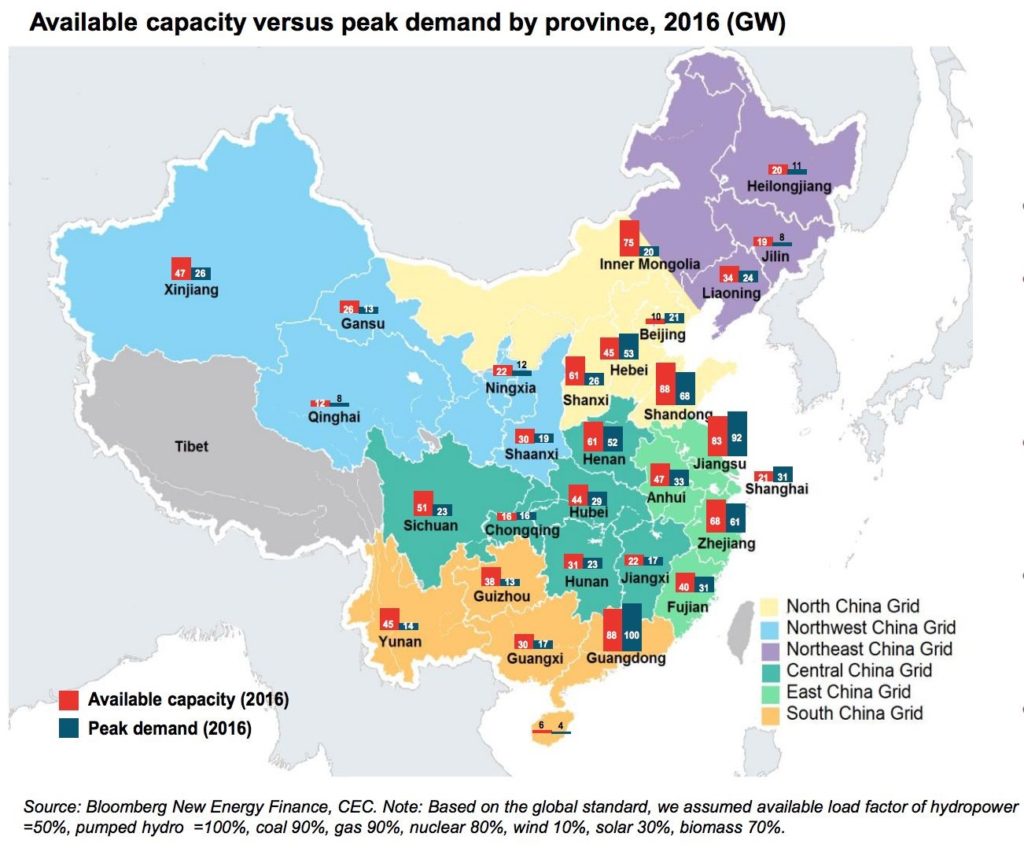

Additionally, approximately 70% of China’s utility-scale wind and solar farms has been built in the sparsely populated northern and western provinces (e.g. Gansu and Xinjiang) with low energy demands (Fig 3). And the resulting oversupply fails to make it to the load centers near the heavily populated eastern coast. According to China’s National Energy Administration (NEA), the renewable energy abandonment rate (otherwise known as curtailment) in the third quarter of 2017 was a whopping 33% in Gansu and 29.3% in Xinjiang. Jilin, Heilongjiang, and Inner Mongolia, major provinces along China’s northern border, also experienced double-digit abandonment rates. China’s solar and wind growth is misleading in two ways. First, big growth implies a big reliance on renewable energy generation, which is not true for China. Second, big growth with limited utilization rates harms the rate of return for renewables projects.

The causes of curtailment are complex and relate mostly to system inflexibility and transmission bottlenecks. Most visibly, the rapid growth of renewable installation has not been matched with extensions and upgrades to existing transmission grids. Additionally exacerbating the issue is an old and ill-fitting electricity governance system based on fragmented planning and competition from other (non-intermittent) sources of power supply.

While current policy and media discourse do not focus on the issue of curtailment, the issue has been long known. In fact, China’s NEA made an announcement last year to stop renewables curtailment by 2020. To this end the NEA proposes: 1) reworking the current energy market reform to bar any further projects in provinces where power shedding is rife; 2) increasing transmission line capacity to link the north and south of the country; and 3) building new 16 ultra-high-voltage DC lines to connect electric farming provinces to costal load centers.

The NEA urged stakeholders, including local governments, grid operators, and large wind power developers, to deal with wind curtailment. The State Grid Cooperation of China (SGCC) plans to increase investment in the grid system to upgrade transmission capacity. SGCC is also responsible for setting market rules and standard practices for electricity market pilot programs. In 2015, NEA announced it would spend at least 2 trillion RMB ($315 billion) to improve its power grid infrastructure.

However, given several important obstacles, the NEA’s 2020 goal seems overly ambitious. To begin, as Bloomberg New Energy Finance (BNEF) reports, less than 50% of these lines are designated to transmit renewables. Also, the progress in improvement of transmission is hampered by the lack of a mature regulatory framework to specify the amount and type of power to be transmitted. And China is still building over 50 GW of wind and solar in high curtailment risk regions.

In effect, if appropriate steps are not taken soon, curtailment may emerge in southern provinces within the next 10 years. To better accommodate renewables, China’s future electricity market planning should emphasize flexibility by diversifying generation sources, diversifying renewable energy locations, and optimizing generation and transmission resources across the grid. China hopes to design an active, fast, wholesale market with balanced regional markets for renewables.

China still has a lot to do if it wants to become a real leader in renewable growth as well as effectively combat air pollution and carbon emissions that result from fossil fuel-based generation. This includes following some of the most common suggestions in this regard, such as: 1) creating effective regional electricity markets; 2) designing a more balanced market to minimize potential conflict and fluctuation among players with new long-term/short-term contracts and features; 3) reworking the market to incentivize efficient renewables transmission; 4) and promoting advanced technology innovations.

Yu “Vera” Tian

School of Arts and ScienceYu “Vera’”Tian is a graduate student in the department of Environmental Sustainability at the University of Pennsylvania.

- Zhu, “Wind Curtailment in China and Lessons from the United States.” [↩]