PJM’s Proposal to Correct for State Subsidies

Earlier this month, I wrote a blog highlighting how competitive power markets are being challenged (for example by state-level policy interventions), identifying key themes going forward, and calling for creative solutions and leadership (as opposed to regression into re-regulation).

This blog is going to highlight some of the creative solutions being proposed by PJM to correct for competitive market distortions that occur when states implement subsidy programs.

In August, PJM Interconnection put forth a proposal identifying ideas to preserve market integrity while recognizing states have the ability to implement certain electricity subsidy policies.

First, PJM identifies a “do nothing” approach, where state subsidies enter the market and PJM makes no rule changes to adjust for these out-of-market payments. The result will be uncompetitive resources supported by subsidies will clear the market, and capacity prices will be artificially suppressed. Since capacity market prices help existing resources cover their going forward costs and also promote investment into new resources needed for reliability, lower prices could force unsubsidized resources out of the market and/or could reduce investment into new resources. Since state subsidies can be put in place or removed at any time, PJM raises concerns about the willingness of competitive suppliers to enter the market (e.g. when new subsidies become available to favored resources) and the ability to maintain resource adequacy (e.g. when subsidies are removed).

Another idea explored by PJM and others is to expand the Minimum Offer Price Rule (MOPR) that currently applies to certain new generation capacity, on to existing resources. The MOPR is an administrative screening process put in place to prevent certain new capacity resources from submitting uncompetitive, below-cost offers that artificially suppress capacity market prices. On its face, it may sound like a well-aligned solution, but PJM notes that this strategy could result in procurement of more capacity than is needed to maintain reliability, at high costs. For example, a resource that does not clear the capacity market because its offer price has been increased as a result of the MOPR rule would eventually cease operations. If a state decides to subsidize that resource to keep it operating, that increment of capacity would be over and above what is needed to maintain reliability (i.e. above what is cleared in the competitive capacity market). In addition, users of that capacity (i.e. load) would pay twice, once for capacity for reliability through the capacity market auction, and a second time for unneeded excess capacity through the subsidy.

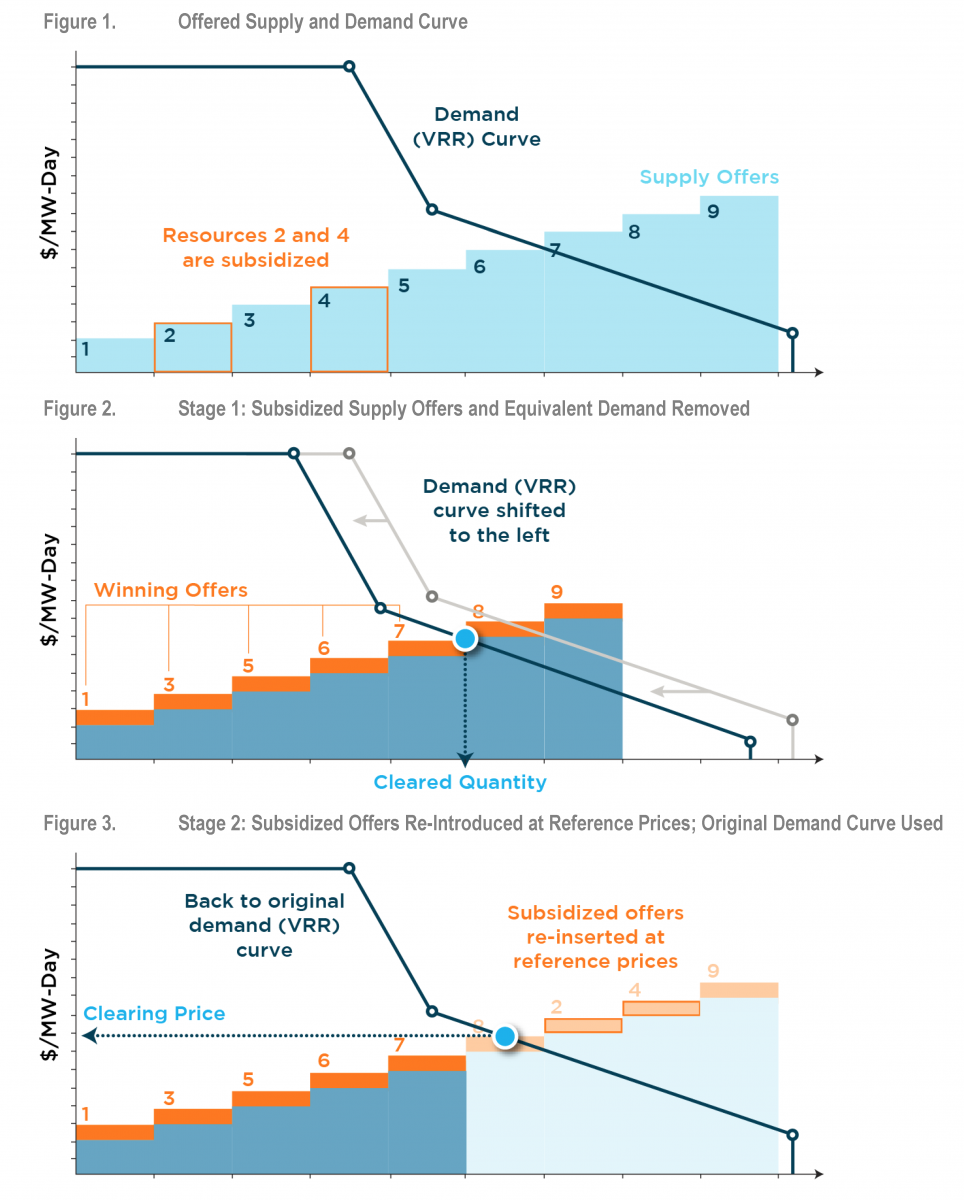

PJM presents a third alternative, a two-stage auction. The first auction would secure just enough capacity commitments for reliability, the second would determine a market-based clearing price where the effects of subsidies are removed.

The first stage would remove subsidized resources and the matching quantity of demand at the appropriate geographic location before implementing the first auction. The auction would then be implemented with the result of identifying unit-specific capacity commitments for unsubsidized resource for the 3-year forward delivery year.

The second stage would add back in the subsidized capacity and related demand. Subsidized capacity would be added in at an administratively set reference price that approximates a competitive offer for that technology- and location-specific resource. The auction would be run again to determine the price that all resources from the first auction would be paid.

Subsidized resources would receive no revenues from PJM, and would rely completely on subsidies to cover going forward costs. Similarly, related demand would not be responsible for paying a capacity price. Subsidized resources would still need to be obligated to provide capacity in the relevant delivery year and must meet PJM’s performance requirements.

In essence, this proposal would put subsidized capacity and related load in a bucket and remove that bucket from the market. The bucket of resources would still need to play by PJM’s performance rules, but would be paid by the states. A proxy that represents a competitive offer for the quantity of supply in the subsidized bucket would be re-inserted into the market and cleared at a level of demand that includes the demand in the subsidized bucket, in order to simulate a competitive market price that theoretically represents all supply and load.

Got that?

So, hats off to PJM for thinking creatively. This plan has the potential to secure the just-right quantity of resources for reliability, at a price that removes the impacts of state subsidies.

PJM acknowledges the main drawback of this strategy is that resources can submit offers into the capacity market at a price lower than what is determined in stage 2, but not clear in stage 1. These marginal resources would therefore not receive a capacity commitment or payment. (This is represented as resource number 8 in figure 3).

Furthermore, PJM acknowledges that there will be several contentious issues to be resolved, such as what constitutes a subsidy? What is the right reference price to use as a unit-specific proxy for a competitive offer? And how to deal with subsidies in other markets, like the energy market?

Obviously, implementing this strategy is going to be technically, legally, and administratively complex. It is unclear whether PJM plans on moving forward with this proposal and if any additional alternatives are being considered. For now, this is all good food for thought.