Once in a Lifetime Investment Opportunity to Trigger More Baseload Retirements in PJM

Billions of dollars in new gas generation investments will trigger more baseload retirements in PJM.

And no, it is not renewables driving these plants out of the market in the Mid-Atlantic. And yes, low-priced natural gas is driving the retirement trends.

But, it is more complicated than that. Risk-taking investors are pouncing on a once in a lifetime opportunity created by newly cheap fuel and technology improvements. You are witnessing disruption.

The Basics. The goal of PJM’s capacity market is to harness market forces to secure investments in resources needed for reliability. Power plants receive revenues from the energy market (for actually producing power) and the capacity market (for being available to produce power), which together are meant to cover costs. The revenues generators receive from the energy market have been decreasing, as low natural gas prices have caused market prices to plummet (by lowering the market clearing price).

Capacity market prices are also stubbornly depressed, even as PJM has implemented new rules (i.e. capacity performance) and procured record-high reserve margins, which together have the intended effect of increasing capacity market prices (by limiting eligible supply and boosting demand, respectively). The combination of low energy and low capacity revenues means some higher cost generators – like coal and nuclear – are not covering their costs and will eventually retire.

But, why are capacity prices so low?

Hyper-Competitive Pricing. In PJM, the minimum offer price rule (MOPR) sets a floor price (or minimum price) on capacity market offer bids from most (excluding landfill gas and co-generation) new gas-fired generation. Essentially, the MOPR prevents uncompetitive, low bids (e.g. resulting from subsidies or cost of service regulation) from entering the market and depressing prices.

However, super-low bids are still occurring. This is because the ‘competitive entry exemption’ to the MOPR allows new gas-fired resources that are not receiving subsidies (i.e. merchant plants built all on private money) to bid below the price floor – including allowing bids of zero cost. All things being equal, a zero bid almost ensures a resource will be the first chosen in the presence of demand.

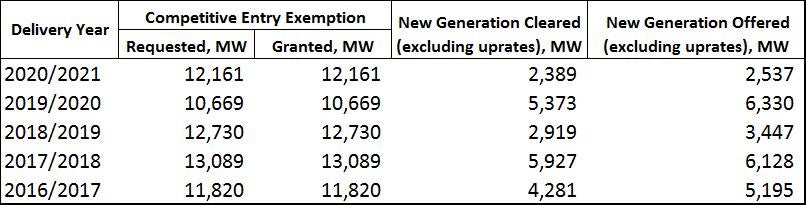

As shown in the table to the right, in each of the last five PJM capacity market auctions, over 10 gigawatts of competitive entry exemptions to the MOPR have been requested and granted, per year. Of course, not all exemptions result in offers and not all offers clear…but I think you get the point.

UBS estimates there are about 15 gigawatts (GWs) of new combined cycle gas capacity under construction in PJM and set to come online sometime in 2017-2018, with about two-thirds of that capacity being built in Ohio and Pennsylvania (where gas fuel costs are lowest). They note another 22 GWs of new gas capacity is in the development stages, mostly in OH and PA, some subset of which could come online anywhere from 2018 – 2022. So, yes, demand is stagnant, but it is the supply glut driving down capacity prices. The combination of low prices and abundant capacity supply is great for consumers, as reliability is achieved at very low cost. Plus, they get new, unsubsidized infrastructure.

So, why are these investors willing to take the risk?

Why would a rational investor put money into a market that is clearly over-supplied, where price signals alone are saying, “don’t put your money here!”?

Performance and Fuel Cost Advantage. New combined cycle gas turbines have heat rates of 6,500 Btu/KWh, compared to the average existing coal plant with 10,500 Btu/KWh, meaning the new gas plants are almost twice as efficient. Plus, a result of cheap and plentiful shale gas and lack of pipeline takeaway capacity, gas fuel prices in the Mid-Atlantic are extremely low (i.e. another supply glut).

Expiring Bonus Depreciation. The phase down and looming expiration of the federal bonus depreciation subsidy may also be contributing the rush to build new gas assets. Eligible assets placed in service by the end of 2018 qualify for 40% bonus depreciation, and those placed in service before the end of 2019 qualify for 30% bonus depreciation, prior to the program expiring.

Once in a Lifetime Window of Opportunity. Combining high heat rates with low fuel costs means these new gas units will be dispatched earlier in the energy market supply stack, reducing run times for higher cost units. Basically, once these units are built, they will operationally out-compete many of their peers in the market. Suppressed energy and capacity market prices are hurting coal and nuclear, but reduced energy market run times will hit coal even harder. If gas prices ever rise, the oldest coal (and other capacity) will be long gone, bringing capacity prices back up. The less efficient gas plants will be on the margin in the energy market, boosting revenues to the new fleet of high efficiency gas plants.

So, what does this mean for baseload coal and nuclear generation?

Retirements. Moody’s estimates that between 2016 and 2020, about 23.8 GWs of new gas combined cycle capacity will come online in PJM. They believe this will result in 100 terawatt hours of new, low-cost energy generation per year, or about 25% above 2015 supply levels. In absence of demand growth, Moody’s expects this to lead to 7 GWs of coal retirements, as well as stress economics for other existing generators (including older gas plants) in the market as energy prices will be forced down about 15% lower, starting in 2021. UBS hints to the GW retirement number being even higher.

The coal retirements could come sooner for those coal plants operating near or below 40% capacity factors, but may accelerate in 2019-2022 for those merchant coal plants with $3 billion in debt set to mature. SNL Energy anticipates (subscription) the coal and gas units most at risk are those older units with the highest heat rates, located primarily in Pennsylvania, Maryland, and Ohio.

In fact, since 2014, Pennsylvania’s Department of Environmental Protection has approved of or is currently considering over 17 GW of new gas-fired capacity, enough to replace every remaining coal plant (12.6 GW) in the state.

Love it or hate it, you are witnessing disruption.

Christina Simeone

Kleinman Center Senior FellowChristina Simeone is a senior fellow at the Kleinman Center for Energy Policy and a doctoral student in advanced energy systems at the Colorado School of Mines and the National Renewable Energy Laboratory, a joint program.