Solar Supporters, Be Aware…Changes Coming?

Solar power is booming. But, supporters of solar energy need to be aware of at least two pending events threatening America’s short-term solar energy future. First, the potential for increased solar costs if new tariffs are placed on imported solar equipment. Second, how solar-heavy states like California manage electricity reliability during the August 21 solar eclipse.

Solar has surpassed a variety of milestones – for example, utility scale solar is growing at a rate faster than other generation technologies, wind and solar provided over 10% of U.S. power in March, and utility scale solar has already broke the $1/watt pricing goal set up by the U.S. DOE.

But there are at least two potential game changers on the horizon.

Tariffs on All Imported Solar Panels

In April, a bankrupt solar manufacturer in Atlanta, Georgia named Suniva (later joined by SolarWorld in Oregon) filed a petition with the International Trade Commission (ITC) under Section 201 of the 1974 Trade Act alleging that imported solar cells and modules significantly harmed its business. The culprit? Chinese-made solar equipment imported into the U.S. and sold at a deep discount compared to U.S. made solar goods.

As a remedy, the petition is seeking a four-year tariff on certain crystalline silicon photovoltaic equipment imported from anywhere in the world. The tariff would include a $0.40 per watt on imported cells, and a $0.78 per watt floor price on modules (inclusive of $0.40 cell price).

Note, the imposition of this tariff would occur at the same time the federal Investment Tax Credit would also be ramping down for solar.

The U.S. Department of Commerce has already slapped China (and later Taiwan) with anti-dumping and countervailing duties on solar equipment exports, in 2012 and expanded in 2015. But, some allege the impact of these efforts was muted, as China offshored operations in an effort to subvert the tariffs.

However, the solar industry asserts these proposed tariffs – applicable to all imports – would devastate the U.S. solar industry and cost 88,000 American jobs. GTM Research found that the 72.5 gigawatts of new U.S. solar installations projected to be built between 2018 – 2022 would fall to only 36.4 gigawatts.

In May, the ITC agreed to move forward with an investigation (No. TA-201-75) of Suniva’s claims, with a determination due by September 22, regarding if injury has been sustained. If there is a positive determination of injury, the ITC will then focus on appropriate remedies. A final report is due to President Trump by November 13.

Maintaining Electric Grid Reliability During Solar Eclipse

On an average summer day during peak demand, solar can serve between 30 to 40 percent of load on California’s grid.

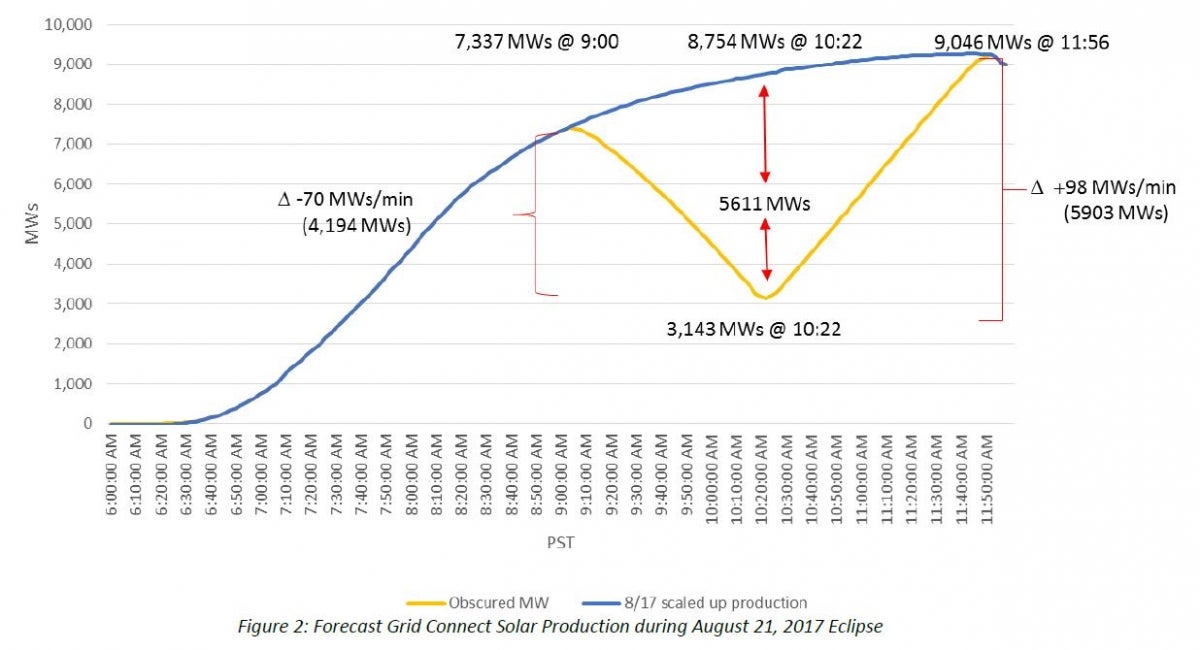

On August 21, 2017, a total solar eclipse will pass over the Pacific Northwest, creating partial eclipse conditions in parts of California from approximately 9am – 12 noon (PST) – the exact time of day when solar is typically ramping up – and obscuring the sun by up to 76% in some areas of the state.

At the time of the eclipse, California’s electricity grid, managed by California Independent System Operator (CaISO) will have over 10,000 megawatts (MWs) of commercially operated, grid-connected solar, an additional 5,800 MW of behind-the-meter rooftop solar, plus hundreds of additional solar MWs located in other states that participate in CaISO’s Western energy imbalance market.

Key to maintaining reliability, CaISO will have to manage a -70 MWs per minute ramp-down in solar power as 4,194 MW of solar capacity goes offline between 9am and 10:22 am, as the sun is blocked. Then, a +98 MWs per minute ramp-up rate as 5,903 MWs of solar capacity comes back online, as the sun reappears.

On a clear day, CaISO’s typically ramp-rate from 9am to noon is about 12.6 MWs per minute, so the eclipse-related ramps will be significantly faster than normal operating conditions.

The good news is CaISO has been preparing to manage the eclipse conditions for over a year and does not expect interruption of service. CaISO has developed a report on the topic, including a plan to ensure reliability, for example by upping procurement of regulation and ramping services, coordinating with other generators in advance of the eclipse, increasing coordination with gas system operators to ensure sufficient natural gas supply, and other actions.

The Prognosis

Best case scenario, the tariffs are not imposed and the eclipse is skillfully managed by grid operators.

Worst case scenario, the tariffs are imposed with ensuing industry devastation and the eclipse experience leads to a reliability event, which is Trumpeted as dispositive proof of the evils of renewable energy.

And there is considerable space to land between these extremes.