The Natural Gas War on Coal

A study recently published in The Electricity Journal, written by two researchers (Dr. Walter Culver and Dr. Mingguo Hong) at Case Western Reserve University, is using data to confirm what many already believed to be true—that low priced natural gas, not a political “war on coal,” is leading to a decline in U.S. coal use.

The study presents itself as, “…the first comprehensive study in recent years about the causes of the decline of the U.S. coal market, and its long-term trends.”

The study findings are as follows:

- EPA rules have little to do with coal’s decline. The study notes that SO2 and NOx regulations were conceived in the 1990 amendments to the Clean Air Act, over 19 years ago, and contribute only $0.01 – $0.03/MMBtu to the overall cost of coal generation (about $2.76 – $4.60 MMBtu). Subsequently proposed regulations on mercury and CO2 have languished in litigation for decades, with coal losing market share before these rules came (or are expected to come) into effect. The paper points to numerous other studies finding low gas prices impact the coal to gas shift far more than EPA regulations.

- Shale-gas competition is crushing coal. As a result of the shale-gas revolution (after 2008), low and sustained (generally non-volatile) average gas prices have increased investor confidence in gas-based capital projects (e.g. infrastructure, drill rigs), further reducing gas prices. Gas-based power can easily outcompete coal power in four of the five coal regions (North and South Appalachian, Illinois Basin, Rockies) and often in the Powder River Basin. In 88% of the 49 months from January 2012 – January 2016, gas was ≤$4.25/MMBtu, beating the breakeven point for Appalachian coal (the highest priced region). For 57% of these months, gas was ≤$3.50/MMBtu, beating out coal from Appalachia, Illinois and the Rockies.

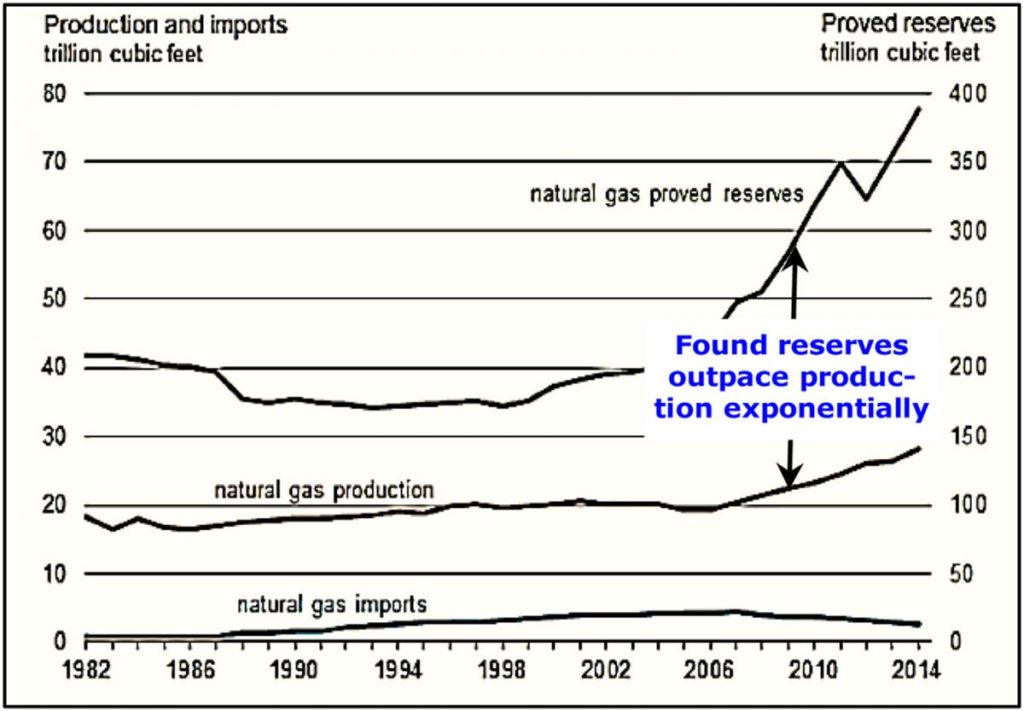

- Gas will likely be plentiful and cheap in the future. The study looks at supply and price drivers to determine future expectations. On supply, the study mentions gas reserves have been growing faster than production, gas extraction costs have decreased, and production output has significantly outpaced expert projections (i.e. U.S. Energy Information Administration). The study then examines three primary market forces as potential pathways to higher gas prices: 1) increased power demand for gas, 2) increased gas exports, and 3) production curtailments in response to low market prices.

The authors do not expect increased demand or pipeline/LNG-based exports to drive price increases. However, a decline in production, as extraction companies reduce drilling investments in response to low prices, is more of an unknown. The authors expect a short-term spike in the price of gas, resulting from drilling cutbacks and producer bankruptcies already experienced. (read more about similar predictions here). Longer-term, they predict a steady-state price of $3.50/MMBtu or less, as surviving producers buy bankrupt-company gas reserves at deep discounts, further decreasing drilling costs. For Appalachia, where gas is cheapest to extract and most future growth is predicted, an expansion of pipeline capacity or reconfiguration of gas reserve ownership could lead to price increases. On the other hand, Appalachian gas could continue to be economic in the $2.80 – $3.50/MMBtu range. The authors note that actual gas prices have consistently been at the lower range of U.S. EIA gas price projections.

- Technology performance and state policy preferences also drive gas dominance. The authors highlight the superior operational performance of gas plants, including the ability to quickly ramp power output up or down, and the low heat rates of modern gas plants (new GE 9HA series boasts a 5,600 heat rate). Coal plants don’t have comparable ramping capability, and average heat rates are about 10,000. Low heat rates equate to lower costs and reduced pollution for power produced. Ramping capability is important, especially as state policies (i.e. renewable portfolio standards) drive investments into renewable resources that are intermittent and need to be paired with either battery storage (currently expensive) or dispatchable, rampable resources as backup. So until energy storage becomes more affordable, a push towards renewables will also benefit gas.

The paper concludes by noting 1) new plant construction will be gas powered instead of coal, 2) mid-life coal plants that are near- to fully- depreciated still have an edge on new gas plants (on a levelized cost basis), but that edge is rapidly eroding, and 3) in some cases, operating and regulatory parameters (e.g. power market rules) may drive power company decisions more than levelized costs.

The paper is an interesting, fact-based, and compelling read. The data not only show how low natural gas prices have reduced coal demand, but that these trends will continue into the future. This has significant implications for electricity and gas policies, as well as social policies aimed at assisting communities traditionally dependent on robust thermal coal-based industries.

Christina Simeone

Kleinman Center Senior FellowChristina Simeone is a senior fellow at the Kleinman Center for Energy Policy and a doctoral student in advanced energy systems at the Colorado School of Mines and the National Renewable Energy Laboratory, a joint program.