Unpacking IEA’s World Energy Outlook 2017

Last week, the International Energy Agency (IEA) published their 2017 Annual World Energy Outlook report. Using current trends of electrification, access, energy demand, global fuel markets, and technological advancement, the nearly 800-page report profiles a likely global energy trajectory out to 2040 in its “New Policies Scenario.” The report also offers a more aspirational “Sustainable Development Scenario.” This second scenario offers a top down assessment of what actions will be necessary if the world is going to achieve three energy development goals: universal energy access, improved air quality, and meeting the carbon emissions target put forth in the Paris Climate Agreement. The implementation gap between these two scenarios paints a clear picture of where we are, and where we need to be.

IEA’s New Policies Scenario is their best assessment of the global energy trajectory we are currently on, and was principally informed by four major global trends:

- The impressive advancement of solar and wind technologies, making clean, renewable energy much more affordable and easily deployed.

- The globally expanding access to electricity as a primary source of energy.

- China’s transition to a cleaner and more service-oriented economy.

- The expanding development of shale gas and tight oil reserves in the United States.

These trends, along with others—such as the EU’s rapid adoption of wind and solar and India’s surging population and economy—led IEA to draw several conclusions about the global energy mix in 2040.

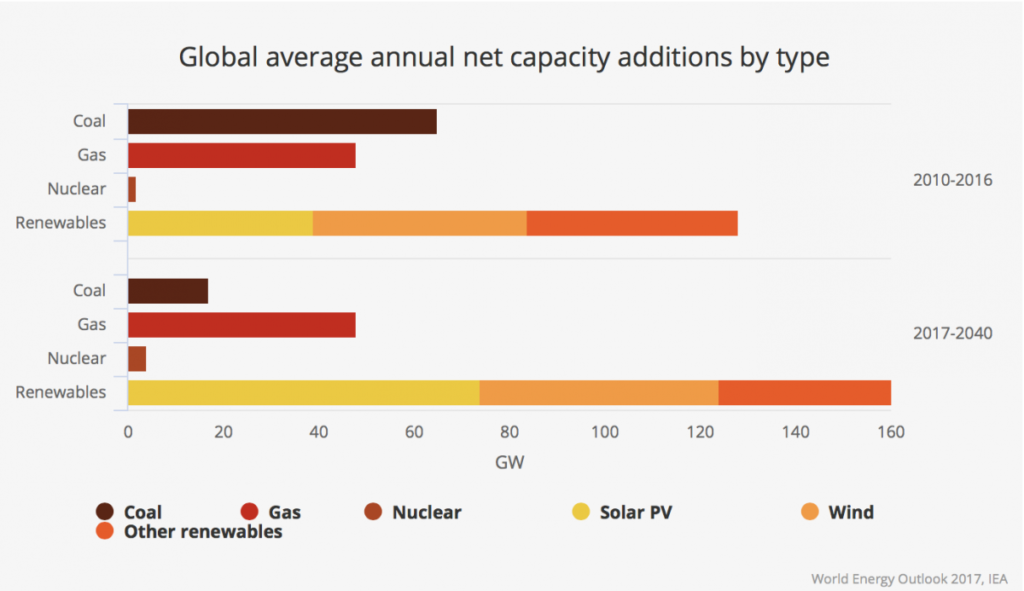

Net Global Capacity Additions and Fuel Demand

Between now and 2040, coal powered generation is projected to add an average of 17 GW/year to the global fuel mix. This is considerably lower than the 65 GW added each year between 2010 and 2016, but it still means that global demand for coal will continue to rise for decades to come. Plant efficiency will play a role in coal generation, as China is projected to add an additional 143 GW of coal generation, but the country’s overall coal consumption is projected to decrease by 358 million tons/year by 2040.

Global demand for oil also continues to grow, though at a significantly slower rate, increasing by 11mb/d between now and 2040. Growth in gas demand, on the other hand, remains consistent with the rate of growth since 1990.

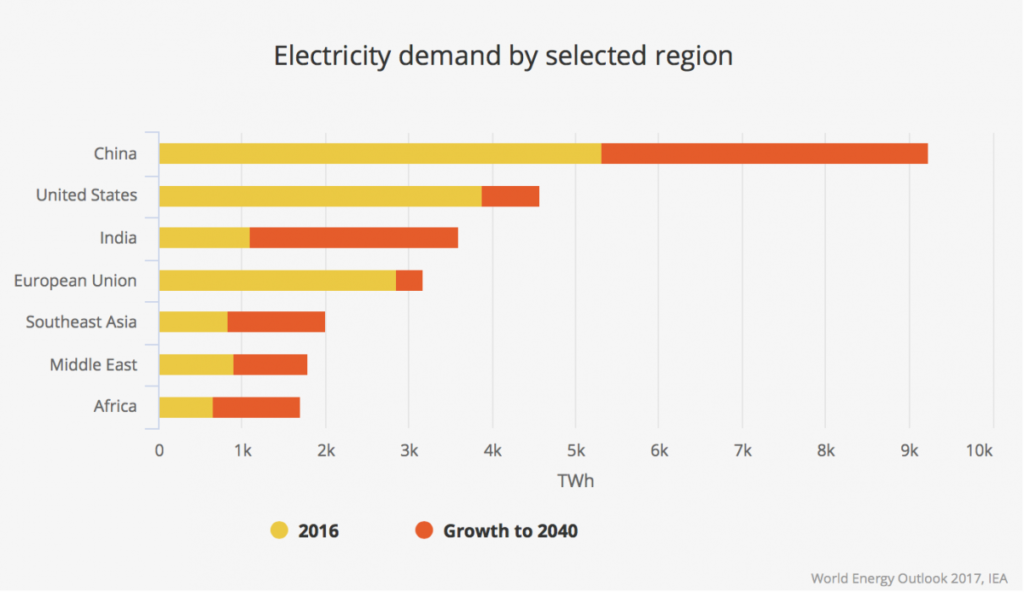

Electricity Access and Demand

Electricity demand increases considerably between now and 2040. In China, the United States, and the European Union, a major driver of increased electricity demand is the rapid market penetration of electric vehicles—from 2 million today to 280 million by 2040. In developing regions, this increased demand for electricity is, instead, primarily fueled by population growth and increased grid connectivity.

The Rise of Gas and U.S. Fuel Exports

By 2040, demand for natural gas is projected to rise across all regions, with the exception of Europe and Russia, where demand is expected to plateau at existing levels. Shale development in the United States, and increased global demand, will make the United States the largest exporter of natural gas and a major exporter of light oil by the mid 2020’s.

Missing Global Climate and Development Goals by a Wide Margin

Under the IEA’s New Policies Scenario, the global community will fail to meet the UN climate goals and the Sustainable Development Goals for access to electricity and improved air quality. Because of increasing energy demand, expansion of renewables to 40% of total electricity generation will not be enough to reduce global carbon emissions, which are projected to rise slightly between now and 2040. Furthermore, although air pollution is expected to improve in many parts of the world, annual premature deaths are expected to rise from 3 million to 4 million because of increased densification around cities. Although global electrification is expanding, 675 million people will still lack access to electricity by 2030, and 2.3 billion people will still rely on fossil fuels or biomass for cooking, contributing to millions more premature deaths from indoor air quality.

A Better Path Forward?

The IEA’s Sustainable Development Scenario offers a glimpse of what would be required to avoid the unfortunate outcomes outlined in the New Policies Scenario above. According to IEA, universal electrification does not make the task of meeting global emissions targets any more difficult. The displacement of distributed fuel burning is enough to counteract the demand for increased electricity generation. In this sustainable scenario, renewables will need to make up 60% of generation, with an additional 15% of demand being met by nuclear by 2040. This scenario calls for a modest application of more experimental negative emissions technologies, and for improved energy efficiency wherever possible.

Coal demand will need to peak immediately, and oil demand soon after. Consequently, the Sustainable Development Scenario demands a rapid rise (20%) in the use of natural gas by 2030. Critical to the long-term sustainability of this proposed fuel switch is the control of methane leaks during gas and oil production. IEA suggests that 45-50% of methane emissions could be mitigated at zero, or even negative, net cost, and that abatement of methane emissions would have an equivalent climate effect as shutting down every coal plant in China.