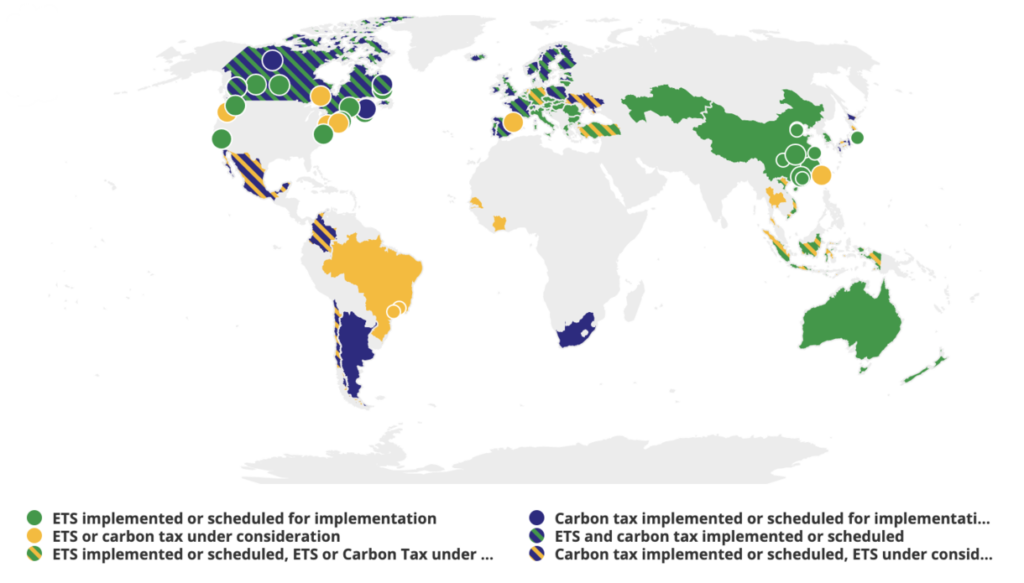

A carbon tax is a fundamental economic necessity to curb egregious greenhouse gas emissions. Under a carbon tax, governments set a price on each ton of carbon emitted from businesses and consumers. Operationally, a carbon tax takes two broad forms: an emissions tax imposed on carbon emitters, such as fossil fuel power plants; or a consumption tax imposed on consumers of goods and services that are typically high in greenhouse gas content, such as gasoline. Carbon taxes fall under the umbrella of “carbon pricing,” which can take many forms, as depicted in Figure 1.

From Figure 1, it’s clear that the U.S. has not yet successfully implemented any federal nor state-wide carbon tax. Our closest bets were two initiatives in Washington State: the I-732 carbon tax ballot initiative in 2016 (the first in the United States), which lost with 40.8% of voters saying “yes,” and the more progressive I-1631 innitiative in 2018, which lost with 43.4% of the vote.

According to research by Ioana Marinescu, Penn professor of public policy, these state bills failed because: (1) Partisan ideologies dominated voter preferences or aversions toward the carbon tax, (2) imbalanced campaign spending swayed voter opinions, and (3) the carbon tax itself threatened to increase prices on consumer necessities, such as gasoline.

This begs the question: How can we pass a carbon tax in the U.S.?

To start, we must maximize the appeal of the carbon tax for everyone on the political spectrum.

Improve the name. Instead of calling it a carbon “tax” (a taboo word in politics), legislators should consider the carbon “dividend.” A carbon “tax” is meant to penalize emitters, but it can also be designed to divide revenues from those penalties to the general populace. ”Dividend” emphasizes the good part of the policy as opposed to the bad part (the tax). In fact, a carbon “dividend,” such as the Baker Schultz Carbon Dividends Plan, has been proven to garner bipartisan support.

Lower the price. An inaugural carbon tax should begin with a very modest price, such as $5 to $10 per ton of carbon, as opposed to Washington State’s $15 proposal. While progressive voters may gawk at this miniscule price, realize this: Any carbon tax, no matter its price tag, is a step forward. A modest price targets large emitters that would incur substantial fees from the sheer magnitude of their emissions. A low, initial carbon tax could establish the viability of the policy and make future increases in the tax more palatable.

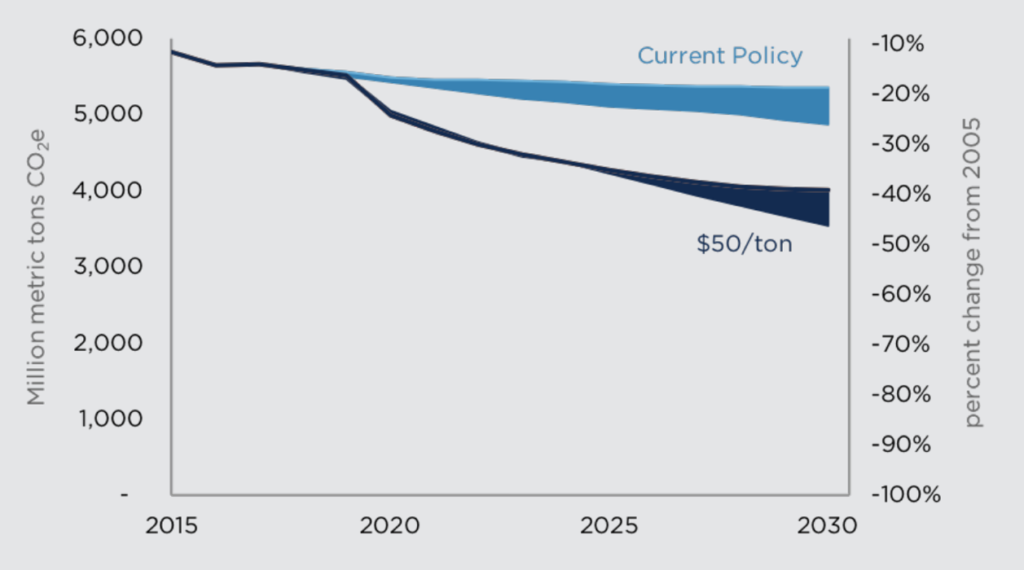

To meet the Paris Climate Accord greenhouse gas (GHG) reduction goals, carbon taxes will ultimately have to be around $35 to $50 per ton. The Center on Global Energy Policy at Columbia University analyzed the net GHG reductions that might occur with a $50 per ton carbon tax, and the result is depicted in Figure 2.

Paris goals urge the U.S. to reduce emissions from 2005 levels by 26 to 28 percent by 2025, and current policy (as seen in Figure 2) is insufficient to reach this goal. A $50 per ton carbon tax would decrease emissions from 2005 by 39 to 46 percent —more than surpassing the Paris goals. Achieving this high carbon tax is unrealistic from initial introduction, given current political climates alone, so it might be better achieved through a low carbon tax with marginal increases per annum.

Tax big emitters, not consumers. The carbon tax should not directly incur penalties on consumer goods like gasoline. This was one of the main reasons that Washington State’s carbon tax failed: Big Oil companies outspent pro-carbon tax donors, such as Bill Gates and Michael Bloomberg, by a 2:1 margin to spread TV ads and other media posts that convinced consumers that gas prices would surge. Instead of fighting these Big Oil companies with ad dollars, we should design a carbon tax that is solely levied on big emitters, and not consumers.

Give back. Revenue from this carbon tax should be returned to individuals within its jurisdiction. This could take many forms, but one of the simplest is a monthly revenue dividend to households, which could give consumers more spending power to purchase carbon-free goods and services as emitters impose tax incidences on carbon-intense goods and services.

In summary, an optimal carbon tax should be renamed as a carbon dividend, incurred as a modest price, levied solely on emitters, and divided among the voting populace. These are but some of the conditions that would ensure a carbon tax that is as attractive as possible to all individuals on the political spectrum.